Unveiling Avery Dennison (AVY)'s Value: Is It Really Priced Right? A Comprehensive Guide

As of September 25, 2023, Avery Dennison Corp (NYSE:AVY) reported a daily gain of 1.96%, and a 3-month gain of 10.16%. With an Earnings Per Share (EPS) of 6.94, the question arises: is the stock fairly valued? This comprehensive analysis aims to answer this question by examining various financial metrics and the company's intrinsic value.

Company Overview

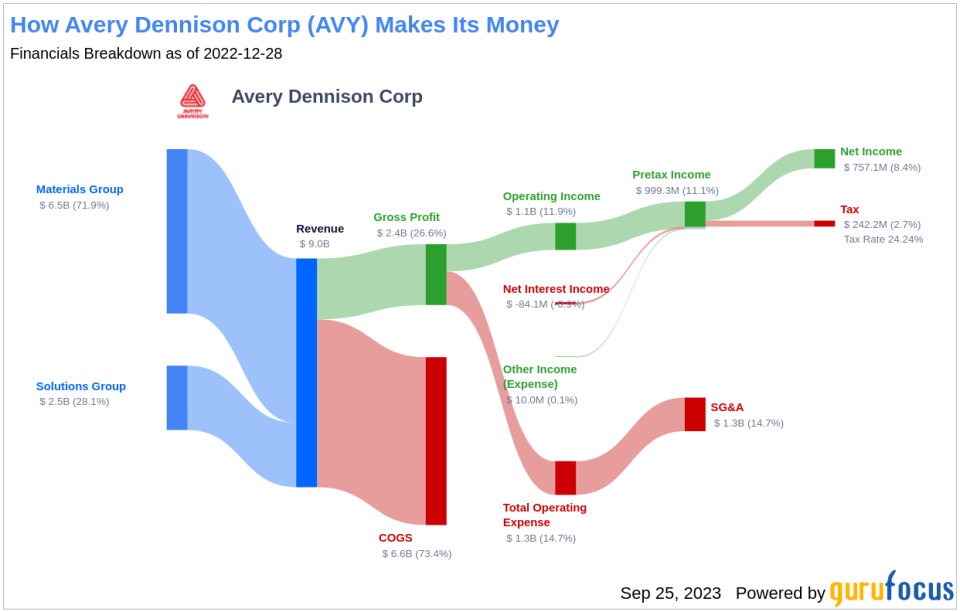

Avery Dennison Corp (NYSE:AVY) is a leading manufacturer of pressure-sensitive materials, merchandise tags, and labels. The company also operates a specialty converting business that produces radio-frequency identification inlays and labels. With a significant portion of its revenue generated from international operations, Avery Dennison is a global player in the industry. The company's stock price currently stands at $184.4, closely matching its GF Value of $186.01, suggesting a fair valuation. This analysis delves deeper into the company's valuation, integrating financial assessment with essential company details.

Understanding the GF Value

The GF Value is a proprietary measure that represents the current intrinsic value of a stock. This value is derived from historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and estimates of future business performance. The GF Value Line provides an overview of the fair value at which the stock should ideally be traded. If the stock price is significantly above the GF Value Line, it may be overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

The stock of Avery Dennison (NYSE:AVY) is estimated to be fairly valued based on GuruFocus' valuation method. Given its current price of $184.4 per share, the stock appears to be trading close to its intrinsic value. As a result, the long-term return of Avery Dennison's stock is likely to be close to the rate of its business growth.

Link: These companies may deliever higher future returns at reduced risk.

Financial Strength

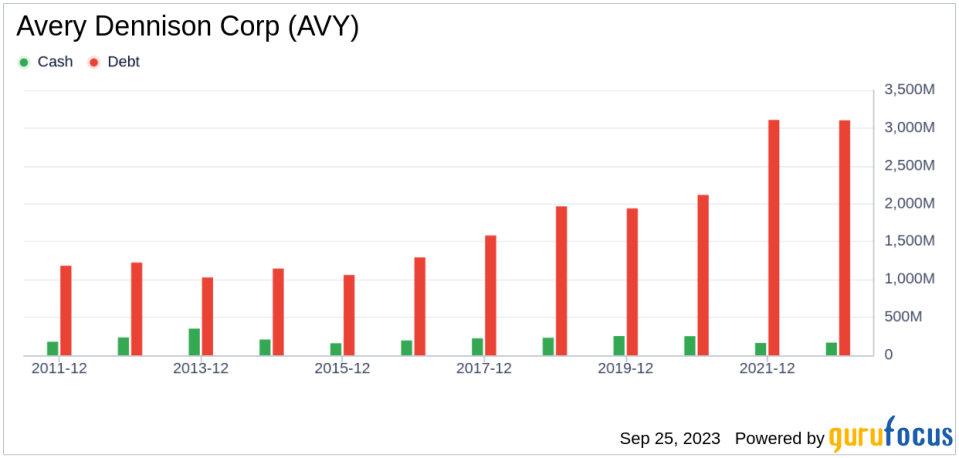

Before investing in a company, it's crucial to assess its financial strength. Investing in companies with poor financial strength poses a higher risk of permanent loss. The cash-to-debt ratio and interest coverage can provide valuable insights into a company's financial strength. Avery Dennison's cash-to-debt ratio stands at 0.06, which is lower than 85.33% of 375 companies in the Packaging & Containers industry. With an overall financial strength ranking of 5 out of 10, Avery Dennison's financial condition is fair.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, is generally less risky. Avery Dennison has been profitable 10 out of the past 10 years. Over the past twelve months, the company reported a revenue of $8.50 billion and an Earnings Per Share (EPS) of $6.94. Its operating margin is 10.8%, ranking better than 81.1% of 381 companies in the Packaging & Containers industry. Overall, Avery Dennison's profitability is strong, with a rank of 9 out of 10.

Growth is a critical factor in a company's valuation. Faster-growing companies create more value for shareholders, especially if the growth is profitable. The 3-year average annual revenue growth of Avery Dennison is 9.8%, ranking better than 60.06% of 363 companies in the Packaging & Containers industry. The 3-year average EBITDA growth rate is 41.2%, ranking better than 90.17% of 346 companies in the Packaging & Containers industry.

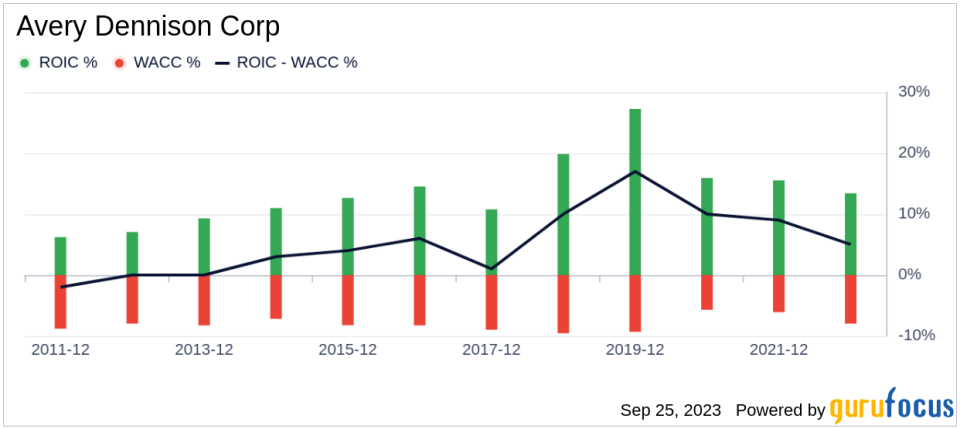

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) can provide insights into its profitability. The ROIC measures how well a company generates cash flow relative to the capital it has invested in its business, while the WACC is the rate that a company is expected to pay on average to finance its assets. When the ROIC is higher than the WACC, it implies the company is creating value for shareholders. For the past 12 months, Avery Dennison's ROIC stands at 10.77, and its cost of capital is 8.62.

Conclusion

In conclusion, Avery Dennison (NYSE:AVY) stock is estimated to be fairly valued. The company's financial condition is fair, its profitability is strong, and its growth ranks better than 90.17% of 346 companies in the Packaging & Containers industry. To learn more about Avery Dennison stock, you can check out its 30-Year Financials here.

To find out the high quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.