Unraveling Melrose Industries PLC's Dividend Performance: A Comprehensive Analysis

Understanding the Sustainability and Growth Prospects of MLSPF's Dividend

Melrose Industries PLC (MLSPF) has recently announced a dividend of $0.02 per share, scheduled for payment on October 20, 2023. With the ex-dividend date set for September 14, 2023, investors are keen to understand the company's dividend history, yield, and growth rates. In this article, we'll delve into Melrose Industries PLC's dividend performance using data from GuruFocus, and assess its sustainability.

Company Overview: Melrose Industries PLC

Warning! GuruFocus has detected 4 Warning Signs with MLSPF. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

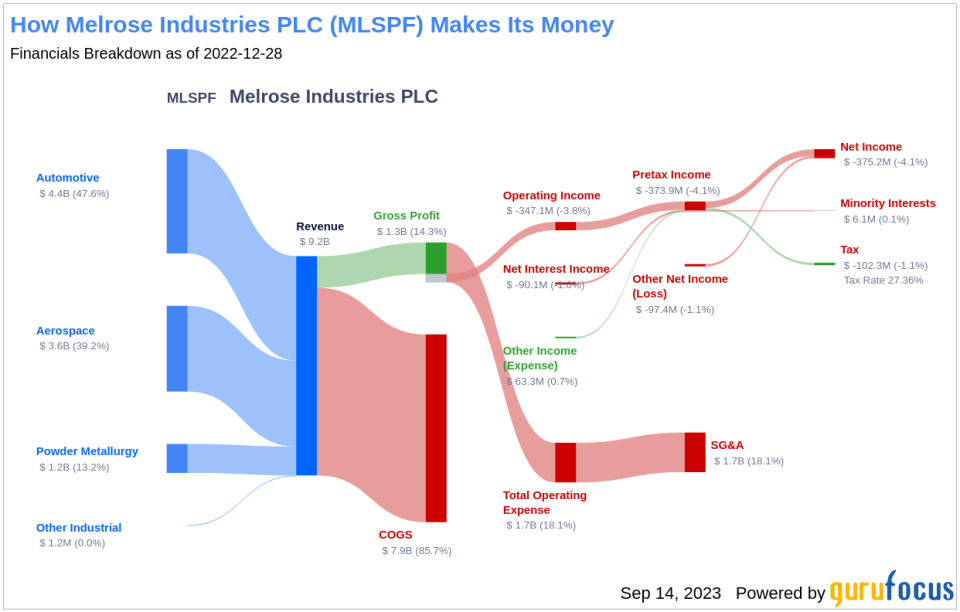

Melrose Industries PLC operates in various geographical regions and sectors, owning manufacturing and industrial businesses. The company's operating segments include Aerospace, Automotive, Powder Metallurgy, and Other Industrial. The Aerospace segment supplies both civil and defense airframes and engine structures, while the Automotive segment designs, develops, manufactures, and integrates an array of driveline technologies, including components for electric vehicles. The Powder Metallurgy segment provides precision powder metal parts for the automotive and industrial sectors. The Other Industrial segment comprises the Group's Ergotron business.

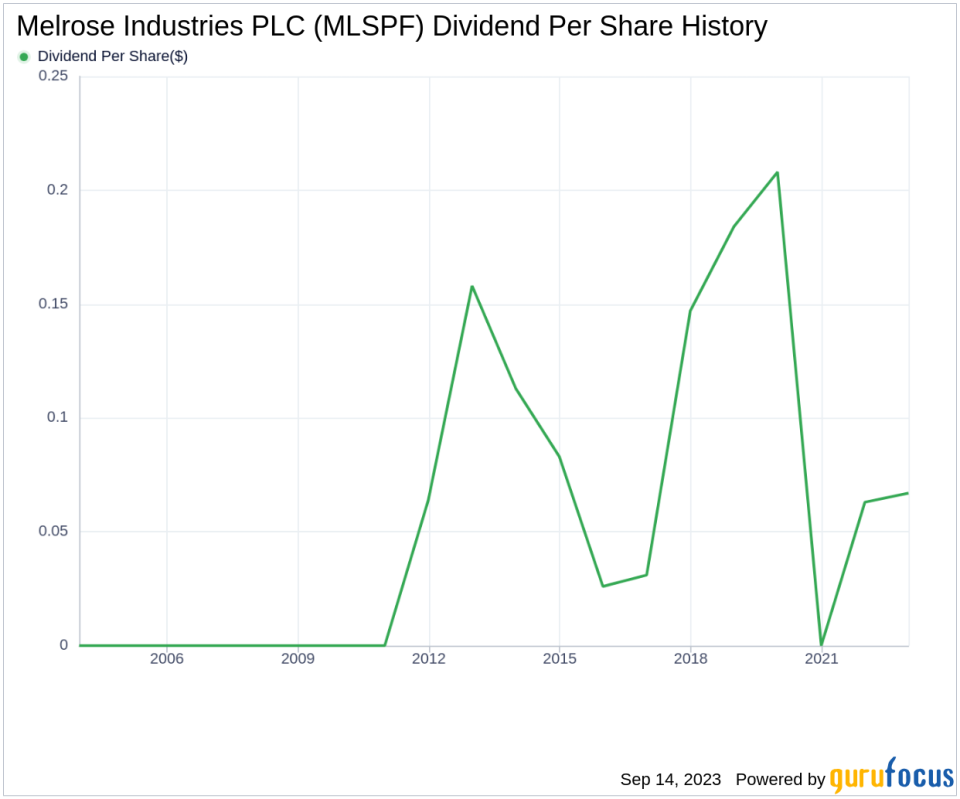

Melrose Industries PLC's Dividend History

Since 2021, Melrose Industries PLC has maintained a consistent dividend payment record, with dividends distributed bi-annually. The following chart illustrates the historical trend of annual Dividends Per Share.

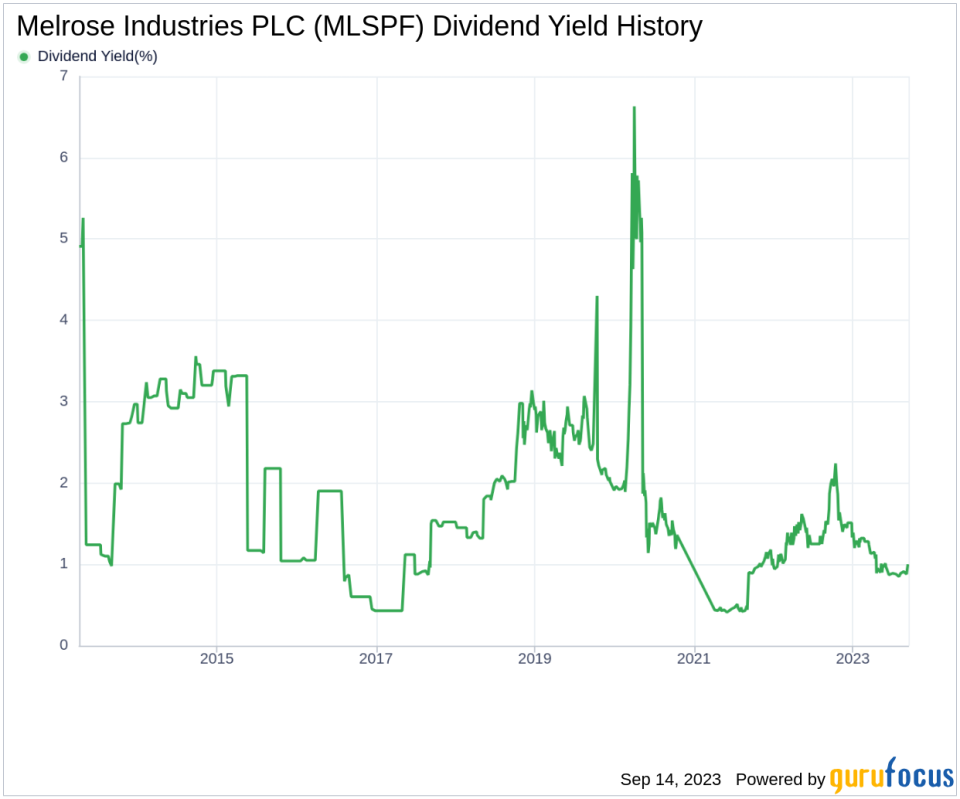

Melrose Industries PLC's Dividend Yield and Growth

As of today, Melrose Industries PLC has a 12-month trailing dividend yield of 1.44% and a 12-month forward dividend yield of 1.29%, indicating an expected decrease in dividend payments over the next 12 months. Over the past three years, the company's annual dividend growth rate was -29.70%. Considering the dividend yield and five-year growth rate, the 5-year yield on cost of Melrose Industries PLC stock today is approximately 1.44%.

Payout Ratio and Profitability: Assessing Dividend Sustainability

To evaluate the sustainability of Melrose Industries PLC's dividend, it's crucial to examine the company's payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, ensuring the availability of funds for future growth and unexpected downturns. As of June 30, 2023, Melrose Industries PLC's dividend payout ratio is 0.00.

The company's profitability rank, as determined by GuruFocus, offers an understanding of the company's earnings prowess relative to its peers. As of June 30, 2023, Melrose Industries PLC's profitability rank is 4 out of 10, suggesting that the dividend may not be sustainable. The company has reported net profit in 4 years out of the past 10 years.

Future Outlook: Growth Metrics

For dividends to be sustainable, a company must exhibit strong growth metrics. Melrose Industries PLC's growth rank of 4 out of 10 suggests that the company has poor growth prospects and thus, the dividend may not be sustainable. However, the company's revenue per share, along with the 3-year revenue growth rate, indicates a strong revenue model. Melrose Industries PLC's revenue has increased by approximately -10.70% per year on average, a rate that underperforms approximately 89.17% of global competitors.

Conclusion

While Melrose Industries PLC has consistently paid dividends since 2021, its negative dividend growth rate and low profitability rank raise concerns about the sustainability of future dividends. Furthermore, the company's poor growth rank and underperforming revenue growth rate compared to global competitors indicate potential challenges ahead. As such, investors should monitor these metrics closely while considering the company's dividend prospects. GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.