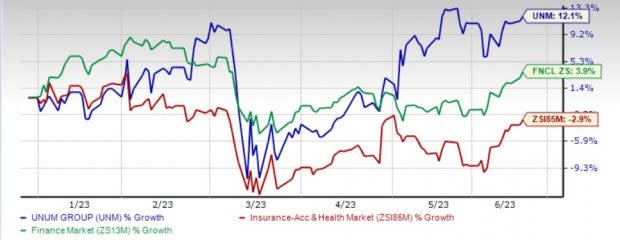

Unum (UNM) Shares Gain 12% YTD: Will the Upside Continue?

Unum Group’s UNM shares have gained 12.1% year to date against the industry’s decrease of 2.9 % and the Finance sector’s increase of 3.9%. With a market capitalization of $9.1 billion, the average volume of shares traded in the last three months was 1.5 million.

Disciplined sales trends, strong persistency, an improving rate environment, favorable risk experience and solid capital continue to drive this Zacks Rank #1 (Strong Buy) insurer’s performance. Earnings of this leading disability income writer have increased 6.8% over the last five years, outperforming the industry average of 2.4%. UNM delivered a four-quarter average earnings surprise of 18.61%.

UNM estimates adjusted operating return on equity (ROE) in the range of 17-19% from the core business in 2023.

The Zacks Consensus Estimate for 2023 and 2024 earnings has moved 0.8% and 0.6% north, respectively, in the past seven days, reflecting analyst optimism.

Image Source: Zacks Investment Research

Can UNM Retain the Momentum?

The Zacks Consensus Estimate for 2023 earnings is pegged at $7.46 per share, suggesting a year-over-year increase of 20.1% on 2.5% higher revenues of $12.3 billion. The consensus estimate for 2024 earnings is pegged at $7.76, indicating a year-over-year increase of 4% on 3.6% higher revenues of $12.8 billion. UNM estimates 2023 bottom line to grow 20-25%. Unum also estimates 45-55% growth in adjusted operating EPS by 2024.

The expected long-term earnings growth rate is pegged at 8.4%, better than the industry average of 6.5%.

Unum’s in-force block growth and higher overall sales have been driving premiums. In 2023, Unum Group expects sales growth in the range of 8-12% and premium growth in the range of 3-5%.

UNM should continue to benefit from solid performance in Unum U.S. and Colonial Life — the two largest operating segments of Unum. While disciplined sales trends, strong persistency in group lines and growth of new product lines like dental and vision should drive Unum US, improving premium income and favorable risk results should drive the Colonial Life segment.

UNM estimates sales growth in the range of 8-12%, premium growth in the range of 4-6% and adjusted operating ROE in the range of 16-18% in 2023 at Unum US. At Colonial Life, sales growth is expected in the range of 8-12%, premium growth in the range of 1-3% and adjusted operating ROE in the range of 20-22% in 2023.

Unum Group boasts a solid capital position. Sustained solid operating results have been fueling a solid level of statutory earnings and capital, cushioning financial flexibility. Strong statutory earnings might provide an impetus to dividend capacity.

In its concerted efforts to enhance shareholders’ value, UNM increased dividends at a five-year CAGR of 7.5%. It has hiked dividends 13 times in the last 12 years. Also, UNM expects to increase share repurchase to $300 million in the second half of 2023 and projects the rate of earnings and dividends to grow in line with the GAAP earnings growth expectations (4-7%). In 2023, Unum targets dividends in the range of $250-$275 million. UNM looks to repurchase shares worth $250 million in 2023.

Attractive Valuation

UNM shares are trading at a discount than the industry average. Its price-to-book value of 0.98X is lower than the industry average of 1.72X. Before the valuation expands, it is preferable to take a position in the stock.

Unum Group has an impressive Value Score of A. Value stocks have a long history of superior returns.

Other Stocks to Consider

Some other top-ranked stocks from the insurance industry are HCI Group HCA, RLI Corporation RLI and Kinsale Capital Group KNSL, each sporting a Zacks Rank #1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for HCI Group’s 2023 and 2024 earnings indicates a year-over-year increase of 149.3% and 35.2%, respectively. HCI delivered a four-quarter average earnings surprise of 308.82%.

The consensus estimate for 2023 and 2024 earnings has moved up 22.7% and 14.1%, respectively, in the past seven days. Shares of HCI have gained 47.5% year to date.

RLI delivered a four-quarter average earnings surprise of 43.50%. Year to date, the insurer has gained 5%.

The Zacks Consensus Estimate for RLI’s 2023 earnings indicates a year-over-year increase of 4.1%.

Kinsale Capital delivered a four-quarter average earnings surprise of 14.77%. Year to date, the insurer has gained 36.1%.

The Zacks Consensus Estimate for KNSL’s 2023 and 2024 earnings indicates a year-over-year increase of 32.9% and 19.7%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

Unum Group (UNM) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report