Unveiling Cars.com (CARS)'s Value: Is It Really Priced Right? A Comprehensive Guide

With a daily gain of 4.24%, a 3-month loss of -5.53%, and an Earnings Per Share (EPS) of 1.65, Cars.com Inc (NYSE:CARS) presents an interesting case for valuation analysis. The question we aim to address is whether the stock is modestly overvalued. This article provides an in-depth analysis of Cars.com's financial performance, growth prospects, and intrinsic value to help investors make informed decisions.

Company Overview

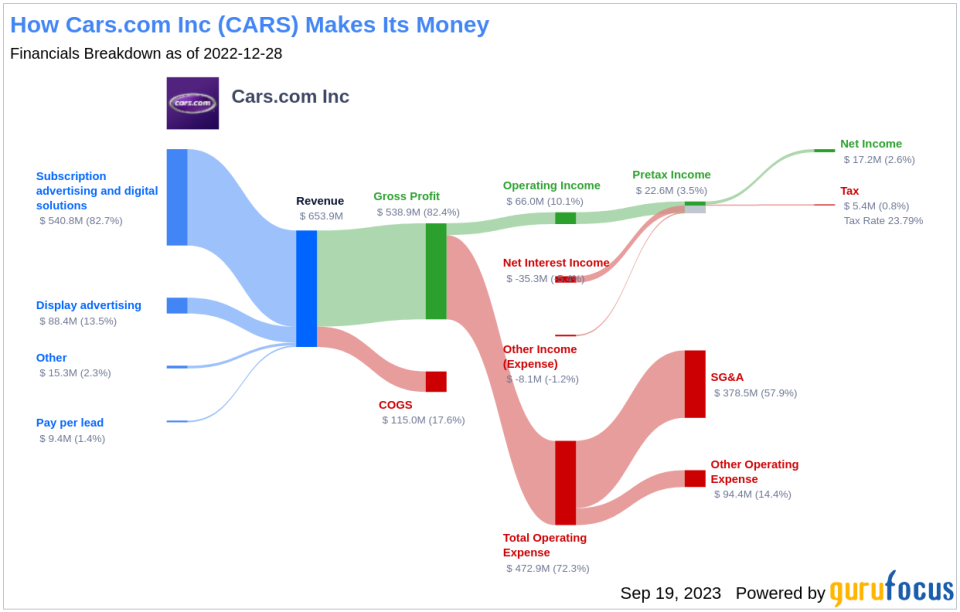

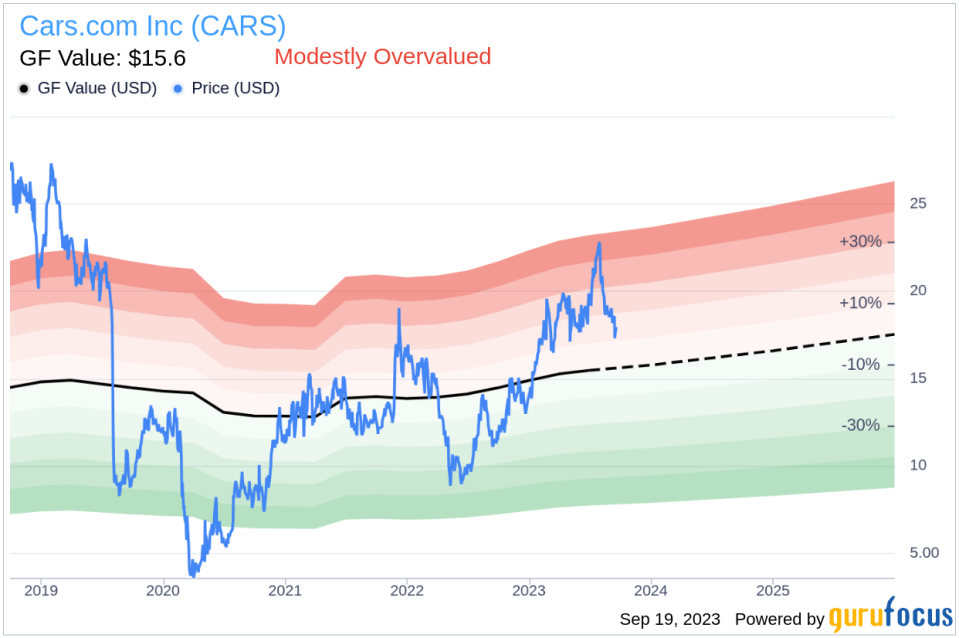

Cars.com Inc is a leading online platform for buying and selling new and used vehicles. The company's portfolio includes brands like Dealer Inspire, DealerRater, FUEL, Accu-Trade, PickupTrucks.com, CreditIQ, and NewCars.com, each targeting different consumer segments. With a current stock price of $17.95, Cars.com has a market cap of $1.2 billion. However, the GF Value, an estimation of the stock's fair value, stands at $15.6, suggesting that the stock might be modestly overvalued. The following sections delve into the detailed analysis of Cars.com's value.

The GF Value of Cars.com

The GF Value is a proprietary measure that represents the stock's intrinsic value. It is calculated based on historical trading multiples, a GuruFocus adjustment factor reflecting the company's past performance and growth, and future business performance estimates. The GF Value Line provides an overview of the stock's fair trading value.

Cars.com (NYSE:CARS) appears to be modestly overvalued according to the GF Value. The stock's fair value is estimated considering historical multiples, the company's past growth, and future business performance. If the stock price is significantly above the GF Value Line, it indicates overvaluation and potential poor future returns. Conversely, if the stock price is significantly below the GF Value Line, the stock might be undervalued, indicating high future returns.

Given that Cars.com is modestly overvalued, the long-term return of its stock is likely to be lower than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

Investing in companies with poor financial strength carries a higher risk of permanent loss of capital. Therefore, it's crucial to scrutinize the financial strength of a company before deciding to buy its stock. A good starting point is the cash-to-debt ratio and interest coverage. Cars.com's cash-to-debt ratio of 0.06 is worse than 90.2% of companies in the Vehicles & Parts industry, indicating poor financial strength.

Profitability and Growth

Investing in profitable companies carries less risk, especially those with consistent profitability over the long term. Cars.com has been profitable for 8 out of the past 10 years, with an operating margin of 9.67%, better than 76.84% of companies in the Vehicles & Parts industry. However, its 3-year average revenue growth rate lags behind 67.14% of companies in the industry, indicating room for improvement.

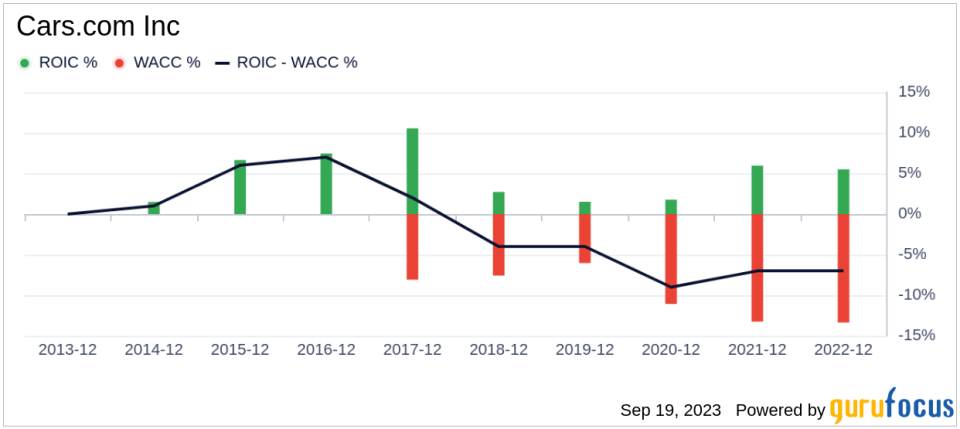

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) is another way to assess profitability. If the ROIC is higher than the WACC, it suggests the company is creating value for shareholders. For Cars.com, the ROIC stands at 27.61, while the WACC is 12.44, indicating positive value creation.

Conclusion

In conclusion, Cars.com (NYSE:CARS) appears to be modestly overvalued. Despite fair profitability, the company's poor financial strength and below-average growth rate suggest caution. For more insights into Cars.com's financial performance, check out its 30-Year Financials here.

For high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.