Unveiling Coty (COTY)'s Value: Is It Really Priced Right? A Comprehensive Guide

Coty Inc (NYSE:COTY) saw a daily gain of 3.75%, despite a 3-month loss of -4.3%. Its Earnings Per Share (EPS) stands at 0.57. Given these figures, the crucial question arises - is the stock significantly overvalued? We invite you to read on as we delve into the valuation analysis of Coty (NYSE:COTY).

Company Overview

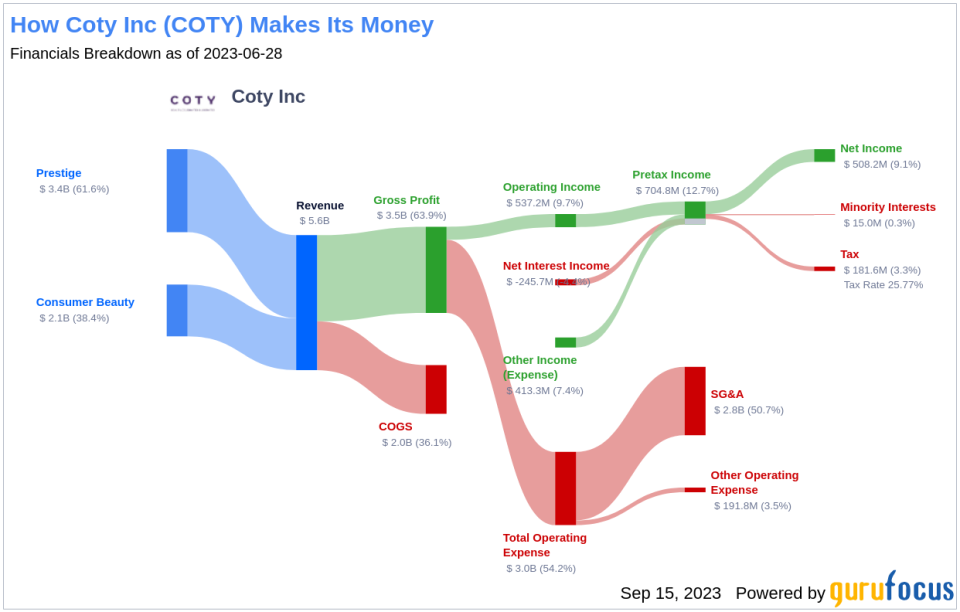

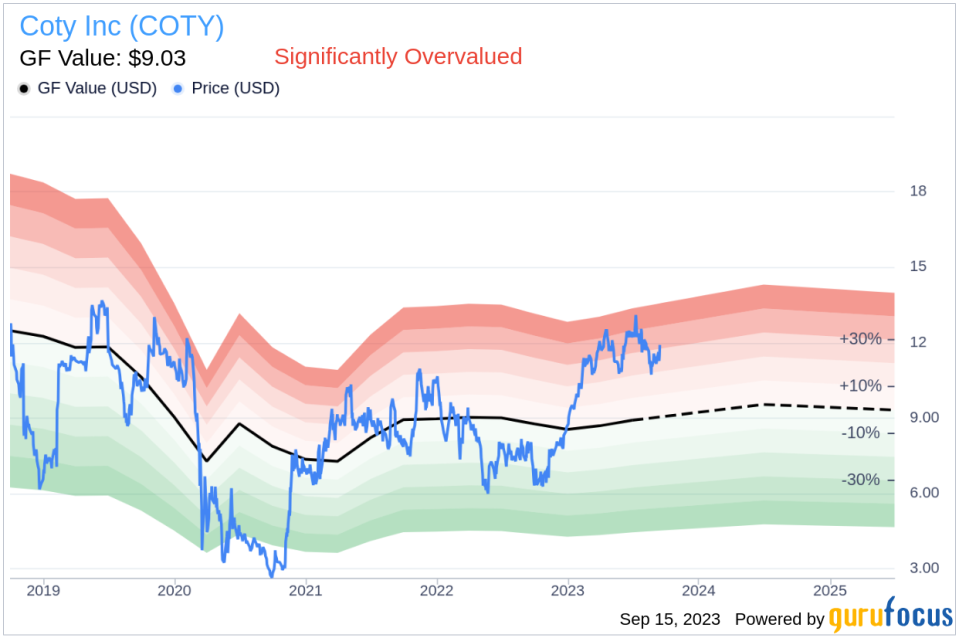

Coty Inc is a global beauty firm that sells fragrance, color cosmetics, and skin and body care products. It licenses brands such as Calvin Klein, Hugo Boss, and Gucci for its prestige portfolio. Coty's most popular color cosmetic brands include CoverGirl, Max Factor, and Rimmel. With a current stock price of $11.91 and a GF Value of $9.03, Coty appears to be significantly overvalued. This article aims to provide a comprehensive analysis of Coty's value, integrating financial assessment with key company details.

Understanding the GF Value

The GF Value is a proprietary measure that represents the current intrinsic value of a stock. It is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides an overview of the fair value at which the stock should be trading. If the stock price significantly exceeds the GF Value Line, it is considered overvalued, and its future return is likely to be poor. Conversely, if the stock price is significantly below the GF Value Line, its future return will likely be higher.

Based on the GF Value calculation, Coty (NYSE:COTY), with a market cap of $10.20 billion, appears to be significantly overvalued. This suggests that the long-term return of its stock is likely to be much lower than its future business growth.

Link: These companies may deliver higher future returns at reduced risk.

Assessing Coty's Financial Strength

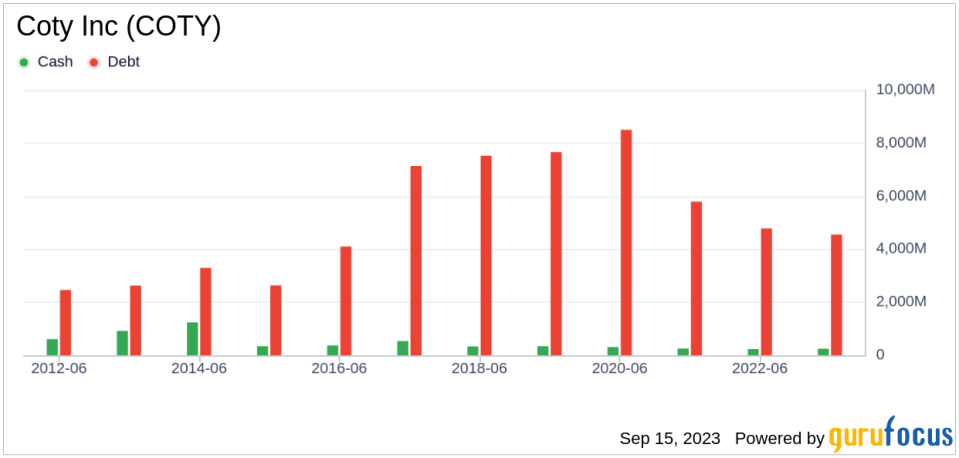

Investing in companies with low financial strength could result in permanent capital loss. Hence, it is crucial to review a company's financial strength before purchasing its shares. Coty's cash-to-debt ratio of 0.05 ranks worse than 87.09% of companies in the Consumer Packaged Goods industry, suggesting a poor balance sheet.

Evaluating Coty's Profitability and Growth

Companies that have been consistently profitable over the long term offer less risk for investors. Coty has been profitable 4 times over the past 10 years. With a revenue of $5.60 billion and Earnings Per Share (EPS) of $0.57 in the past twelve months, its operating margin is 9.67%, ranking better than 72.59% of companies in the Consumer Packaged Goods industry.

Growth is a crucial factor in a company's valuation. The faster a company is growing, the more likely it is to be creating value for shareholders. However, Coty's 3-year average annual revenue growth rate is only 0.3%, which ranks worse than 71.32% of companies in the Consumer Packaged Goods industry.

Comparing ROIC and WACC

Comparing a company's Return on Invested Capital (ROIC) to the Weighted Average Cost of Capital (WACC) can provide insights into its profitability. When the ROIC is higher than the WACC, the company is creating value for shareholders. However, Coty's ROIC over the past 12 months is 3.72, while its WACC is 14.08, indicating that it is not creating value for shareholders.

Conclusion

In conclusion, Coty (NYSE:COTY) appears to be significantly overvalued. Its financial condition is poor, and its profitability is fair. Its growth ranks worse than 0% of companies in the Consumer Packaged Goods industry. For more information about Coty stock, you can check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.