Unveiling Comcast (CMCSA)'s Value: Is It Really Priced Right? A Comprehensive Guide

Comcast Corp (NASDAQ:CMCSA) has experienced a 2.72% loss in its daily stock value and a 17.33% gain over the last three months. With an Earnings Per Share (EPS) (EPS) of 1.58, the question arises: Is the stock modestly undervalued? This article aims to provide an insightful valuation analysis of Comcast, guiding potential investors in making informed decisions.

Company Introduction

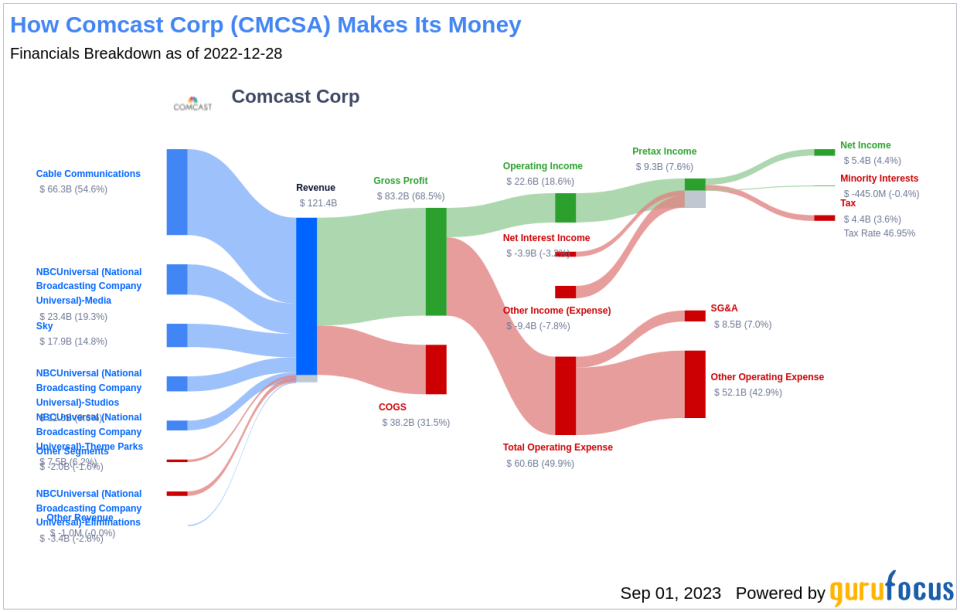

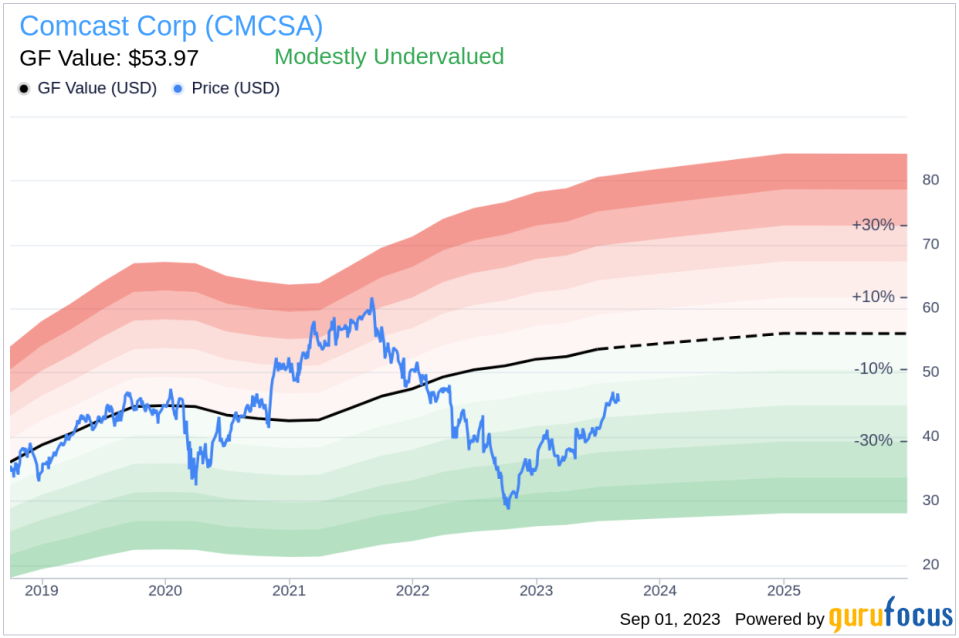

Comcast Corp (NASDAQ:CMCSA) is a multifaceted company, owning networks capable of providing television, internet access, and phone services to 62 million U.S. homes and businesses. It also owns NBCUniversal and Sky, a dominant television provider in the U.K. Despite a recent loss, the stock has shown a 17.33% gain over the past three months. Currently trading at $45.49 per share, Comcast's market cap stands at $187.70 billion. The company's GF Value, a measure of its intrinsic value, is estimated at $53.97, suggesting that the stock is modestly undervalued.

Understanding the GF Value

The GF Value is a proprietary measure that represents the intrinsic value of a stock. It is computed based on historical trading multiples, a GuruFocus adjustment factor accounting for the company's past performance and growth, and future business performance estimates. The GF Value Line, represented on our summary page, gives an overview of the fair value at which the stock should ideally be traded. According to our analysis, Comcast is modestly undervalued.

Link: These companies may deliever higher future returns at reduced risk.

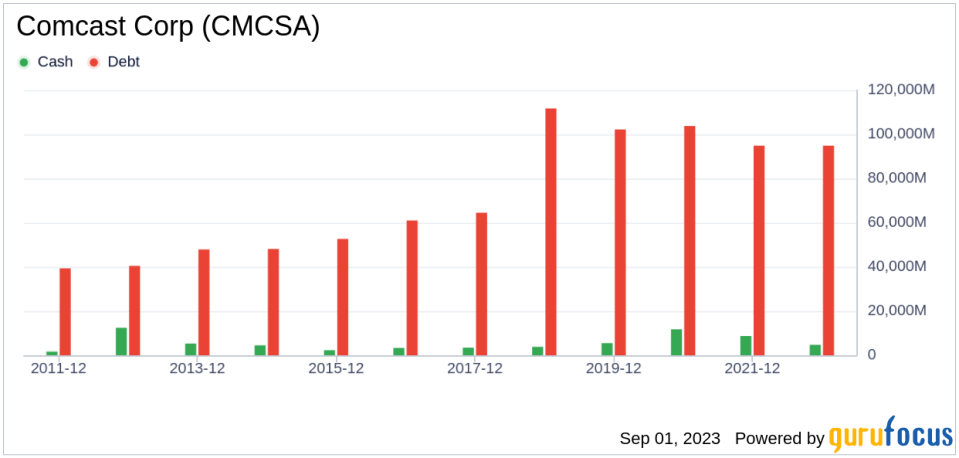

Evaluating Financial Strength

Investing in companies with sound financial strength significantly reduces the risk of permanent loss. Looking at Comcast's cash-to-debt ratio of 0.07, which is worse than 80.61% of 392 companies in the Telecommunication Services industry, the overall financial strength of Comcast is assessed to be poor.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, poses less risk. Comcast, with a revenue of $120.60 billion and an EPS of $1.58, has been profitable 10 out of the past 10 years. Its operating margin of 19.11% ranks better than 76.49% of 387 companies in the Telecommunication Services industry, indicating strong profitability. However, Comcast's growth ranks worse than 78.01% of 332 companies in the same industry.

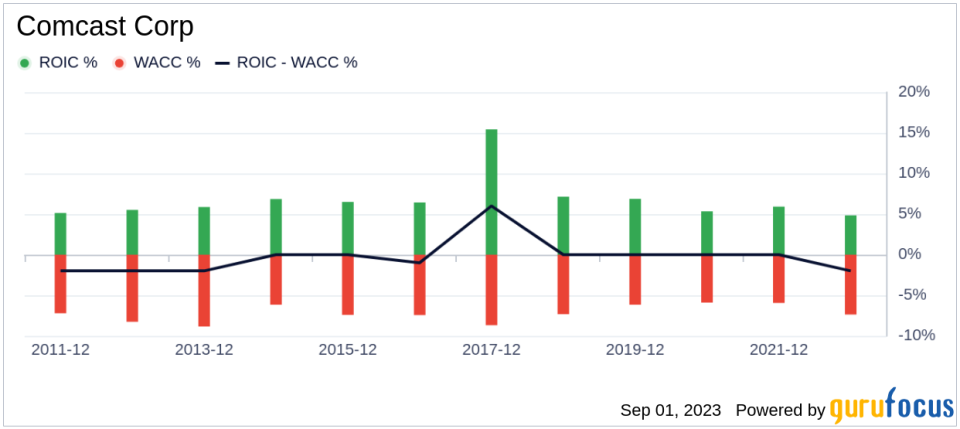

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) and the Weighted Average Cost of Capital (WACC) is another approach to assess its profitability. Over the past 12 months, Comcast's ROIC is 5.31, and its WACC is 8.15, suggesting potential areas for improvement.

Conclusion

In conclusion, Comcast's stock is estimated to be modestly undervalued. Despite its poor financial strength, the company's strong profitability and modest undervaluation suggest potential for higher long-term returns. However, its growth ranks worse than most companies in the Telecommunication Services industry. For a more detailed financial analysis of Comcast, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.