Unveiling Coty (COTY)'s Value: Is It Really Priced Right? A Comprehensive Guide

With a daily loss of -3.35%, a 3-month decline of -6.6%, and Earnings Per Share (EPS) of 0.57, Coty Inc (NYSE:COTY) is currently in the spotlight. The key question for investors is whether the stock is modestly overvalued. This article presents a detailed valuation analysis to answer this critical question. Keep reading for an insightful exploration.

Company Introduction

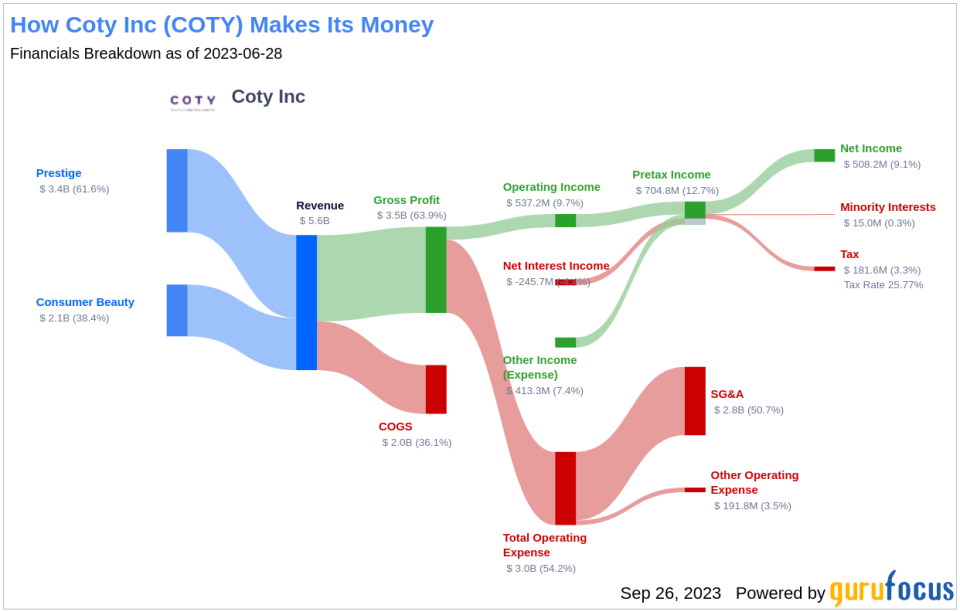

Coty Inc (NYSE:COTY) is a global beauty company with a diverse portfolio of brands. Its products range from fragrance and color cosmetics to skin and body care, with brands like Calvin Klein, Hugo Boss, Gucci, Burberry, and Davidoff. Coty also holds a minority stake in a salon and retail haircare business, including brands like Wella, Clairol, OPI, and GHD. The company's stock price currently stands at $11.4, while its GF Value, an estimate of fair value, is $9.06. This discrepancy suggests that Coty (NYSE:COTY) may be modestly overvalued.

Understanding GF Value

The GF Value is a proprietary measure that gives an overview of a stock's fair value. It is calculated based on historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. If a stock's price is significantly above the GF Value Line, it is likely overvalued, and its future return may be poor. Conversely, if it is significantly below the GF Value Line, it may be undervalued, and its future return could be high.

According to GuruFocus' valuation method, Coty (NYSE:COTY) appears to be modestly overvalued. With a market cap of $9.80 billion at its current price of $11.4 per share, the long-term return of its stock is likely to be lower than its business growth.

Link: These companies may deliever higher future returns at reduced risk.

Financial Strength

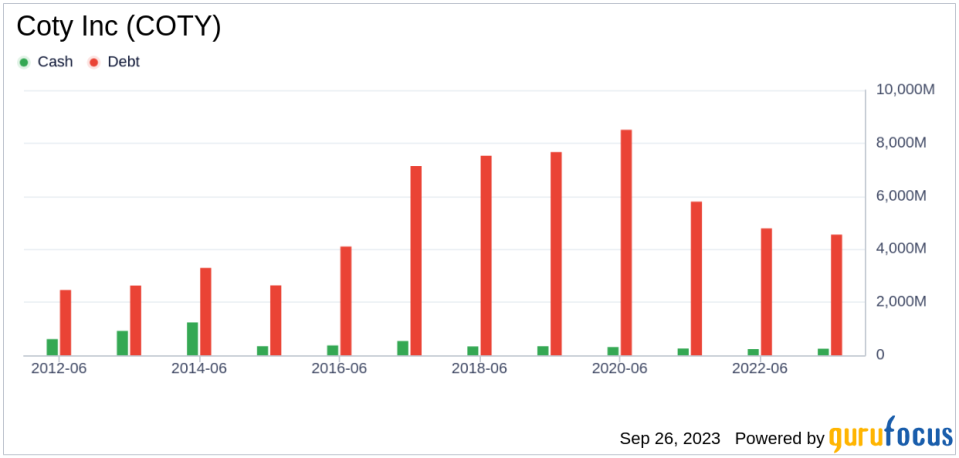

Investing in companies with poor financial strength can lead to a higher risk of permanent loss. Therefore, understanding a company's financial strength is crucial. Coty's cash-to-debt ratio of 0.05 is worse than 86.96% of the companies in the Consumer Packaged Goods industry, indicating that its financial strength is poor.

Profitability and Growth

Investing in profitable companies is generally less risky, especially those with consistent profitability over the long term. Coty has been profitable 4 times over the past 10 years. Its operating margin of 9.67% ranks better than 72.46% of the companies in the Consumer Packaged Goods industry, indicating fair profitability.

One of the most crucial factors in a company's valuation is growth. Companies that grow faster create more value for shareholders. However, Coty's average annual revenue growth of 0.3% ranks worse than 71.39% of the companies in the Consumer Packaged Goods industry.

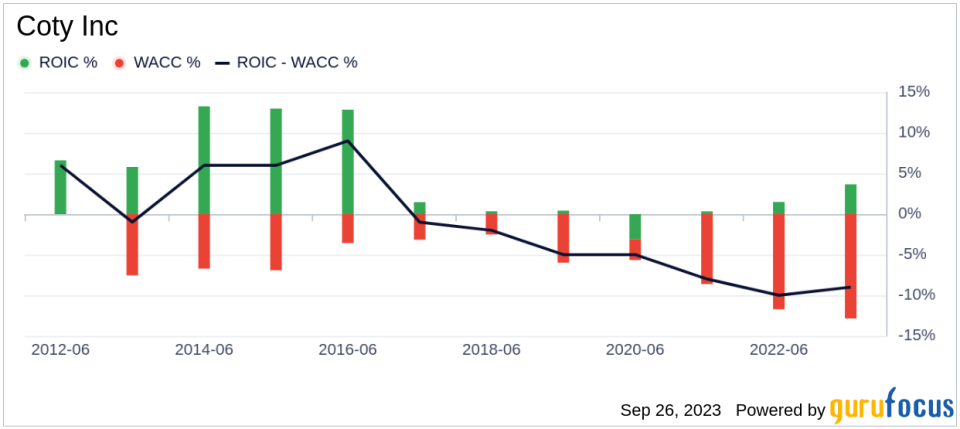

ROIC vs WACC

Return on invested capital (ROIC) and the weighted average cost of capital (WACC) are useful measures of a company's profitability. For the past 12 months, Coty's ROIC is 3.72, while its cost of capital is 14.32.

Conclusion

In summary, Coty (NYSE:COTY) appears to be modestly overvalued. The company's financial condition is poor, and its profitability is fair. Its growth ranks worse than 0% of 1524 companies in the Consumer Packaged Goods industry. For more detailed financial information about Coty, check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.