Unveiling Akebia Therapeutics (AKBA)'s Value: Is It Really Priced Right? A Comprehensive Guide

With a daily gain of 15.57% and a 3-month gain of 13.19%, Akebia Therapeutics Inc (NASDAQ:AKBA) has caught the attention of many investors. However, the company reported a Loss Per Share of 0.31. The question that arises is whether the stock is modestly undervalued despite these figures. This article aims to provide a comprehensive valuation analysis of Akebia Therapeutics (NASDAQ:AKBA). So, let's delve into the details.

Company Introduction

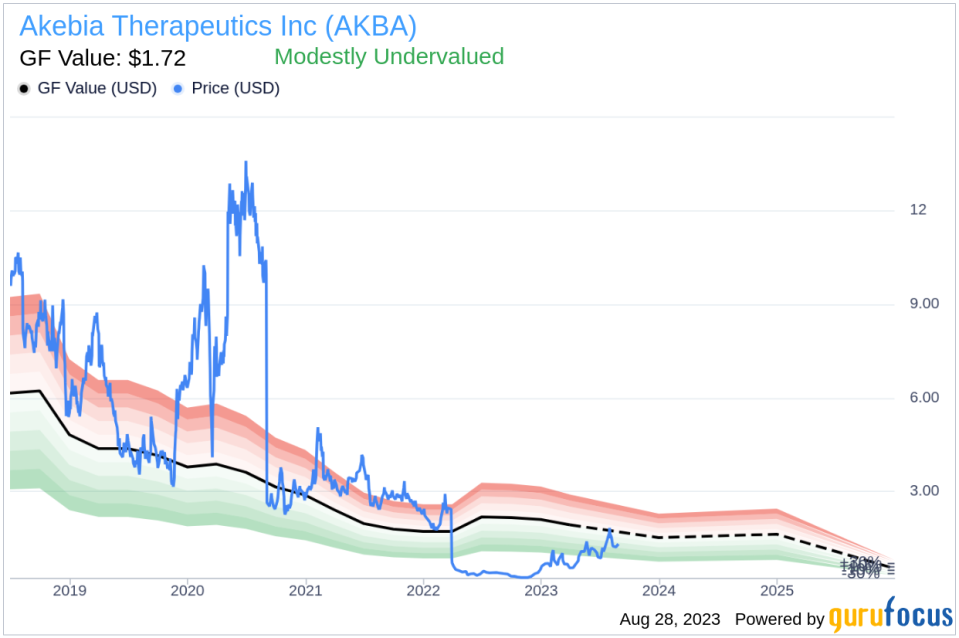

Akebia Therapeutics Inc is a fully integrated biopharmaceutical company, primarily focusing on developing and commercializing novel therapeutics for people with kidney disease. The company's portfolio includes Auryxia and Vafseo, approved and marketed medicines for the treatment of various kidney diseases. Despite a current stock price of $1.33, the GuruFocus Fair Value (GF Value) estimates the fair value at $1.72, suggesting that the stock might be modestly undervalued.

Understanding the GF Value

The GF Value is a proprietary measure that estimates a stock's intrinsic value based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

For Akebia Therapeutics (NASDAQ:AKBA), the GF Value suggests that the stock is modestly undervalued. This implies that the long-term return of its stock is likely to be higher than its business growth.

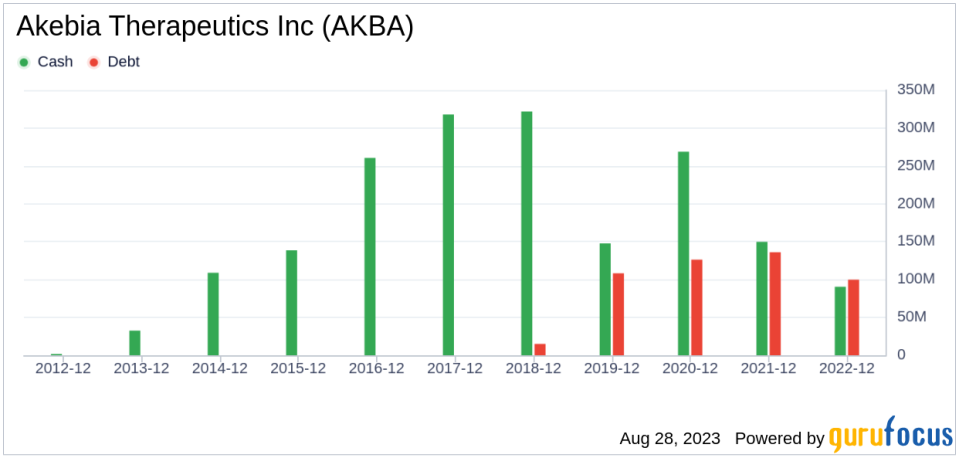

Financial Strength

Investing in companies with poor financial strength can lead to a higher risk of permanent capital loss. Therefore, it's crucial to review a company's financial strength before deciding to buy its stock. Akebia Therapeutics has a cash-to-debt ratio of 0.69, which is worse than 82.97% of companies in the Biotechnology industry. This indicates that the financial strength of Akebia Therapeutics is poor.

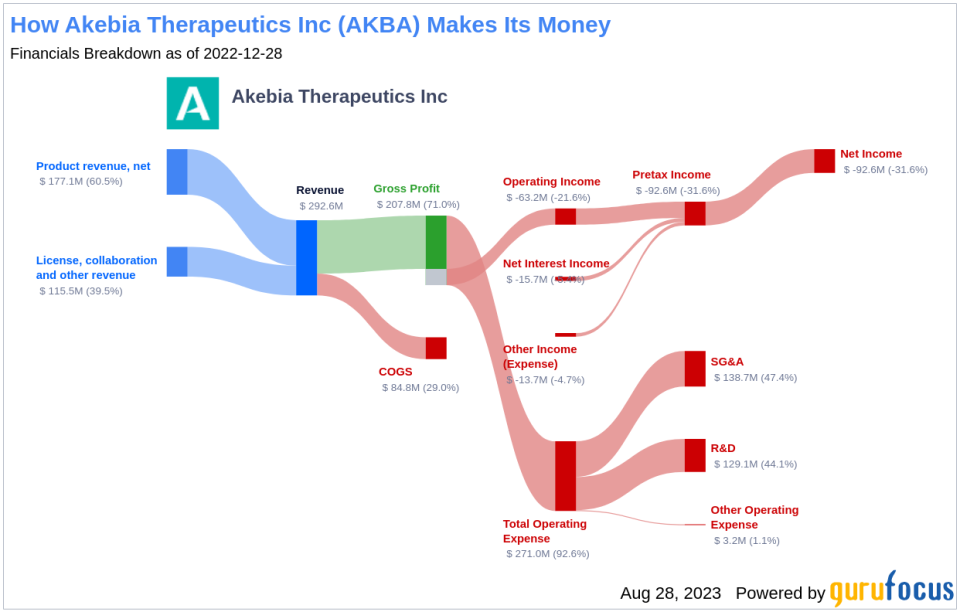

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, typically poses less risk. Akebia Therapeutics has been profitable 0 times over the past 10 years, indicating poor profitability. However, the company's growth ranks better than 93.9% of companies in the Biotechnology industry, suggesting its potential for value creation.

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) and its Weighted Average Cost of Capital (WACC) can provide insights into its profitability. For Akebia Therapeutics, the ROIC is -9.8, and the WACC is 9, indicating a need for improvement.

Conclusion

In conclusion, the stock of Akebia Therapeutics (NASDAQ:AKBA) is estimated to be modestly undervalued. Despite its poor financial condition and profitability, its growth ranks better than a significant portion of companies in the Biotechnology industry. To learn more about Akebia Therapeutics stock, you can check out its 30-Year Financials here.

To find out other high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.