Unveiling Charles River Laboratories International's Value: Is It Really Priced Right? A ...

Charles River Laboratories International Inc (NYSE:CRL)'s stock has recently experienced a daily gain of 2.84%, and a 3-month gain of 6.87%. With an Earnings Per Share (EPS) of 9.43, the stock appears to be significantly undervalued. This article aims to provide a comprehensive valuation analysis to answer this question and guide potential investors.

Company Overview

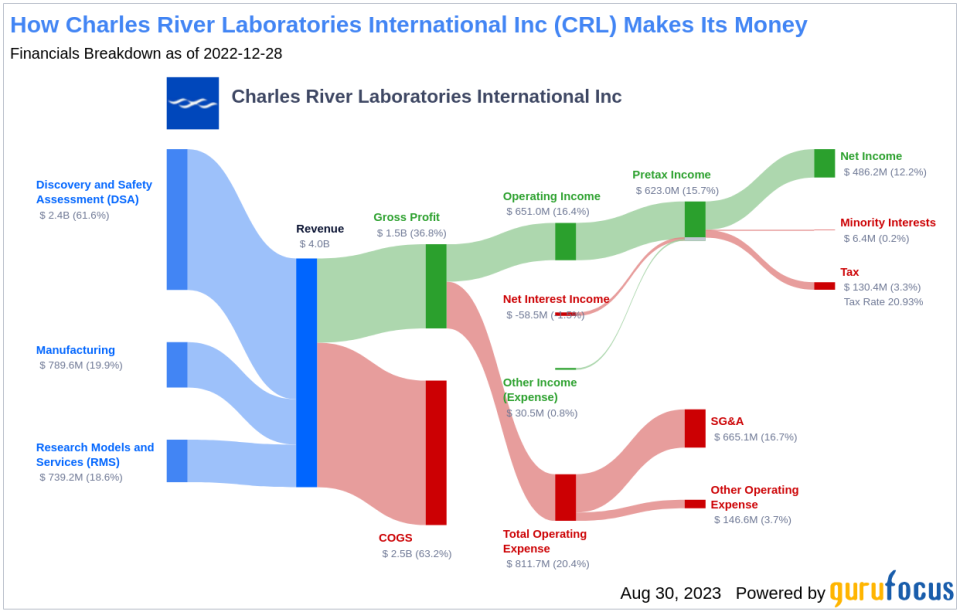

Established in 1947, Charles River Laboratories International is a leading provider of drug discovery and development services. The company's research model & services segment is the top provider of animal models for laboratory testing. The discovery & safety assessment segment includes services required to take a drug through the early development process. The manufacturing support segment includes microbial solutions, which provides in vitro (non-animal) testing products, biologics testing services, and avian vaccine services.

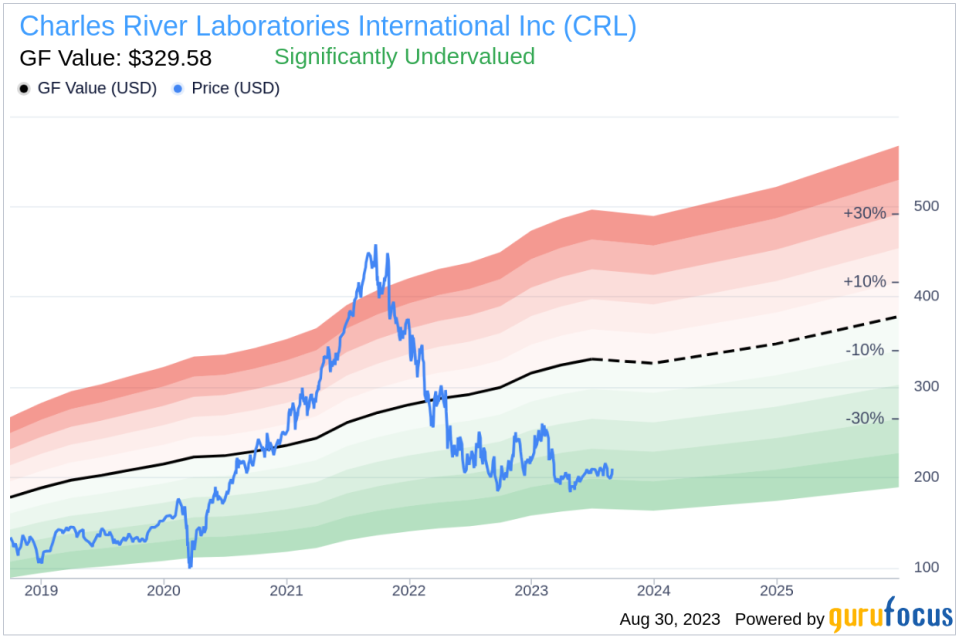

As of August 30, 2023, the company's stock price stands at $209.68, which is significantly lower than its GF Value of $329.58. This discrepancy paves the way for a deeper exploration of the company's intrinsic value.

Understanding GF Value

The GF Value is a proprietary measure that represents a stock's intrinsic value. It's calculated based on historical multiples, an internal adjustment factor based on past performance and growth, and future business performance estimates. It serves as a guideline for the fair value at which the stock should be traded. If the stock price significantly exceeds the GF Value Line, it's likely overvalued and may yield poor future returns. Conversely, if it's significantly below the GF Value Line, the stock is likely undervalued and may offer higher future returns.

Charles River Laboratories International's current stock price of $209.68 per share indicates that it is significantly undervalued according to the GF Value. This suggests that the long-term return of its stock is likely to be much higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Assessing Financial Strength

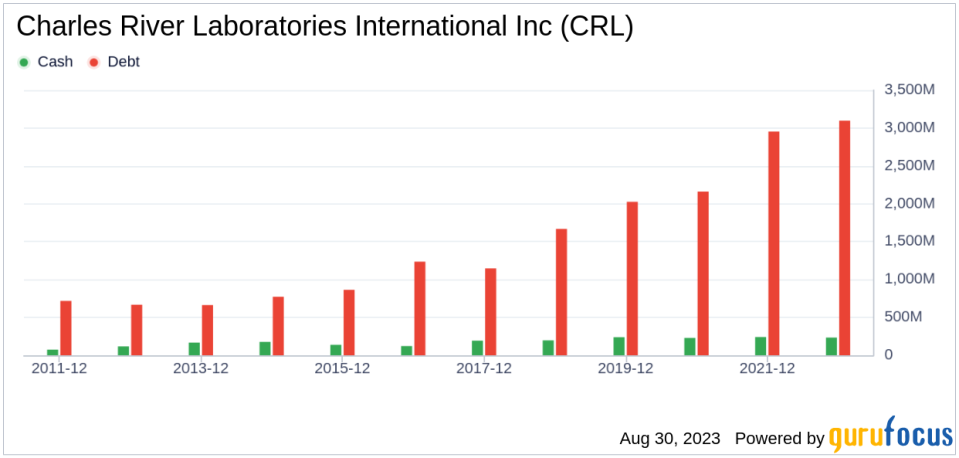

Investing in companies with poor financial strength can lead to a high risk of permanent capital loss. To avoid this, it's crucial to review a company's financial strength before purchasing shares. Key indicators of financial strength include the cash-to-debt ratio and interest coverage. Charles River Laboratories International has a cash-to-debt ratio of 0.07, ranking worse than 92.11% of companies in the Medical Diagnostics & Research industry. Overall, the company's financial strength is rated 5 out of 10, indicating fair financial stability.

Profitability and Growth

Companies that have consistently demonstrated profitability over the long term offer less risk to investors. Charles River Laboratories International has been profitable for 10 out of the past 10 years. Over the past twelve months, the company had a revenue of $4.20 billion and Earnings Per Share (EPS) of $9.43. Its operating margin is 15.5%, which ranks better than 76.23% of companies in the Medical Diagnostics & Research industry. Overall, the company's profitability is ranked 9 out of 10, indicating strong profitability.

Growth is one of the most crucial factors in a company's valuation. Charles River Laboratories International's 3-year average revenue growth rate is better than 57.92% of companies in the Medical Diagnostics & Research industry. Its 3-year average EBITDA growth rate is 19.3%, ranking better than 61.05% of companies in the same industry.

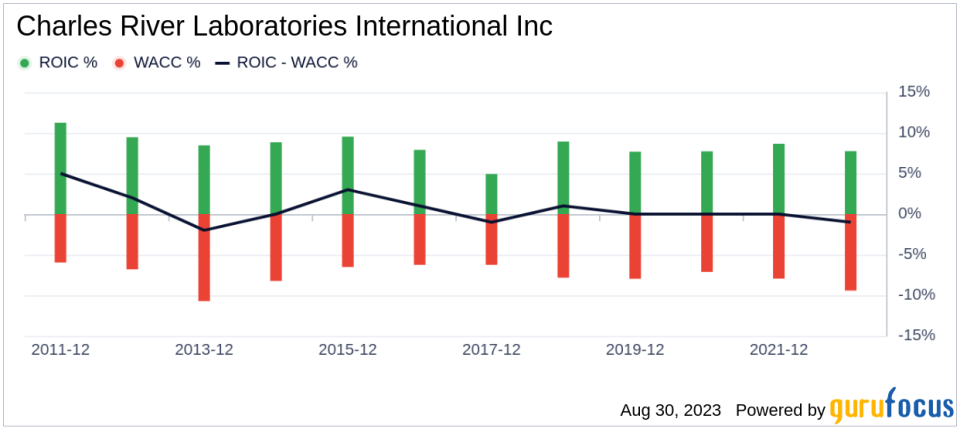

Return on Invested Capital vs. Weighted Average Cost of Capital

Comparing a company's Return on Invested Capital (ROIC) with the Weighted Average Cost of Capital (WACC) provides insight into its profitability. For the past 12 months, Charles River Laboratories International's ROIC is 7.25, and its WACC is 9.47.

Conclusion

In conclusion, the stock of Charles River Laboratories International (NYSE:CRL) appears to be significantly undervalued. The company's financial condition is fair, and its profitability is strong. Its growth ranks better than 61.05% of companies in the Medical Diagnostics & Research industry. To learn more about Charles River Laboratories International stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.