Unveiling Brown-Forman (BF.B)'s Value: Is It Really Priced Right? A Comprehensive Guide

Brown-Forman Corp (NYSE:BF.B) experienced a daily gain of 1.5%, despite a 3-month loss of -14.63%. With an Earnings Per Share (EPS) of 1.59, the question arises: Is Brown-Forman (NYSE:BF.B) modestly undervalued? This comprehensive analysis aims to answer that question by examining the company's financial health, profitability, and growth. Read on to discover if Brown-Forman's stock is a worthy investment.

A Snapshot of Brown-Forman

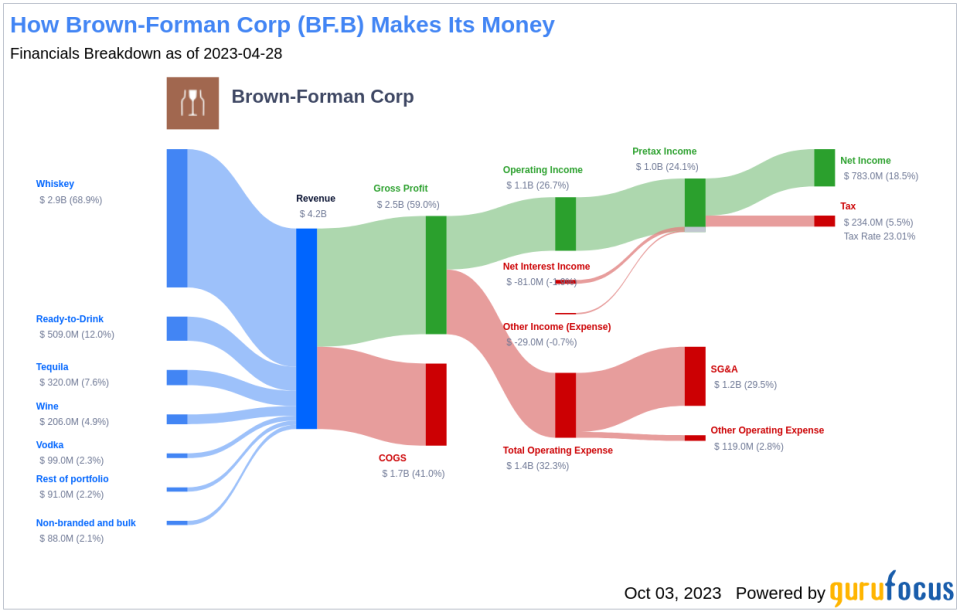

Brown-Forman Corp (NYSE:BF.B) is a renowned U.S.-based manufacturer of premium distilled spirits. The company garners approximately 70% of its revenues from the whiskey category, with popular brands like Jack Daniel's, Woodford Reserve, and Old Forester. It also offers tequila, vodka, rum, gin, and premium wines. With 47% of sales generated domestically, the rest of its revenues come from Europe, Australia, and Latin America. The Brown family controls over 50% of the economic interests and voting power of the company.

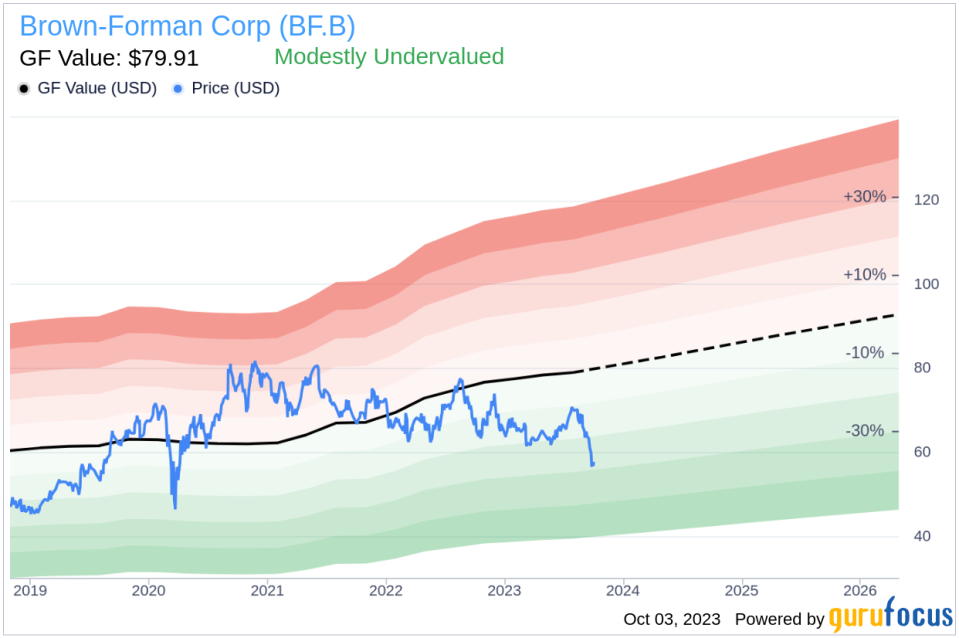

At present, Brown-Forman's stock is priced at $57.68, which is significantly lower than its GF Value of $79.91. This discrepancy suggests that the stock might be undervalued, which we will explore further in the analysis below.

Understanding the GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line represents the fair trading value of the stock. If the stock price significantly deviates from the GF Value Line, it could suggest that the stock is overvalued or undervalued.

According to the GF Value, Brown-Forman (NYSE:BF.B) appears to be modestly undervalued. This conclusion is drawn from the current stock price of $57.68, which is lower than the GF Value of $79.91. This implies that the long-term return of Brown-Forman's stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

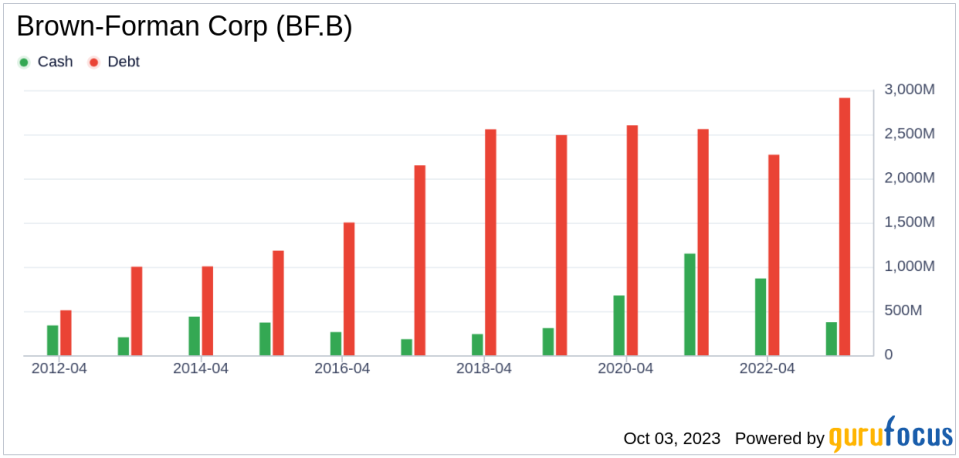

Financial Strength of Brown-Forman

Examining the financial strength of a company is crucial before investing in its stock. Brown-Forman has a cash-to-debt ratio of 0.14, which is lower than 72% of 200 companies in the Beverages - Alcoholic industry. This gives Brown-Forman a financial strength score of 6 out of 10, indicating fair financial health.

Profitability and Growth

Investing in profitable companies carries less risk. Brown-Forman has been profitable for 10 years over the past decade. In the past 12 months, the company generated revenues of $4.30 billion and Earnings Per Share (EPS) of $1.59. Its operating margin of 26.09% is better than 86.6% of companies in the Beverages - Alcoholic industry, indicating strong profitability .

Growth is a significant factor in a company's valuation. Brown-Forman's 3-year average revenue growth rate is better than 58.46% of companies in the Beverages - Alcoholic industry. However, its 3-year average EBITDA growth rate is 0.6%, ranking lower than 65.73% of companies in the industry, indicating a need for improvement in growth .

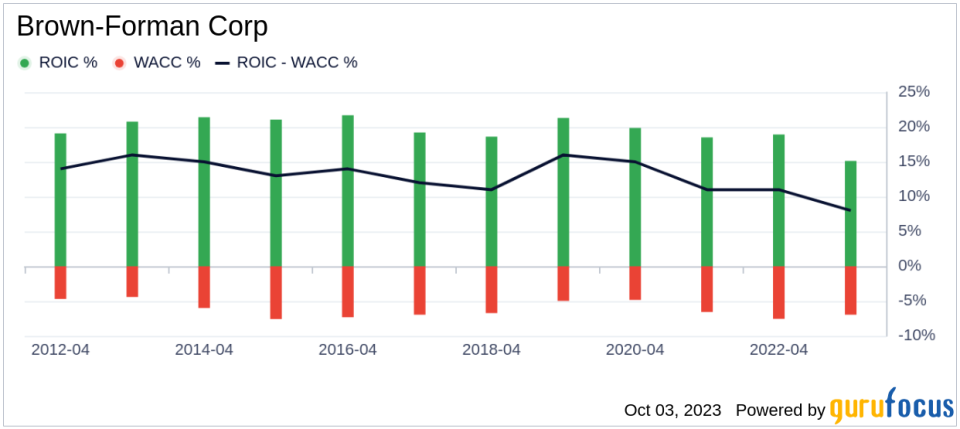

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can also evaluate its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. In the past 12 months, Brown-Forman's ROIC was 14.54, while its WACC was 8.06.

Conclusion

In conclusion, Brown-Forman (NYSE:BF.B) appears to be modestly undervalued. The company exhibits fair financial strength and strong profitability, despite its growth ranking lower than 65.73% of companies in the Beverages - Alcoholic industry. For a more detailed analysis of Brown-Forman's financials, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.