Unveiling CenterPoint Energy (CNP)'s Value: Is It Really Priced Right? A Comprehensive Guide

CenterPoint Energy Inc (NYSE:CNP) recently recorded a daily gain of 2.33%, despite a 3-month loss of 10.02%. With an Earnings Per Share (EPS) (EPS) of 1.15, the question arises: is the stock modestly undervalued? To answer this, we delve into the company's valuation analysis, providing a comprehensive exploration of its intrinsic value and future prospects. We encourage readers to delve into this analysis for a clearer understanding of CenterPoint Energy's (NYSE:CNP) valuation.

Company Introduction

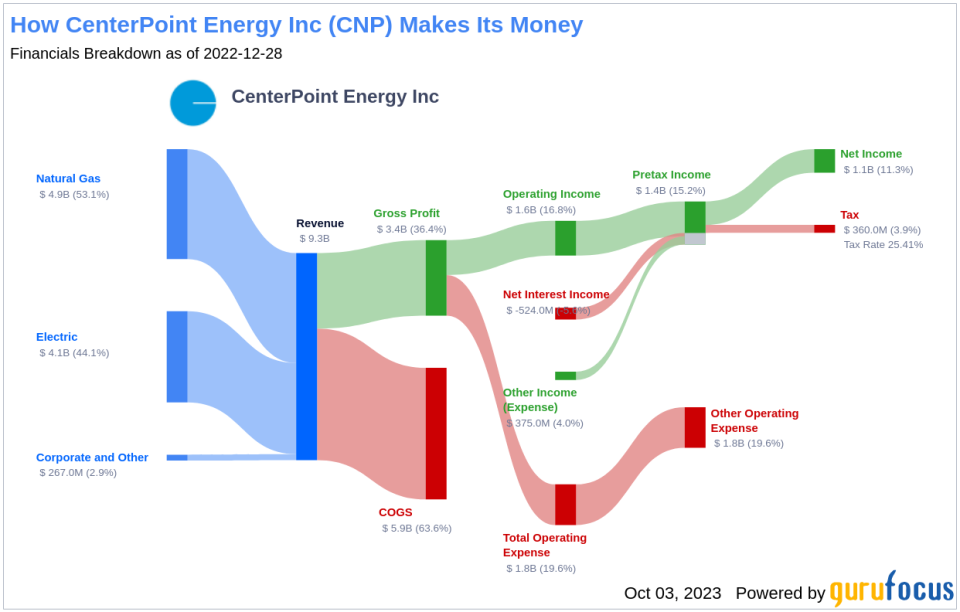

CenterPoint Energy owns a portfolio of energy-related businesses. It provides transmission and distribution services to over 2.5 million customers in the Houston area, southern Indiana, and west central Ohio. Additionally, the company operates natural gas distribution systems in six states, serving approximately 4 million customers. With a current stock price of $26.35 and a GF Value of $29.2, it appears that CenterPoint Energy may be modestly undervalued. The following analysis offers a deeper understanding of the company's value, combining financial assessment with essential company details.

Understanding the GF Value

The GF Value represents the current intrinsic value of a stock, derived from a unique method. It considers historical multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. The GF Value Line on our summary page provides an overview of the fair value that the stock should be trading at. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

According to GuruFocus Value calculation, CenterPoint Energy (NYSE:CNP) appears to be modestly undervalued. With a market cap of $16.60 billion, the stock may offer higher long-term returns than its business growth due to its relative undervaluation.

Financial Strength

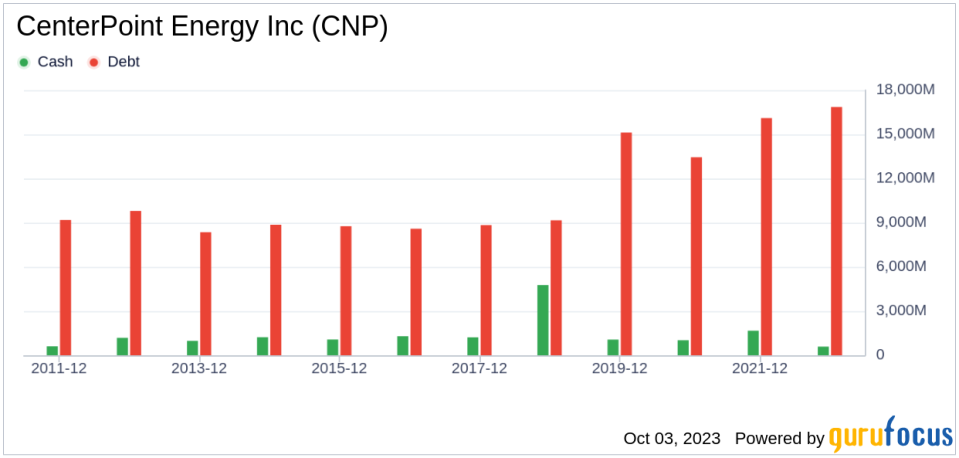

Investing in companies with low financial strength could result in permanent capital loss. Therefore, reviewing a company's financial strength is crucial before deciding to buy shares. CenterPoint Energy has a cash-to-debt ratio of 0.04, ranking worse than 83.13% of 480 companies in the Utilities - Regulated industry. Based on this, GuruFocus ranks CenterPoint Energy's financial strength as 3 out of 10, suggesting a poor balance sheet.

Profitability and Growth

Investing in profitable companies carries less risk, especially those demonstrating consistent profitability over the long term. CenterPoint Energy has been profitable 8 years over the past 10 years. With revenues of $9.30 billion and an EPS of $1.15 in the past 12 months, its operating margin of 17.9% is better than 65.87% of 501 companies in the Utilities - Regulated industry. GuruFocus ranks CenterPoint Energy's profitability as fair.

Growth is a crucial factor in a company's valuation. CenterPoint Energy's 3-year average revenue growth rate is worse than 83.99% of 481 companies in the Utilities - Regulated industry. Its 3-year average EBITDA growth rate is 3.4%, ranking worse than 54.29% of 455 companies in the industry.

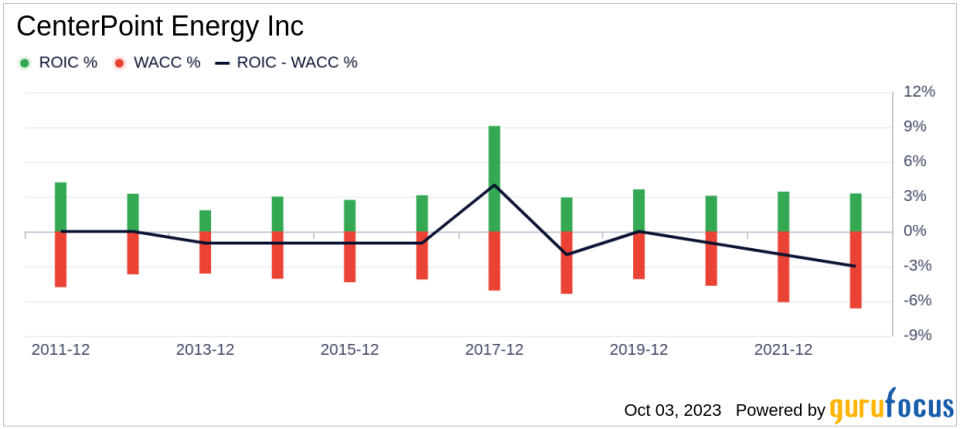

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) and the weighted average cost of capital (WACC) can provide insights into its profitability. For the past 12 months, CenterPoint Energy's ROIC is 3.36, and its cost of capital is 5.75.

Conclusion

In summary, CenterPoint Energy (NYSE:CNP) shows signs of being modestly undervalued. Despite its poor financial condition, its profitability is fair. However, its growth ranks worse than 54.29% of 455 companies in the Utilities - Regulated industry. To learn more about CenterPoint Energy stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.