Unveiling Denison Mines (DNN)'s True Worth: Is It Really Priced Right? A Comprehensive Guide

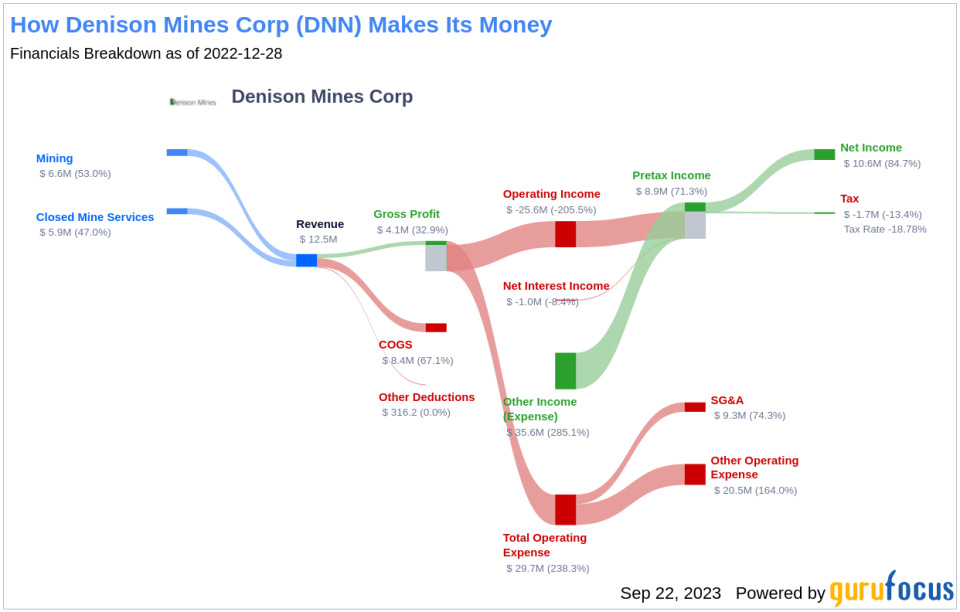

Denison Mines Corp (DNN) experienced a daily gain of 5.88% and a three-month gain of 38.18% despite a Loss Per Share of 0.01. This has led to questions about the stock's valuation: is it significantly overvalued? This article aims to provide a comprehensive valuation analysis of Denison Mines (DNN). Let's delve into the financial details and intrinsic value of this uranium exploration and development company.

An Overview of Denison Mines Corp

Denison Mines Corp is a uranium exploration and development company with a primary focus in the Athabasca Basin region of northern Saskatchewan, Canada. The company holds a 95% interest in the Wheeler River Uranium Project, the largest undeveloped uranium project in the eastern portion of the Athabasca Basin region. Additionally, Denison Mines provides mine decommissioning and environmental services through its Closed Mines group. At a current price of $1.66 per share, Denison Mines has a market cap of $1.40 billion.

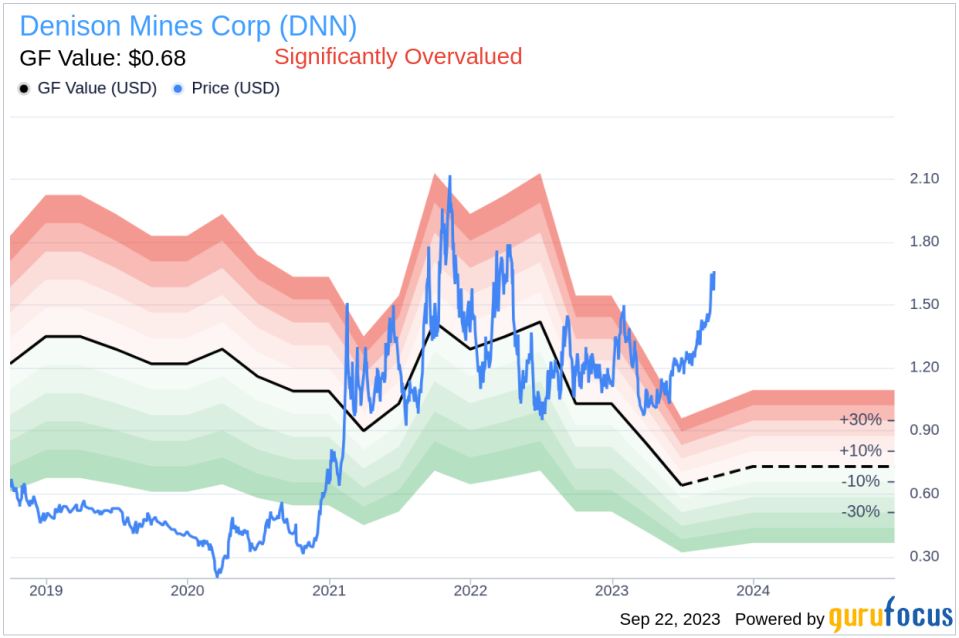

Understanding the GF Value of Denison Mines

The GF Value is a unique valuation model that considers historical trading multiples, the company's past performance and growth, and future business performance estimates. The GF Value Line provides a visual representation of the stock's fair trading value. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Based on this model, Denison Mines (DNN) appears to be significantly overvalued. The GF Value estimates the stock's fair value at $0.68, while its current price is $1.66 per share. Therefore, the long-term return of its stock is likely to be much lower than its future business growth.

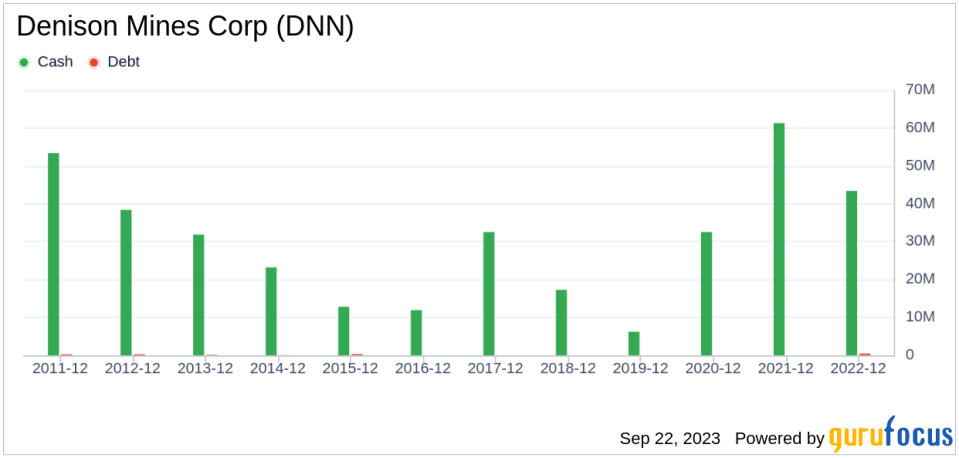

Financial Strength of Denison Mines

Investing in companies with poor financial strength can lead to a higher risk of permanent capital loss. Therefore, it's crucial to review a company's financial strength before investing. Denison Mines has a cash-to-debt ratio of 106.97, which is better than 72.73% of companies in the Other Energy Sources industry. This strong financial position indicates a lower risk for investors.

Profitability and Growth of Denison Mines

Investing in profitable companies carries less risk, especially for companies that have demonstrated consistent profitability over the long term. Denison Mines has been profitable for 2 years over the past 10 years. However, with an operating margin of -369.9% and a 3-year average annual revenue growth rate of -8.4%, Denison Mines's profitability and growth rank poorly compared to other companies in the Other Energy Sources industry.

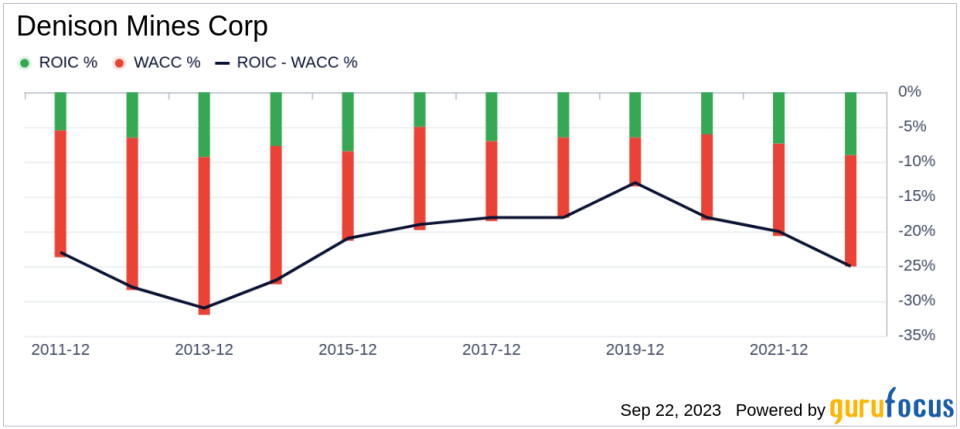

ROIC vs WACC

Another way to evaluate a company's profitability is to compare its return on invested capital (ROIC) to its weighted cost of capital (WACC). Over the past 12 months, Denison Mines's ROIC was -7.38, while its WACC came in at 16.11. This comparison suggests that the company is not creating value for shareholders.

Conclusion

In conclusion, Denison Mines (DNN) appears to be significantly overvalued. While the company's financial condition is strong, its profitability is poor, and its growth ranks worse than most companies in the Other Energy Sources industry. To learn more about Denison Mines stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.