Unveiling Cia Paranaense De Energia Copel (ELP)'s Value: Is It Really Priced Right? A ...

The stock of Cia Paranaense De Energia Copel (NYSE:ELP) has experienced a daily loss of -5.36%, with a 3-month gain of 0.81%. Its Earnings Per Share (EPS) stands at 0.14. However, the critical question is, is the stock modestly overvalued? This article aims to provide a comprehensive analysis of the company's valuation, financial strength, and growth prospects. So, let's delve in.

Company Introduction

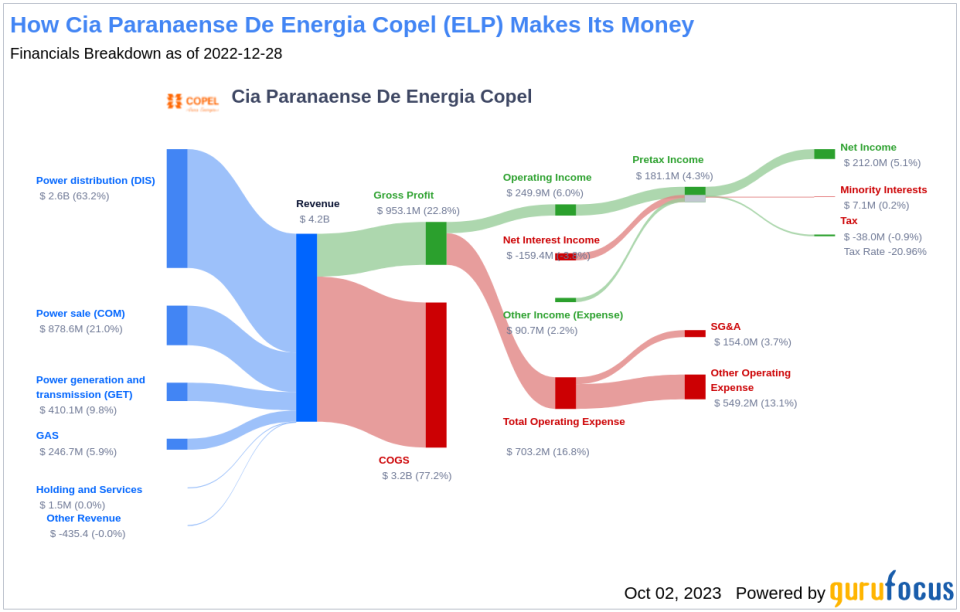

Cia Paranaense De Energia Copel is primarily involved in the production of power in the Brazilian state of Parana. The company operates in various segments, including power generation and transmission, gas, power distribution, power sale, and Holding and Services. Most of its revenue comes from the sale of electricity, generated through renewable energy sources such as hydroelectric, wind plants, and thermoelectric plants.

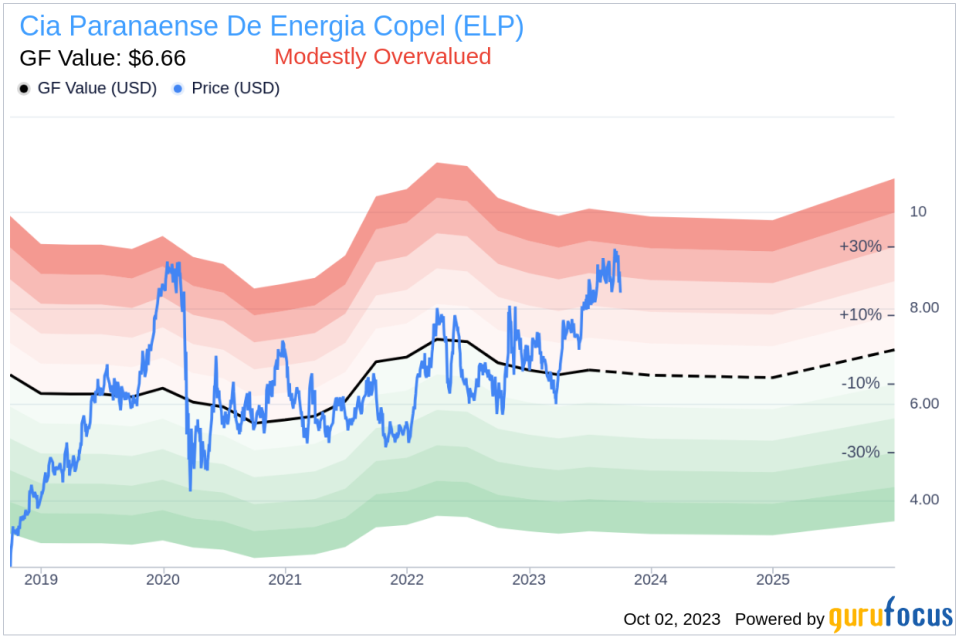

The company's current stock price stands at $8.3 per share, with a market cap of $24.80 billion. However, the GF Value, an estimation of the fair value, is $6.66. This discrepancy suggests that the stock might be modestly overvalued.

Understanding the GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, computed considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line represents the ideal fair trading value of the stock.

Based on the GF Value, Cia Paranaense De Energia Copel (NYSE:ELP) is believed to be modestly overvalued. This suggests that the long-term return of its stock is likely to be lower than its business growth.

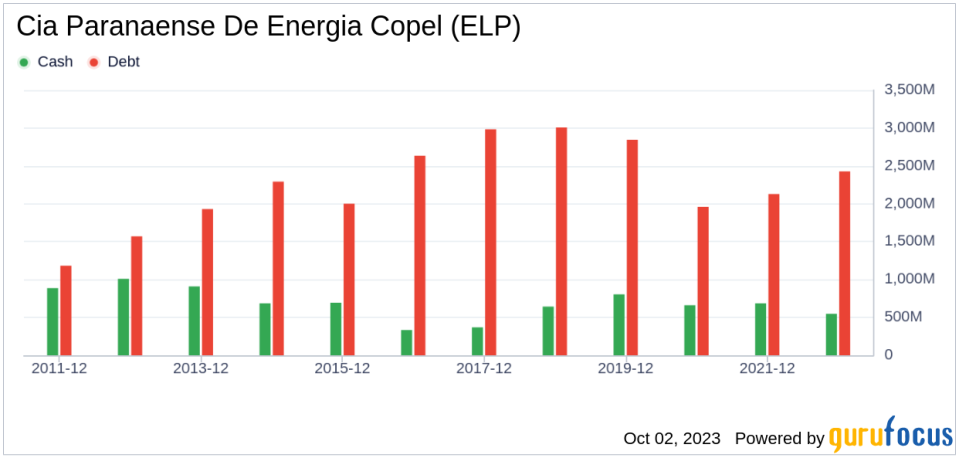

Assessing Financial Strength

Companies with poor financial strength pose a high risk of permanent capital loss. To avoid this, it's crucial to review a company's financial strength before purchasing shares. Key indicators of financial strength include the cash-to-debt ratio and interest coverage. Cia Paranaense De Energia Copel has a cash-to-debt ratio of 0.27, ranking better than 51.04% of companies in the Utilities - Regulated industry. This gives the company a financial strength score of 5 out of 10, indicating fair financial strength.

Profitability and Growth

Investing in profitable companies carries less risk. Cia Paranaense De Energia Copel has been profitable 10 years over the past 10 years, with revenues of $4.30 billion and Earnings Per Share (EPS) of $0.14 in the past 12 months. Furthermore, its operating margin of 12.96% is better than 52.1% of companies in the Utilities - Regulated industry. This puts the company's profitability in a strong position.

However, growth is a critical factor in a company's valuation. The 3-year average annual revenue growth rate of Cia Paranaense De Energia Copel is 11.4%, ranking better than 65.7% of companies in the Utilities - Regulated industry. Yet, its 3-year average EBITDA growth rate is -15.8%, ranking worse than 90.99% of companies in the same industry.

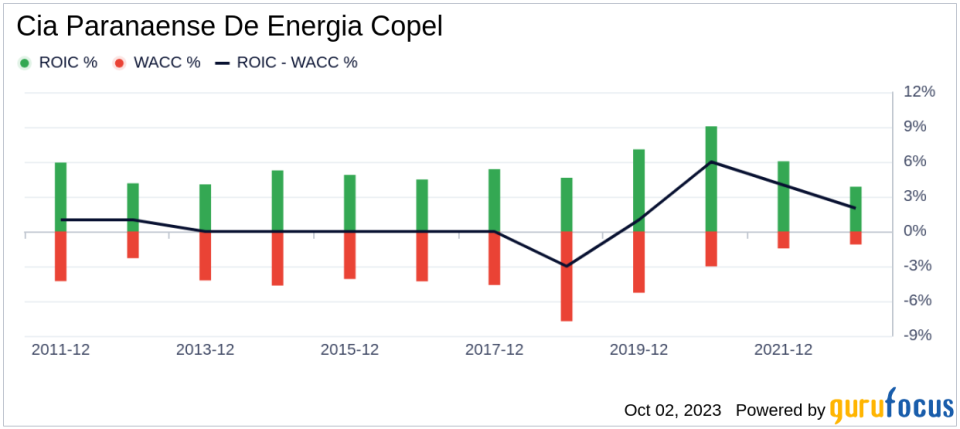

ROIC vs WACC

Another way to assess a company's profitability is to compare its Return on Invested Capital (ROIC) and the Weighted Average Cost of Capital (WACC). For the past 12 months, Cia Paranaense De Energia Copel's ROIC is 5.5, and its WACC is 7.06, indicating a need for improvement.

Conclusion

In conclusion, the stock of Cia Paranaense De Energia Copel (NYSE:ELP) is believed to be modestly overvalued. Despite its fair financial condition and strong profitability, its growth ranks worse than 90.99% of companies in the Utilities - Regulated industry. To learn more about Cia Paranaense De Energia Copel stock, you can check out its 30-Year Financials here.

To find out high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.