Unveiling CVR Energy (CVI)'s Value: Is It Really Priced Right? A Comprehensive Guide

Recently, CVR Energy Inc (NYSE:CVI) recorded a daily gain of 3.24%, and a significant 3-month gain of 35.17%. With an Earnings Per Share (EPS) (EPS) standing at 5.26, the question arises - is the stock modestly overvalued? In the following analysis, we will delve into CVR Energy's valuation, exploring its financial strength, profitability, and growth prospects to answer this question.

Company Introduction

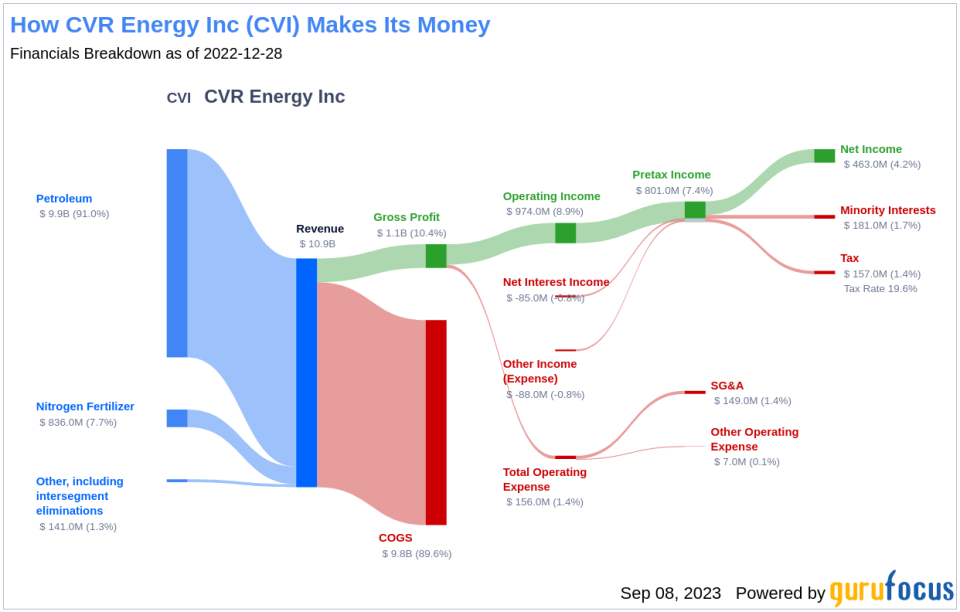

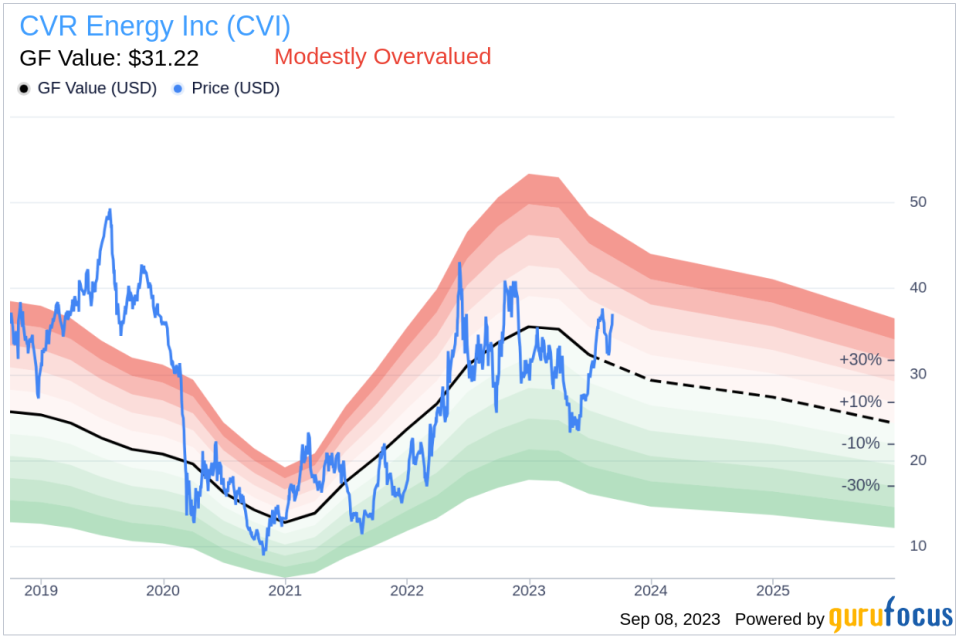

CVR Energy Inc is a holding company engaged in petroleum refining and nitrogen fertilizer manufacturing. The company operates through its holdings in CVR Refining LP and CVR Partners, LP, which include several complex full coking crude oil refineries, a crude oil gathering system, pipelines and storage tanks, and marketing and supply. CVR Energy's refineries can process blends of a variety of crude oil, ranging from heavy sour to light sweet crude oil. The company's customers include retailers, railroads, and farm cooperatives. As of September 08, 2023, CVR Energy's stock price stands at $37, while our estimate of its fair value (GF Value) is $31.22, indicating that the stock might be modestly overvalued.

Understanding the GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, computed considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. If the price of a stock is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher. At its current price of $37 per share and the market cap of $3.70 billion, CVR Energy stock may be modestly overvalued. Consequently, the long-term return of its stock is likely to be lower than its business growth.

Link: These companies may deliever higher future returns at reduced risk.

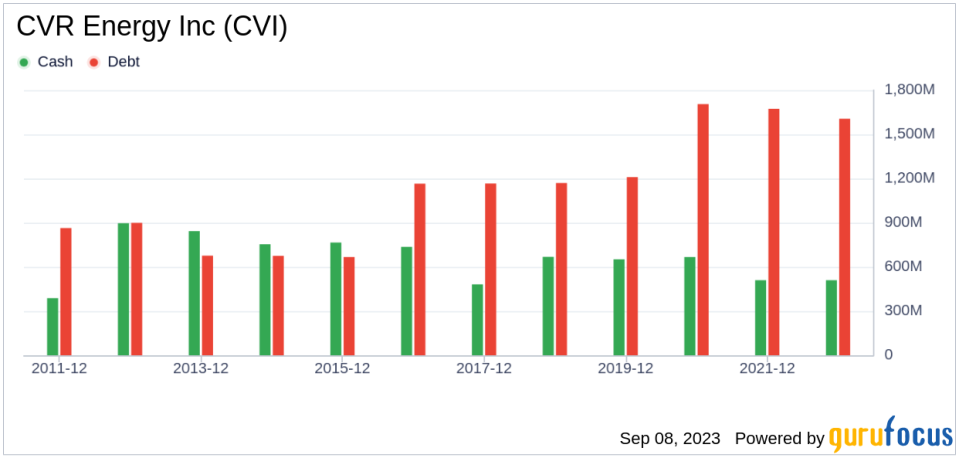

Financial Strength

Examining the financial strength of a company is crucial before investing in its stock. Companies with poor financial strength pose a higher risk of permanent loss. A company's cash-to-debt ratio and interest coverage are reliable indicators of its financial strength. CVR Energy's cash-to-debt ratio of 0.47 is lower than 51.42% of 1021 companies in the Oil & Gas industry, indicating fair financial strength.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, poses less risk. CVR Energy has been profitable 9 out of the past 10 years. With an operating margin of 9.14%, which ranks better than 50.98% of 967 companies in the Oil & Gas industry, CVR Energy demonstrates fair profitability .

Furthermore, growth is a critical factor in a company's valuation. Companies that grow faster create more value for shareholders, especially if that growth is profitable. CVR Energy's average annual revenue growth of 19.6% ranks better than 69.88% of 850 companies in the Oil & Gas industry. However, its 3-year average EBITDA growth of 10.1% ranks worse than 55.49% of 820 companies in the Oil & Gas industry, indicating a need for improvement in its growth strategy.

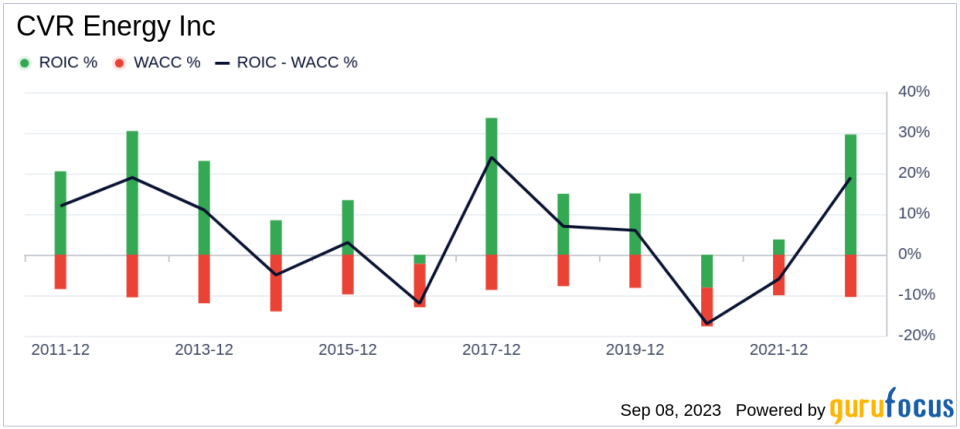

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) provides an insight into its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business, while WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. In the past 12 months, CVR Energy's ROIC was 27.68, significantly higher than its WACC of 10.4.

Conclusion

In conclusion, CVR Energy (NYSE:CVI) appears to be modestly overvalued. The company's financial condition and profitability are fair, but its growth ranks worse than 55.49% of 820 companies in the Oil & Gas industry. For more detailed financial information about CVR Energy, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, visit GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.