Unveiling AZZ (AZZ)'s Value: Is It Really Priced Right? A Comprehensive Guide

With a daily gain of 8.89%, AZZ Inc (NYSE:AZZ) has shown a promising 3-month gain of 13.93%. However, the company reported a Loss Per Share of 2.45. This raises the question: is AZZ (NYSE:AZZ) significantly undervalued? In this article, we will conduct a detailed valuation analysis to answer this question. Read on to gain a comprehensive understanding of AZZ's financial standing.

Company Introduction

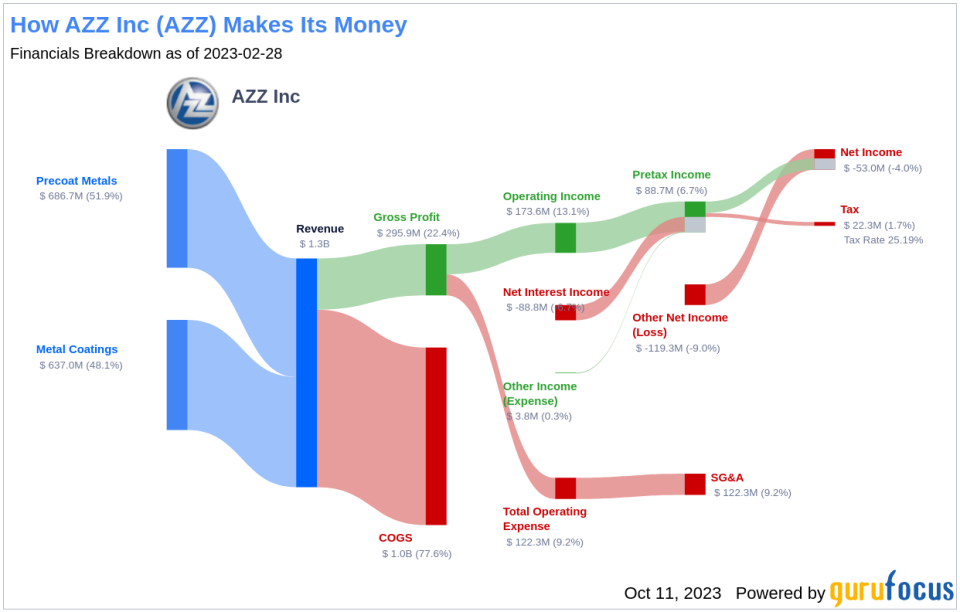

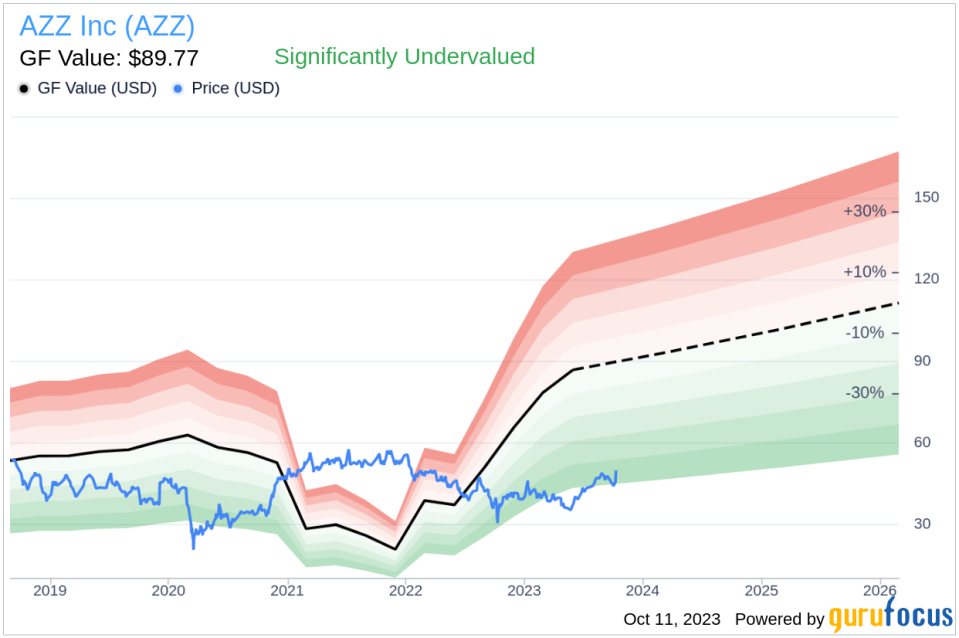

AZZ Inc is a provider of galvanizing and a variety of metal coating solutions and coil coating solutions to a broad range of end markets in North America. Its Metal Coatings segment offers metal finishing services to protect against corrosion, such as hot dip galvanizing, spin galvanizing, powder coating, anodizing, and plating. The Precoat Metals Segment offers aesthetic and corrosion-resistant coatings for steel and aluminum coils. Despite a current stock price of $49.98, the GuruFocus Fair Value (GF Value) for AZZ stands at $89.77, suggesting that the stock is significantly undervalued.

Understanding the GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line on our summary page provides an overview of the fair value at which the stock should ideally be traded. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

According to GuruFocus Value calculation, AZZ (NYSE:AZZ) appears to be significantly undervalued. The current price of $49.98 per share and the market cap of $1.30 billion suggest that AZZ stock is significantly undervalued. Because of this undervaluation, the long-term return of AZZ's stock is likely to be much higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.