Unveiling Cinemark Holdings (CNK)'s Value: Is It Really Priced Right? A Comprehensive Guide

With a daily gain of 4.35%, a three-month gain of 9.14%, and a Loss Per Share of 0.25, Cinemark Holdings Inc (NYSE:CNK) is the subject of our valuation analysis today. The question we seek to answer is: Is the stock modestly undervalued? This article will provide a detailed analysis of Cinemark Holdings' valuation, encouraging readers to delve deeper into the financials of this intriguing company.

Company Overview

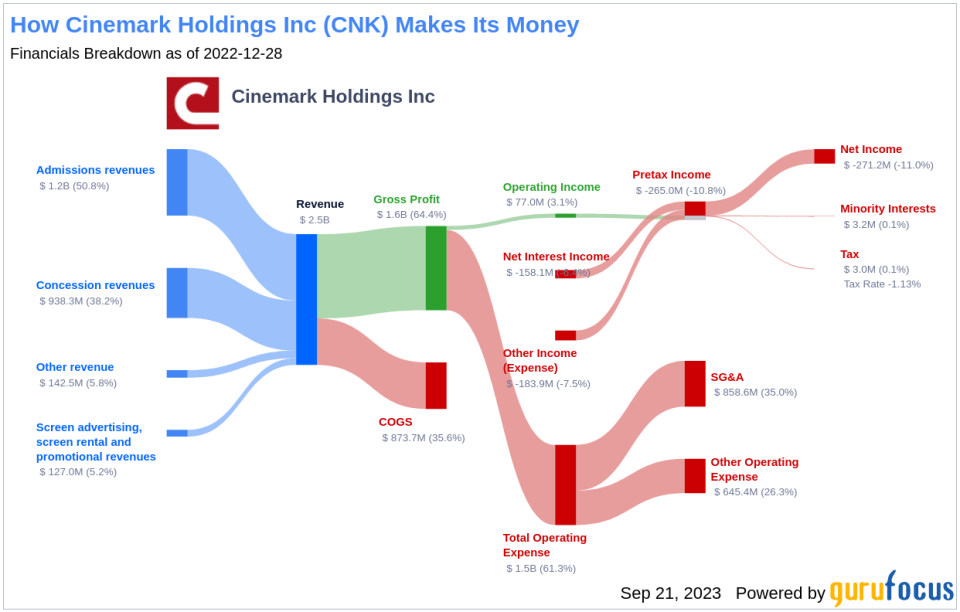

Cinemark Holdings Inc is a geographically diverse operator in the motion picture exhibition industry in the United States. The company operates about 518 theaters and 5,847 screens in the United States and Latin America. Cinemark Holdings generates revenue from filmed entertainment box office receipts and concession sales, with additional revenue from screen advertising, screen rental, and other revenue streams, such as transactional fees, vendor marketing promotions, studio trailer placements, meeting rentals, and electronic video games located in some of the theaters. Most of Cinemark's theaters are located in midsize cities or suburbs of large cities.

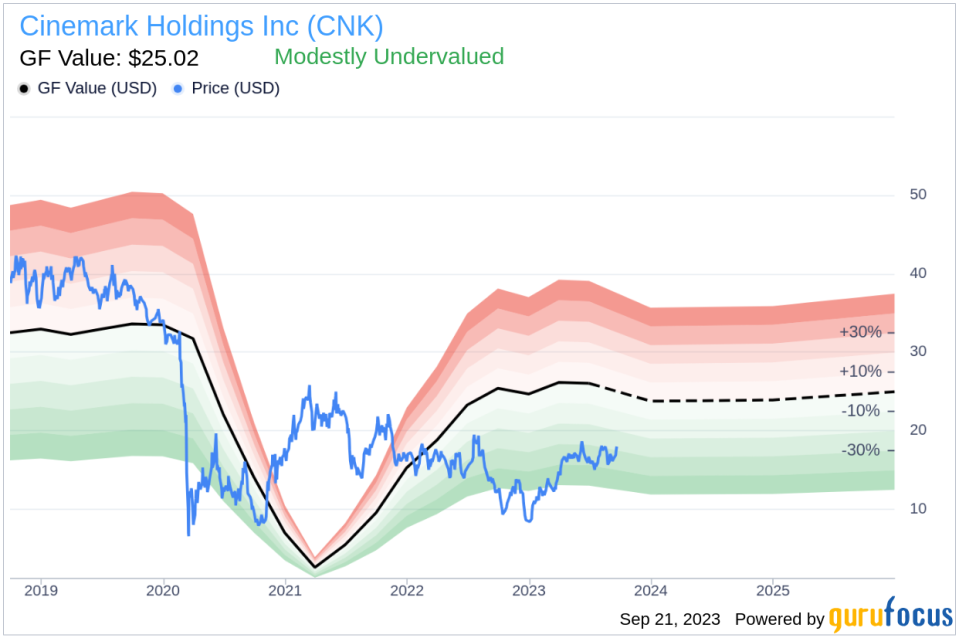

As of September 21, 2023, Cinemark Holdings' stock price is $17.98, with a market cap of $2.20 billion. The GF Value, an estimation of fair value, is $25.02, suggesting that the stock is modestly undervalued.

Understanding GF Value

The GF Value is a proprietary measure that represents the current intrinsic value of a stock. It's derived from historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line gives an overview of the fair value at which the stock should ideally be traded. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Based on the GuruFocus Value calculation, Cinemark Holdings (NYSE:CNK) stock is estimated to be modestly undervalued. As Cinemark Holdings is relatively undervalued, the long-term return of its stock is likely to be higher than its business growth.

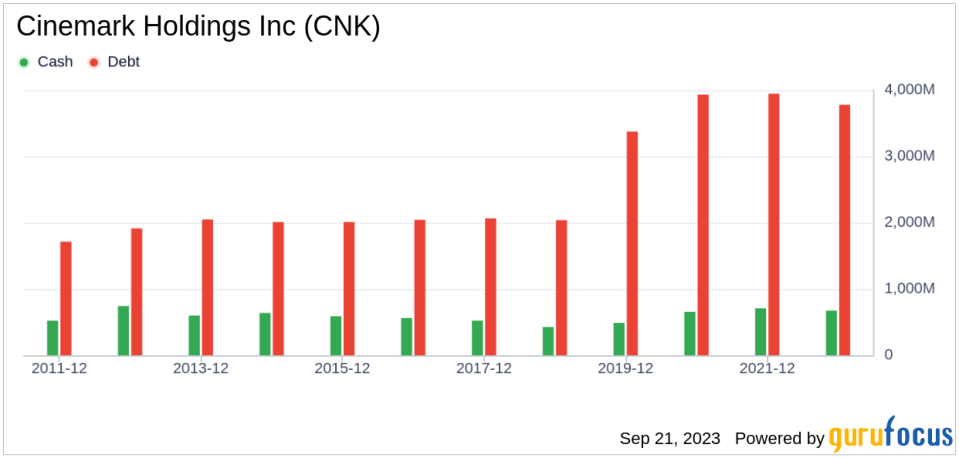

Assessing Financial Strength

Before buying a company's stock, it's crucial to check its financial strength. Investing in companies with poor financial strength poses a higher risk of permanent loss. The cash-to-debt ratio and interest coverage are great ways to understand a company's financial strength. Cinemark Holdings has a cash-to-debt ratio of 0.21, which is worse than 76.2% of 1004 companies in the Media - Diversified industry. The overall financial strength of Cinemark Holdings is 4 out of 10, indicating that its financial strength is poor.

Profitability and Growth

Companies that have been consistently profitable over the long term offer less risk to investors. Higher profit margins usually indicate a better investment compared to a company with lower profit margins. Cinemark Holdings has been profitable 7 over the past 10 years. Over the past twelve months, the company had a revenue of $2.80 billion and a Loss Per Share of $0.25. Its operating margin is 8.86%, which ranks better than 68.3% of 1038 companies in the Media - Diversified industry. Overall, the profitability of Cinemark Holdings is ranked 6 out of 10, indicating fair profitability.

Growth is probably the most important factor in the valuation of a company. The faster a company is growing, the more likely it is to be creating value for shareholders, especially if the growth is profitable. The 3-year average annual revenue growth rate of Cinemark Holdings is -9.6%, which ranks worse than 72.67% of 955 companies in the Media - Diversified industry. The 3-year average EBITDA growth rate is -39.1%, which ranks worse than 90.79% of 771 companies in the Media - Diversified industry.

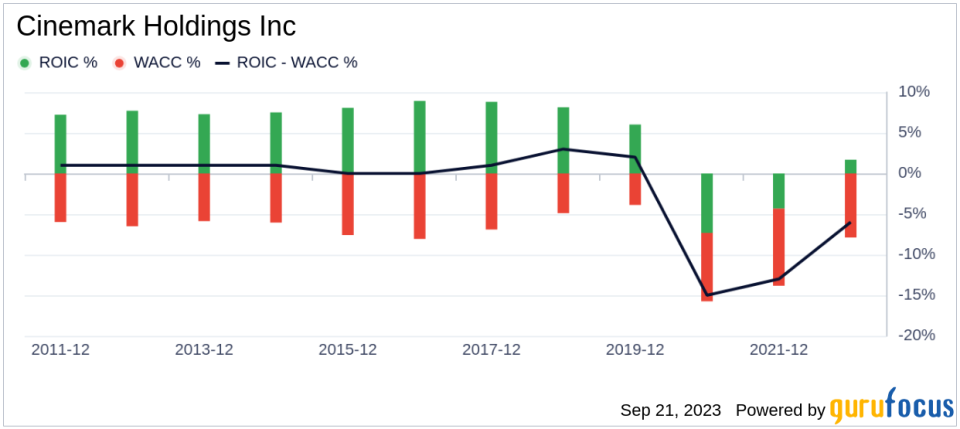

ROIC vs WACC

Comparing a company's return on invested capital to the weighted average cost of capital is another method of determining its profitability. Return on invested capital (ROIC) measures how well a company generates cash flow relative to the capital it has invested in its business. The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. When the ROIC is higher than the WACC, it implies the company is creating value for shareholders. For the past 12 months, Cinemark Holdings's return on invested capital is -7.52, and its cost of capital is 9.46.

Conclusion

In summary, the stock of Cinemark Holdings (NYSE:CNK) is estimated to be modestly undervalued. The company's financial condition is poor, and its profitability is fair. Its growth ranks worse than 90.79% of 771 companies in the Media - Diversified industry. To learn more about Cinemark Holdings stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.