Unveiling Aehr Test Systems (AEHR)'s Value: Is It Really Priced Right? A Comprehensive Guide

Aehr Test Systems (NASDAQ:AEHR) recently experienced a daily gain of 3.94%, with a three-month gain of 16.13%. The company's Earnings Per Share (EPS) stands at 0.5. However, the question remains: is the stock significantly overvalued? This article seeks to provide a comprehensive analysis of Aehr Test Systems' valuation, guiding potential investors towards an informed decision.

Company Introduction

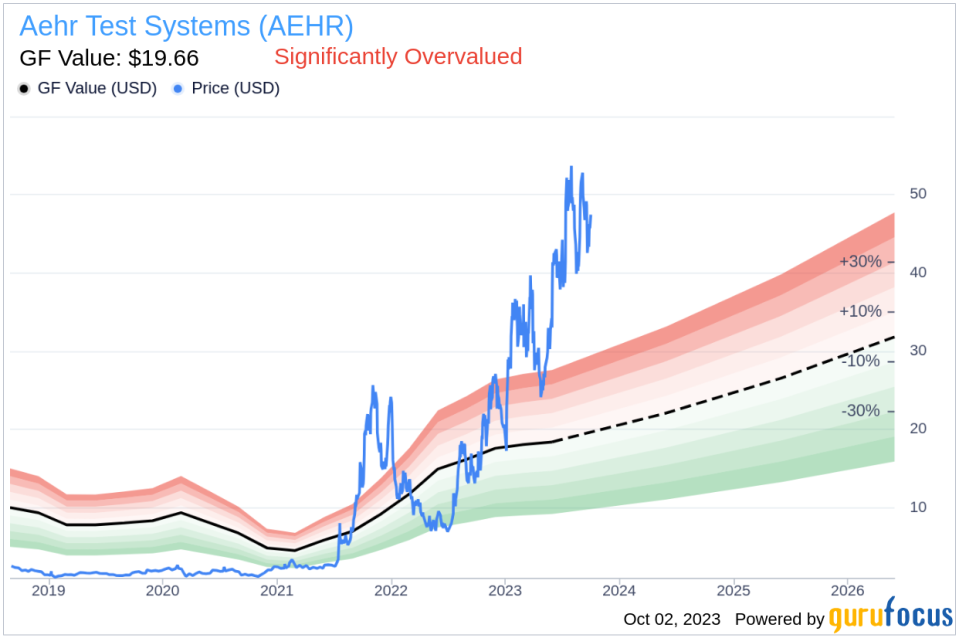

Aehr Test Systems is a leading player in the creation of test systems for burning-in and testing logic, optical, and memory integrated circuits. The company has seen a surge in demand due to the increased quality and reliability needs of the Automotive and Mobility integrated circuit markets. Despite its current stock price of $47.5, the GF Value, a proprietary measure of the stock's intrinsic value, stands at $19.66, indicating a possible overvaluation.

Understanding the GF Value

The GF Value offers a unique perspective on a stock's current intrinsic value, calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. If the stock price significantly surpasses the GF Value Line, it is likely overvalued, and its future return might be poor. Conversely, if it significantly falls below the GF Value Line, its future return will likely be higher. Currently, Aehr Test Systems' stock appears to be significantly overvalued.

Financial Strength

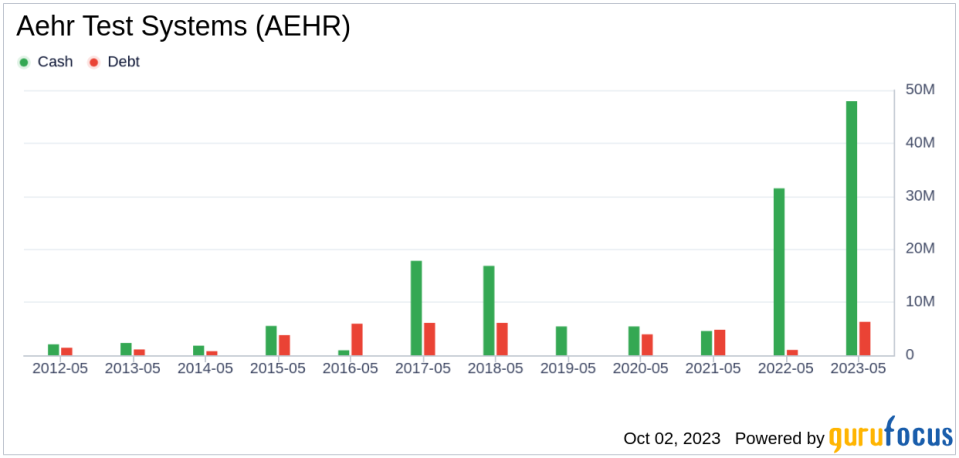

Before investing, it's crucial to assess the financial strength of a company. Aehr Test Systems boasts a cash-to-debt ratio of 7.6, ranking better than 68.14% of companies in the Semiconductors industry. Its overall financial strength is 8 out of 10, indicating strong financial health.

Profitability and Growth

Consistent profitability over the long term often indicates a safer investment. Aehr Test Systems has been profitable 4 times over the past 10 years, with an operating margin of 20.59%, ranking better than 82.7% of companies in the Semiconductors industry.

Growth is a crucial factor in a company's valuation. Aehr Test Systems' 3-year average revenue growth rate is better than 86.27% of companies in the Semiconductors industry. However, its 3-year average EBITDA growth rate ranks worse than 0% of companies in the same industry.

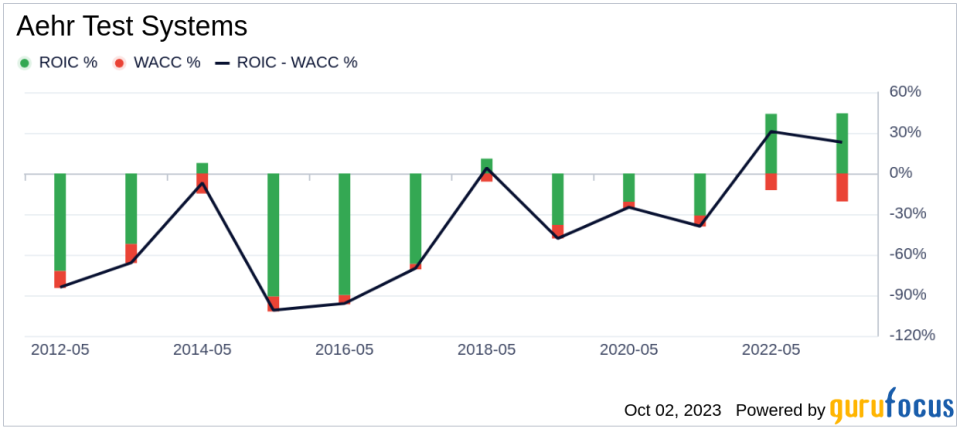

ROIC vs. WACC

Another way to gauge a company's profitability is by comparing its return on invested capital (ROIC) to the weighted average cost of capital (WACC). A higher ROIC than WACC signifies that the company is creating value for shareholders. Aehr Test Systems' ROIC for the past 12 months is 48.58, while its WACC is 24.13.

Conclusion

Based on the analysis, Aehr Test Systems (NASDAQ:AEHR) appears to be significantly overvalued. While the company's financial condition is strong, its profitability is relatively low, and its growth ranks poorly within the Semiconductors industry. For more detailed financial information on Aehr Test Systems, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, visit the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.