Unveiling AAON Inc's (AAON) True Worth: A Comprehensive Guide to Its Modestly Undervalued Status

AAON Inc (NASDAQ:AAON), a renowned manufacturer of air-conditioning and heating equipment, witnessed a daily loss of 7.42% and a 3-month loss of 14.92%. Despite these losses, the company's Earnings Per Share (EPS) stands at a solid 1.81. This article aims to answer a critical question: Is AAON (NASDAQ:AAON) modestly undervalued? We will provide an in-depth valuation analysis of AAON, encouraging readers to delve into the subsequent analysis.

Company Overview

AAON Inc (NASDAQ:AAON) is a leading manufacturer of air-conditioning and heating equipment. Its product range includes rooftop units, chillers, packaged outdoor mechanical rooms, air-handling units, makeup air units, energy-recovery units, condensing units, geothermal heat pumps, and self-contained units and coils. Primarily serving the commercial and industrial new construction and replacement markets in North America, AAON has built a strong presence in the industry. Despite the recent losses, the company's stock price stands at $56.68, with a market cap of $4.60 billion, indicating a modest undervaluation when compared to its GF Value of $80.3.

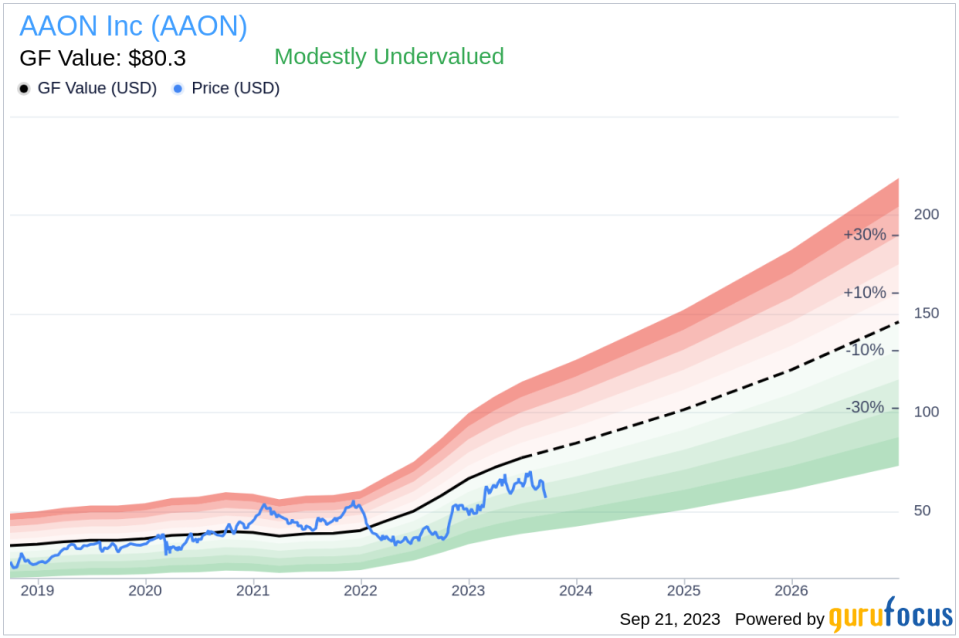

Understanding the GF Value

The GF Value is a proprietary estimation of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides an overview of the stock's fair trading value. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher. Currently, AAON (NASDAQ:AAON) appears to be modestly undervalued, indicating that the long-term return of its stock is likely to be higher than its business growth.

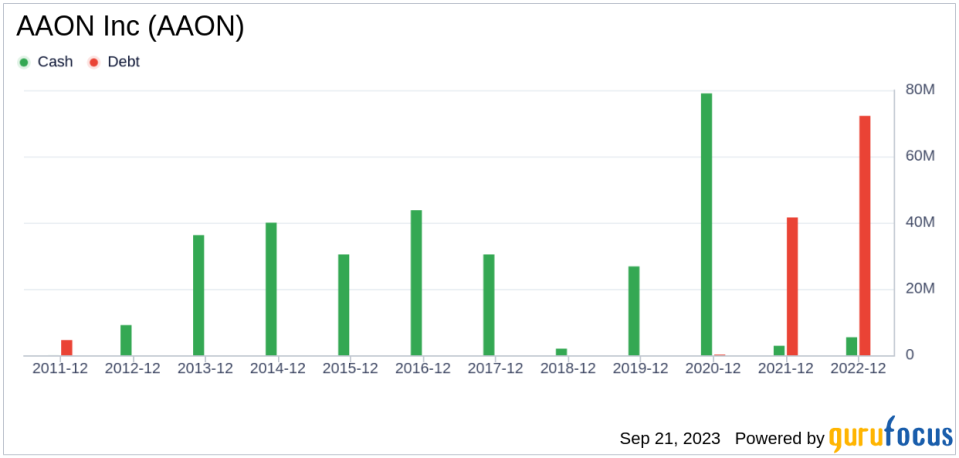

Financial Strength

Investing in companies with low financial strength could result in permanent capital loss. Hence, it is crucial to review a company's financial strength before buying shares. AAON's cash-to-debt ratio of 0.06 ranks lower than 91.96% of 1605 companies in the Construction industry. However, GuruFocus ranks AAON's financial strength as 8 out of 10, suggesting a strong balance sheet.

Profitability and Growth

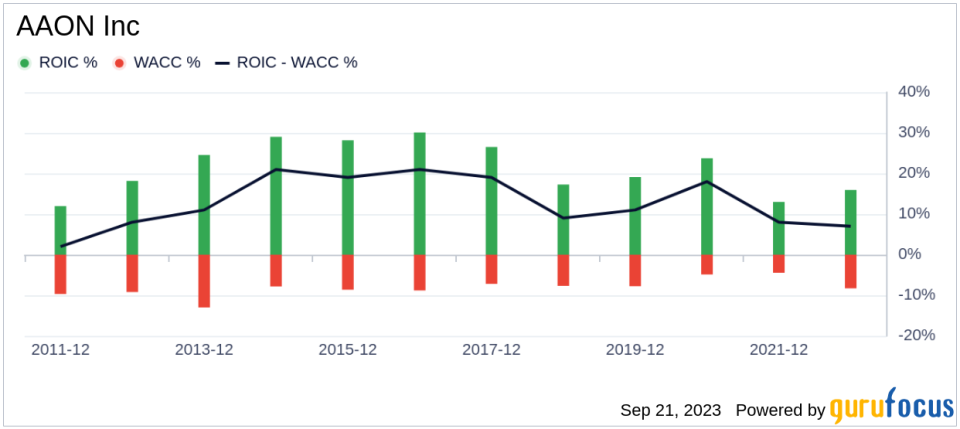

Investing in profitable companies carries less risk. AAON has been profitable for 10 years over the past decade. With revenues of $1 billion and Earnings Per Share (EPS) of $1.81 in the past 12 months, the company's operating margin of 17.41% is better than 88.72% of the companies in the Construction industry. Furthermore, AAON's 3-year average revenue growth rate is better than 87.9% of 1554 companies in the Construction industry, and its 3-year average EBITDA growth rate is 20.6%, ranking better than 76.32% of 1322 companies in the industry.

Another way to determine a company's profitability is to compare its return on invested capital (ROIC) to the weighted average cost of capital (WACC). AAON's ROIC for the past 12 months is 20.87, and its cost of capital is 10.04, implying value creation for shareholders.

Conclusion

In conclusion, AAON (NASDAQ:AAON) appears to be modestly undervalued. The company's strong financial condition, robust profitability, and impressive growth rank it higher than 76.32% of 1322 companies in the Construction industry. For more information on AAON stock, check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.