Unveiling CDW (CDW)'s Value: Is It Really Priced Right? A Comprehensive Guide

CDW Corp (NASDAQ:CDW) has recently experienced a daily loss of -2.18%, but it has gained 13.84% over the past three months. With an Earnings Per Share (EPS) of 7.86, we are left wondering: is the stock fairly valued? This article delves into an in-depth valuation analysis of CDW (NASDAQ:CDW). Let's explore.

Understanding CDW Corp (NASDAQ:CDW)

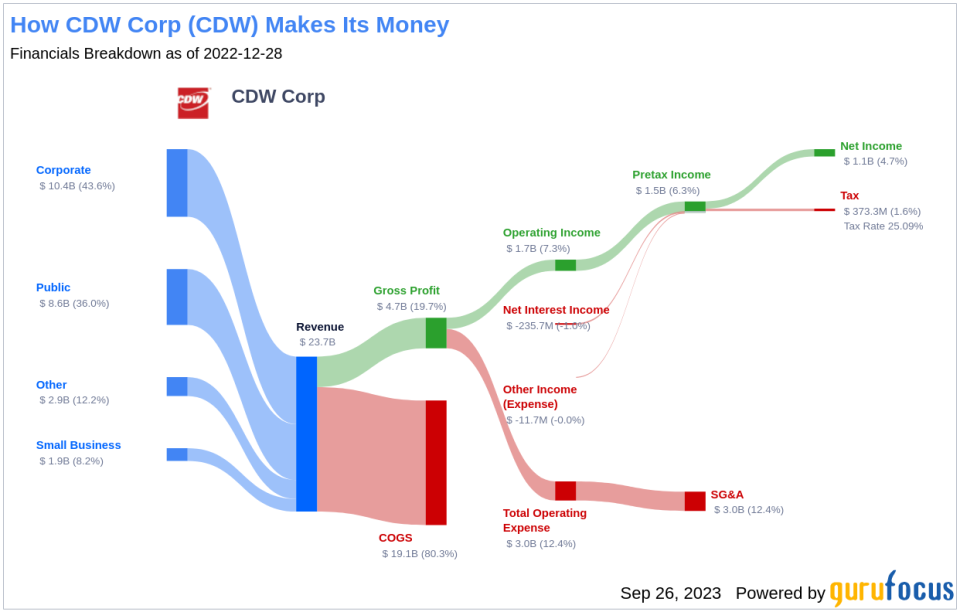

CDW Corp is a value-added reseller operating predominantly in the U.S. (95% of sales) and Canada (5%). The company boasts over 100,000 products ranging from notebooks to data center software. Revenue is derived from a variety of sectors, including midsize and large businesses, small businesses, government agencies, education institutions, and health-care organizations.

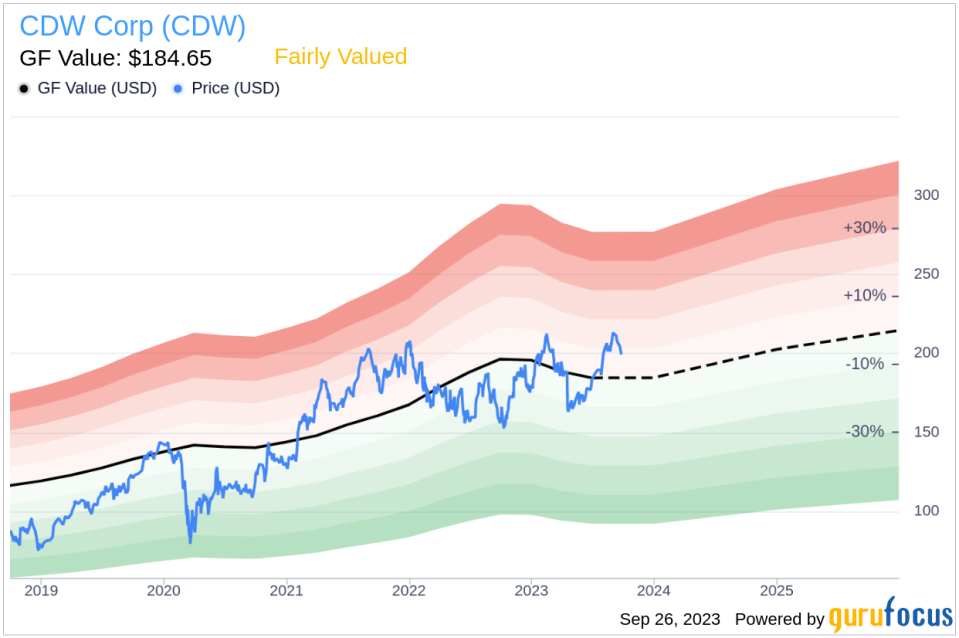

Deciphering the GF Value

The GF Value is a proprietary measure that represents the intrinsic value of a stock. It is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides an overview of the fair value at which the stock should ideally be traded.

According to GuruFocus Value calculation, CDW (NASDAQ:CDW) appears to be fairly valued. At its current price of $200.54 per share and a market cap of $26.90 billion, CDW stock aligns closely with our estimate of its fair value. As CDW is fairly valued, the long-term return of its stock is likely to be close to the rate of its business growth.

Link: These companies may deliever higher future returns at reduced risk.

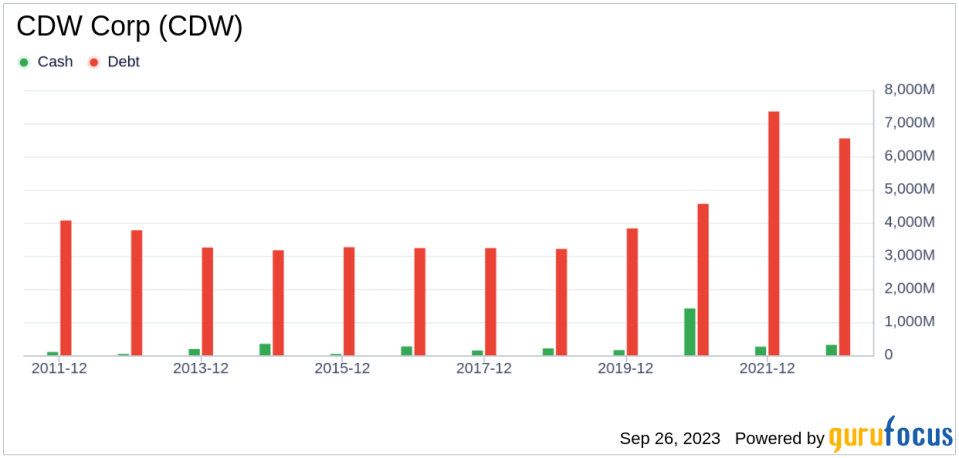

Evaluating CDW's Financial Strength

CDW's financial strength is a crucial factor to consider to avoid potential capital loss. The company's cash-to-debt ratio is 0.03, which ranks worse than 96.8% of 2751 companies in the Software industry. The overall financial strength of CDW is rated 5 out of 10, indicating fair financial stability.

CDW's Profitability and Growth

CDW's profitability has been consistent over the past 10 years. The company had a revenue of $22.40 billion and Earnings Per Share (EPS) of $7.86 in the past twelve months. Its operating margin is 7.51%, which ranks better than 63.73% of 2785 companies in the Software industry. The overall profitability of CDW is ranked 9 out of 10, indicating strong profitability.

CDW's growth is another vital factor in its valuation. The 3-year average annual revenue growth rate of CDW is 12.4%, which ranks better than 60.46% of 2413 companies in the Software industry. The 3-year average EBITDA growth rate is 16.4%, which ranks better than 62.76% of 2006 companies in the Software industry.

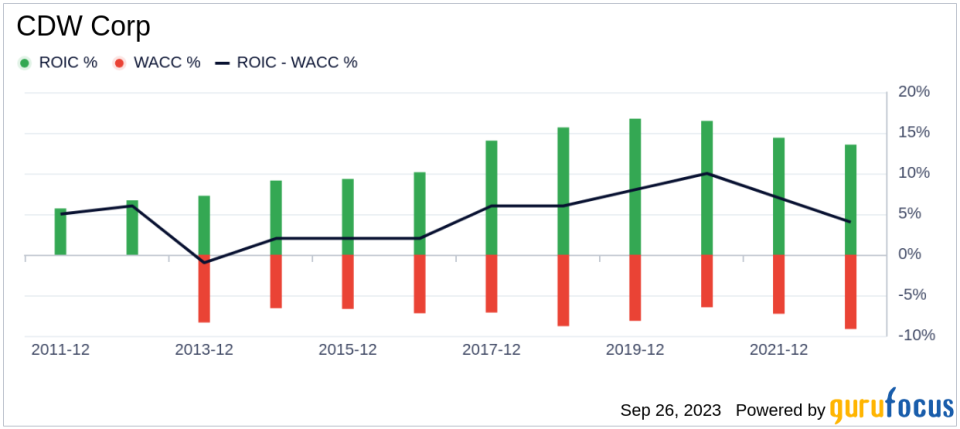

ROIC vs WACC

Comparing CDW's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can also provide insight into its profitability. For the past 12 months, CDW's ROIC was 13.51, and its cost of capital was 8.92, indicating the company is creating value for shareholders.

Conclusion

In summary, CDW (NASDAQ:CDW) appears to be fairly valued. The company's financial condition is fair, its profitability is strong, and its growth ranks better than 62.76% of 2006 companies in the Software industry. To learn more about CDW stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.