Unraveling Kaman Corp's Dividend Story: A Comprehensive Analysis

Delving into Kaman Corp's dividend history, yield, growth, and sustainability

Kaman Corp(NYSE:KAMN) recently announced a dividend of $0.2 per share, payable on 2023-10-12, with the ex-dividend date set for 2023-09-18. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's deep dive into Kaman Corps dividend performance and assess its sustainability.

About Kaman Corp

Warning! GuruFocus has detected 5 Warning Signs with KAMN. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

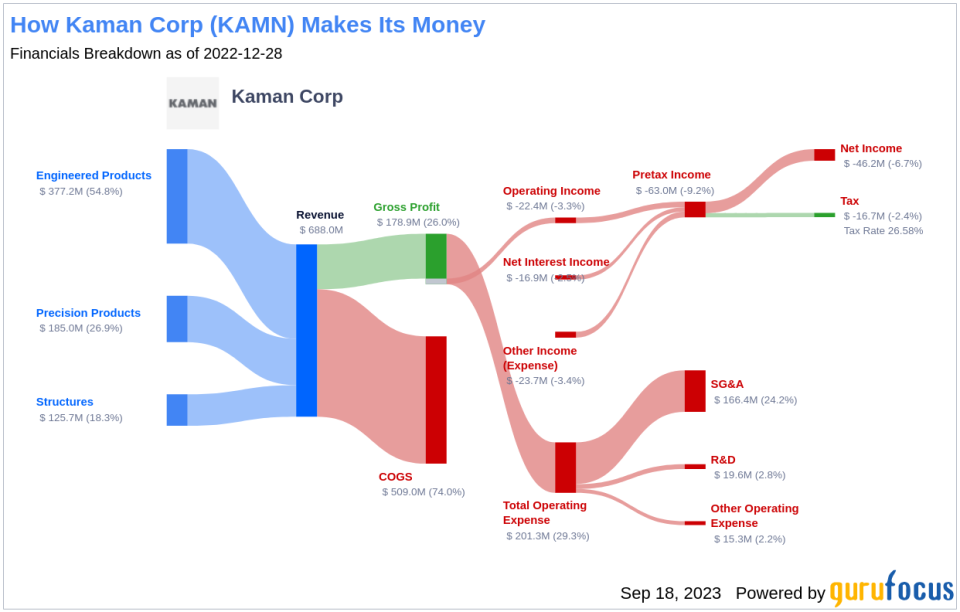

Kaman Corp is a diversified company that conducts business in the aerospace and defense, medical, and industrial markets. The Engineered Products segment serves the aerospace and defense, industrial, and medical markets providing sophisticated proprietary aircraft bearings and components. The Precision Products segment serves the aerospace and defense markets providing precision safe and arming solutions for missile and bomb systems for the U.S. and allied militaries. The Structures segment serves the aerospace and defense and medical end markets providing sophisticated complex metallic and composite aerostructures for commercial, military, and general aviation fixed and rotary wing aircraft, and medical imaging solutions.

Exploring Kaman Corp's Dividend History

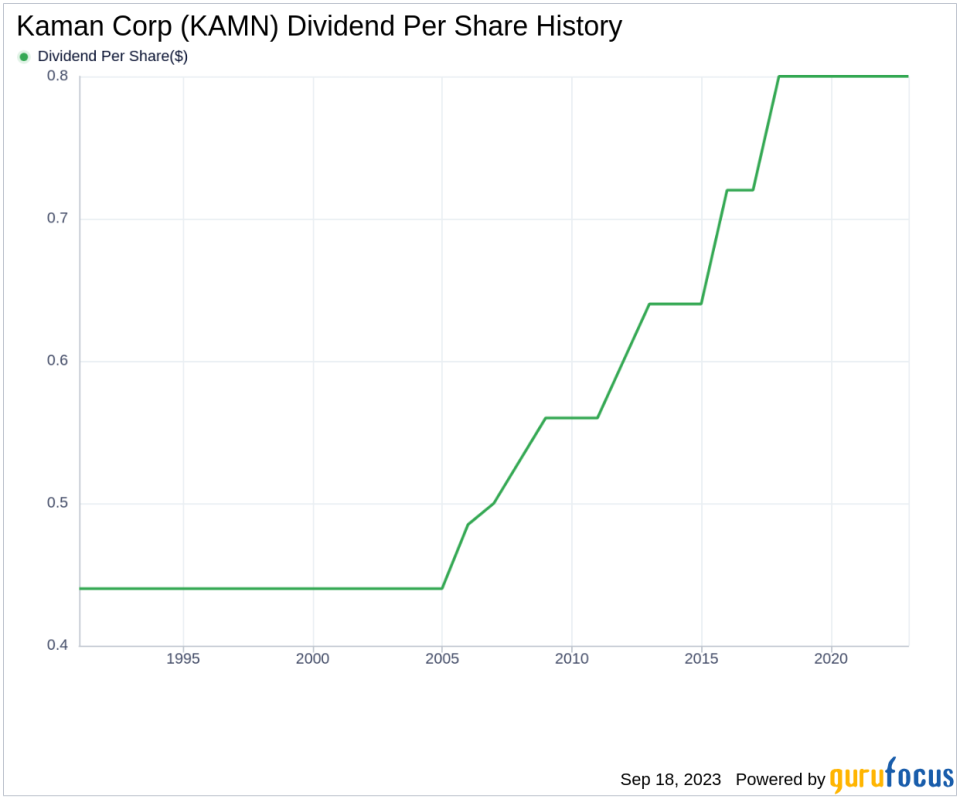

Kaman Corp has maintained a consistent dividend payment record since 1984. Dividends are currently distributed on a quarterly basis. The company has increased its dividend each year since 1984, earning it the status of a dividend aristocrat, an honor given to companies that have steadily increased their dividend each year for at least the past 39 years.

Understanding Kaman Corp's Dividend Yield and Growth

As of today, Kaman Corp has a 12-month trailing dividend yield of 3.84% and a 12-month forward dividend yield of 3.84%, indicating an expectation of consistent dividend payments over the next 12 months. Over the past decade, the company's annual dividends per share growth rate stands at 2.80%. Based on these metrics, the 5-year yield on cost of Kaman Corp stock as of today is approximately 3.84%.

Assessing Dividend Sustainability: Payout Ratio and Profitability

The sustainability of a company's dividend is often evaluated through its payout ratio. Kaman Corp's dividend payout ratio as of 2023-06-30 is 0.00, suggesting that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. The company's profitability rank of 6 out of 10 suggests fair profitability, with net profit reported in 8 out of the past 10 years.

Looking Ahead: Kaman Corp's Growth Metrics

Robust growth metrics are crucial for the sustainability of dividends. Kaman Corp's growth rank of 6 out of 10 suggests a fair growth outlook. The company's revenue per share and 3-year revenue growth rate indicate a strong revenue model, despite an average annual increase of approximately -3.20%, underperforming approximately 65.02% of global competitors.

Conclusion

Considering Kaman Corp's consistent dividend payments, steady dividend growth rate, low payout ratio, fair profitability, and growth metrics, it appears to maintain a solid dividend profile. However, the future sustainability of its dividends will depend on the company's ability to maintain its profitability and growth. Investors looking for high-dividend yield stocks can use the GuruFocus High Dividend Yield Screener for more opportunities.

This article first appeared on GuruFocus.