Unveiling Ameren (AEE)'s Value: Is It Really Priced Right? A Comprehensive Guide

In the volatile world of stocks, Ameren Corp (NYSE:AEE) has experienced a daily loss of -1.86%, with a 3-month loss of -1.61%. Despite these fluctuations, Ameren (NYSE:AEE) has reported a robust Earnings Per Share (EPS) (EPS) of 4.27. This article aims to answer a crucial question: Is Ameren modestly undervalued? We invite you to delve into our comprehensive valuation analysis that will provide you with valuable insights.

About Ameren Corp

Ameren Corp, with its rate-regulated generation, transmission, and distribution networks, delivers electricity and natural gas to over 2.4 million electricity customers and more than 900,000 natural gas customers in Missouri and Illinois. With a current stock price of $78.72, Ameren has a market cap of $20.70 billion. The question that arises here is, how does this price compare with the company's intrinsic value, also known as the GF Value? To answer this, we need to delve deeper into the company's financials and its potential for growth.

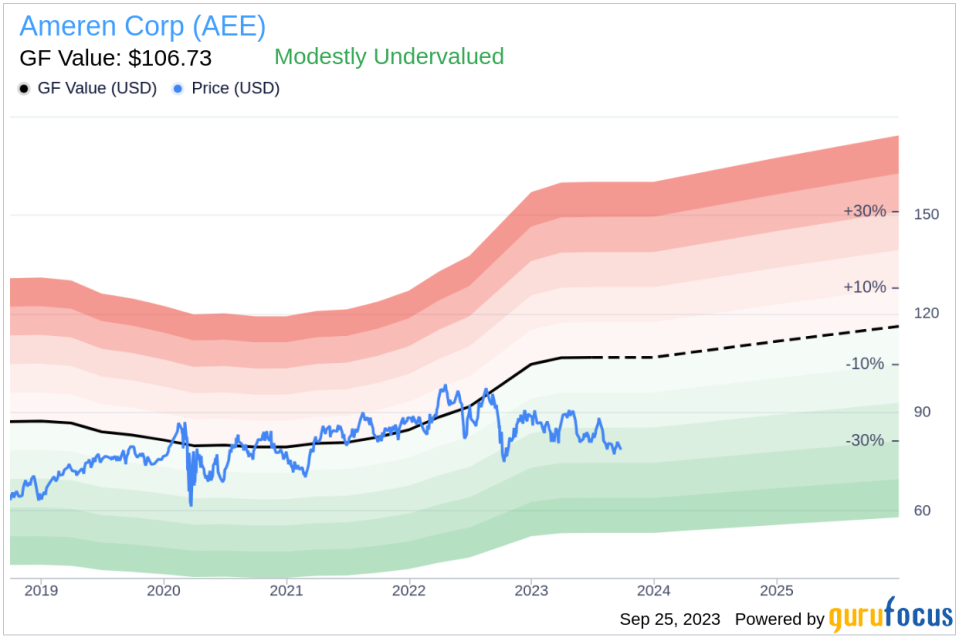

Understanding GF Value

The GF Value is a proprietary measure that estimates a stock's intrinsic value. It takes into consideration historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line on our summary page provides an overview of the stock's fair value. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher.

Our analysis indicates that Ameren (NYSE:AEE) shows signs of being modestly undervalued. This conclusion is based on the GF Value Line, which factors in historical multiples, an internal adjustment based on the company's past business growth, and analyst estimates of future business performance. With a market cap of $20.70 billion and a current price of $78.72 per share, Ameren's stock appears to be modestly undervalued. As a result, the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

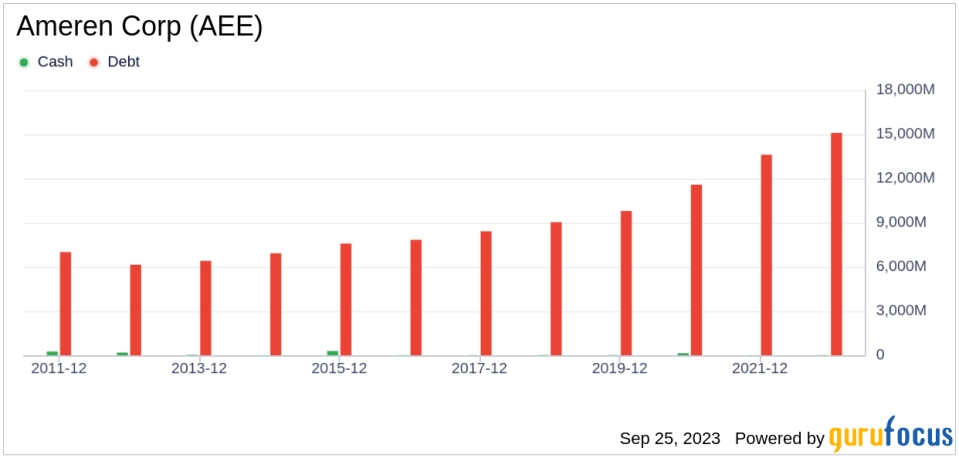

Ameren's Financial Strength

Investing in companies with poor financial strength can pose a high risk of permanent capital loss. To avoid this, it's crucial to review a company's financial strength before purchasing shares. Ameren's cash-to-debt ratio is 0, ranking worse than 0% of 485 companies in the Utilities - Regulated industry. This indicates that Ameren's financial strength is poor.

Profitability and Growth

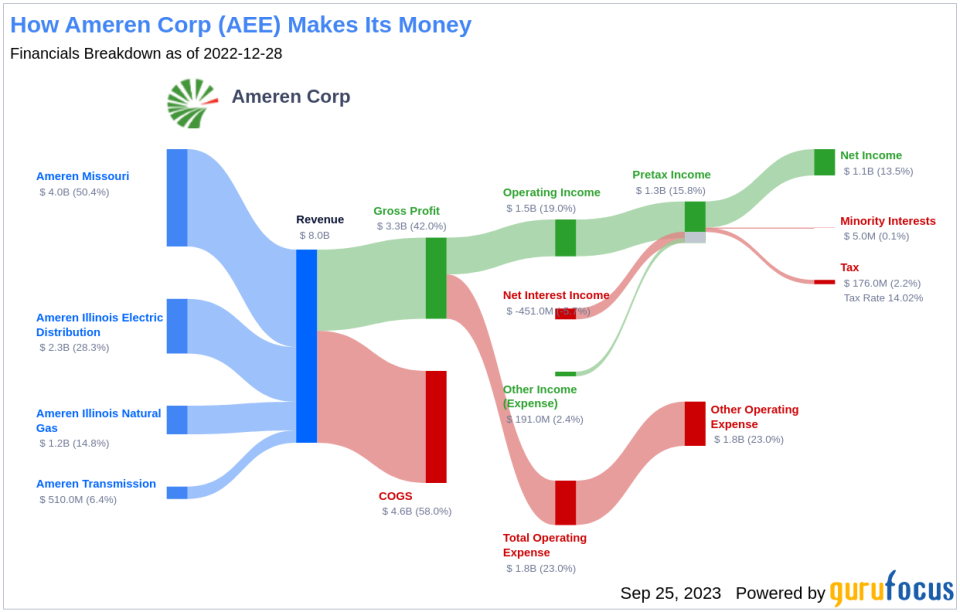

Investing in profitable companies carries less risk. Ameren has been profitable 10 years over the past 10 years, with revenues of $8.20 billion and an EPS of $4.27 over the past 12 months. Its operating margin of 19.02% is better than 68.77% of 506 companies in the Utilities - Regulated industry. This indicates fair profitability.

Another critical factor in a company's valuation is its growth. Companies that grow faster create more value for shareholders. Ameren's average annual revenue growth is 8.6%, which ranks better than 53.29% of 486 companies in the Utilities - Regulated industry. Its 3-year average EBITDA growth is 6.9%, ranking better than 59.69% of 459 companies in the same industry.

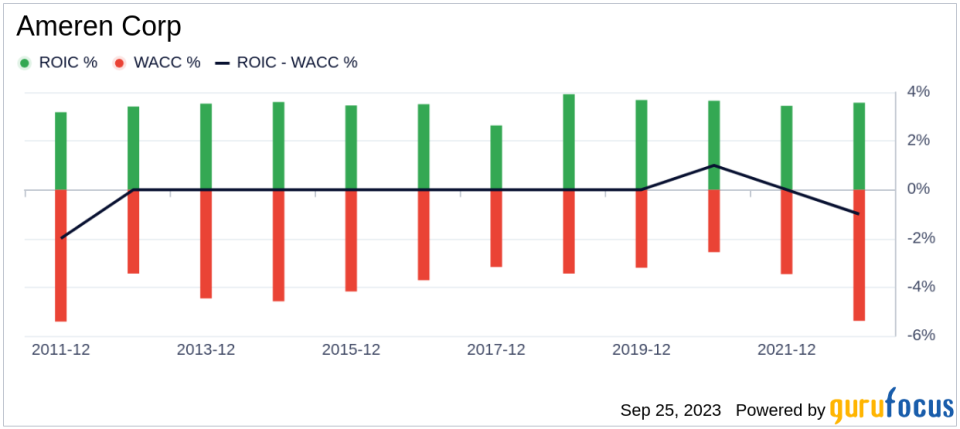

Another way to assess a company's profitability is to compare its return on invested capital (ROIC) and the weighted average cost of capital (WACC). For Ameren, the ROIC is 3.53, and the WACC is 5.79 for the past 12 months.

Conclusion

Based on our analysis, Ameren (NYSE:AEE) appears to be modestly undervalued. Although the company's financial condition is poor, its profitability is fair, and its growth ranks better than 59.69% of companies in the Utilities - Regulated industry. For more information about Ameren's stock, you can check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.