Unum Group (UNM) Reports Solid Q4 Earnings with Strong Year-End Performance

Net Income: $330.6 million in Q4, a rise from $289.2 million in the same quarter last year.

Adjusted Operating Income: $350.5 million after-tax in Q4, with a significant EPS growth of 23.3% for the full year.

Premium Growth: Full year core operations premium growth of 5.2% on a constant currency basis.

Book Value: $49.91 per common share, a 13.0% increase year-over-year.

Capital Strength: Holding company cash of $1.7 billion and a risk-based capital ratio of approximately 415%.

2024 Outlook: Anticipated premium growth of 5% to 7% and after-tax adjusted operating EPS growth of 7% to 9%.

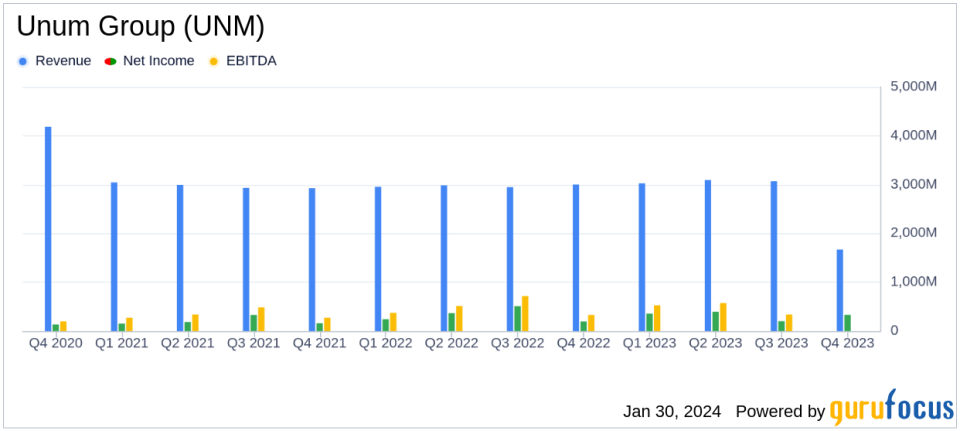

On January 30, 2024, Unum Group (NYSE:UNM), a leading provider of income protection insurance products, released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The company reported a net income of $330.6 million, or $1.69 per diluted common share, an increase from the $289.2 million, or $1.44 per diluted common share, reported in the same quarter of the previous year. The after-tax adjusted operating income stood at $350.5 million, or $1.79 per diluted common share, reflecting robust margins and growth momentum.

Unum Group is a provider of group and individual income protection insurance products in the United States, the United Kingdom, Poland, and other countries. It is the largest domestic disability insurer, with the majority of premiums generated from employer plans. The company also offers a complementary portfolio of other insurance products, including long-term care insurance, life insurance, and employer- and employee-paid group benefits. It operates through segments such as Unum US, Unum International, and Colonial Life, with Unum US being the major revenue contributor.

The company's performance in 2023 was marked by strong premium and sales growth, driven by a favorable operating environment. This growth is significant for an insurance company like Unum Group, as it indicates the company's ability to attract and retain customers, as well as its success in expanding its product offerings. The full year core operations premium growth of 5.2 percent on a constant currency basis and the full year after-tax adjusted operating earnings per share growth of 23.3 percent when compared to historically reported 2022, underscore the company's financial achievements.

Unum Group's balance sheet and liquidity remain robust, with holding company cash of $1.7 billion and a weighted average risk-based capital ratio of approximately 415 percent. The book value per common share increased by 13.0 percent compared to the year-ago quarter, reaching $49.91, while the book value per common share excluding accumulated other comprehensive income (AOCI) grew 8.8 percent over the year-ago quarter to $67.02. These metrics are important as they reflect the company's financial health and its ability to cover liabilities, which is crucial for investor confidence in the insurance industry.

President and CEO Richard P. McKenney commented on the results, stating,

We closed 2023 with a solid fourth quarter and delivered another year of very strong performance in which we grew adjusted EPS by 23%, reflecting the fundamental strength of our business."

He also highlighted the company's successful execution of its growth strategy and capital allocation priorities, including de-risking the balance sheet and increasing returns to shareholders.

Looking ahead, Unum Group expects positive business trends to continue into 2024, with an outlook for core operations premium growth of 5 percent to 7 percent and after-tax adjusted operating earnings per share growth of 7 percent to 9 percent. This forward-looking perspective is essential for investors as it provides an indication of the company's confidence in its future performance and ongoing growth potential.

For a detailed breakdown of Unum Group's financial performance, including segment results and key financial metrics, investors are encouraged to review the full 8-K filing. The company's commitment to transparency and comprehensive reporting is evident in the depth of information provided, offering valuable insights for value investors and potential GuruFocus.com members.

Overall, Unum Group's fourth quarter and full-year 2023 results demonstrate the company's resilience and strategic focus in a competitive insurance market. With a strong capital position and a positive outlook for the coming year, Unum Group continues to be a noteworthy company for value investors interested in the insurance sector.

Explore the complete 8-K earnings release (here) from Unum Group for further details.

This article first appeared on GuruFocus.