Unveiling AtriCure (ATRC)'s Value: Is It Really Priced Right? A Comprehensive Guide

With a daily loss of 4.37%, a 3-month loss of 13.06%, and a Loss Per Share of $0.61, AtriCure Inc (NASDAQ:ATRC) seems to be on a downward trajectory. However, is the stock genuinely undervalued? This article provides a comprehensive valuation analysis of AtriCure, aiming to provide a clear picture of its intrinsic worth. Let's delve in and explore.

Company Overview

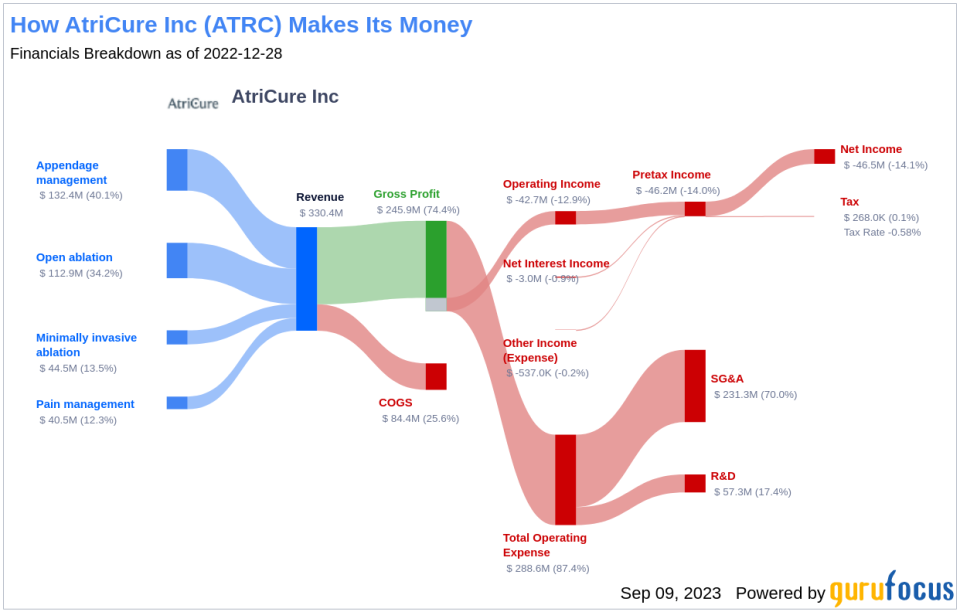

AtriCure Inc is an innovative medical device company, specializing in surgical treatments for atrial fibrillation (Afib), left atrial appendage (LAA) management, and post-operative pain management. With a majority of its revenue generated from the United States, the company's product line includes Cryo, Soft Tissue Dissection, RF Ablation Pacing and Sensing, among others. AtriCure has an estimated fair value of $64.91, significantly higher than its current stock price of $41.61, indicating potential undervaluation.

Understanding the GF Value

The GF Value is a unique valuation model that considers historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line represents the stock's ideal trading value. If the stock price is significantly above the GF Value Line, it is overvalued, and if it's below, it's undervalued.

According to GuruFocus' valuation method, AtriCure (NASDAQ:ATRC) is significantly undervalued. With a market cap of $2 billion, the stock's current price of $41.61 per share is considerably below the GF Value Line. Consequently, the long-term return of AtriCure's stock is likely to be much higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength Analysis

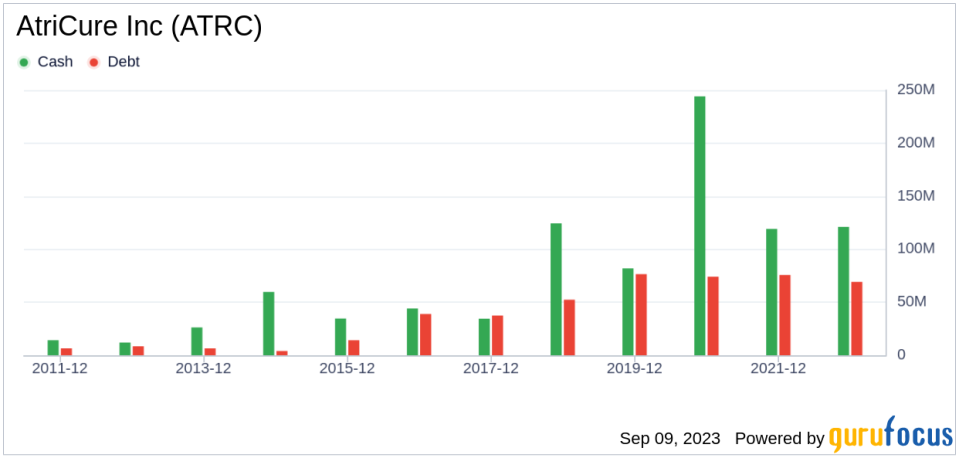

Investing in companies with poor financial strength can lead to a high risk of permanent capital loss. AtriCure's cash-to-debt ratio of 1.7, although worse than 55.33% of 835 companies in the Medical Devices & Instruments industry, still indicates strong overall financial strength with a rating of 8 out of 10.

Profitability and Growth

Profitable companies are generally less risky investments. AtriCure's profitability ranking of 3 out of 10, however, indicates poor profitability. Additionally, the company's growth ranks worse than 68.31% of companies in the Medical Devices & Instruments industry, with an average annual revenue growth of 5.6% and a 3-year average EBITDA growth of -4.1%.

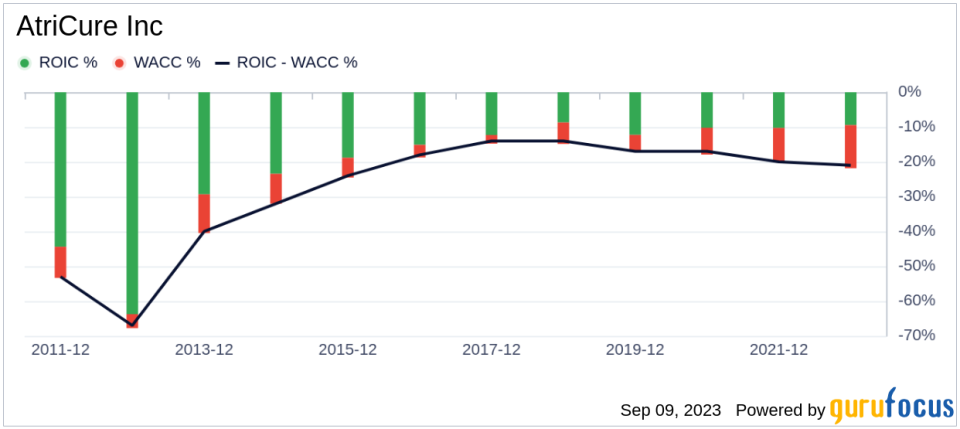

Evaluating ROIC and WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can provide insights into its profitability. AtriCure's ROIC of -5.8 is significantly lower than its WACC of 13.9, indicating that the company may not be creating value for its shareholders.

Conclusion

In conclusion, AtriCure (NASDAQ:ATRC) appears to be significantly undervalued, with strong financial health but poor profitability and growth. To learn more about AtriCure stock, check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.