Unveiling Denison Mines (DNN)'s Value: Is It Really Priced Right? A Comprehensive Guide

Denison Mines Corp (DNN) ended the day with a loss of 4.75%, bringing the stock's 3-month gain to 20.8%. Despite the recent gains, the company reported a Loss Per Share of $0.01. This raises the question: is the stock significantly overvalued? In this article, we will delve into the valuation analysis of Denison Mines to answer this question. Read on for an in-depth exploration of the company's valuation, financial strength, profitability, and growth prospects.

Company Introduction

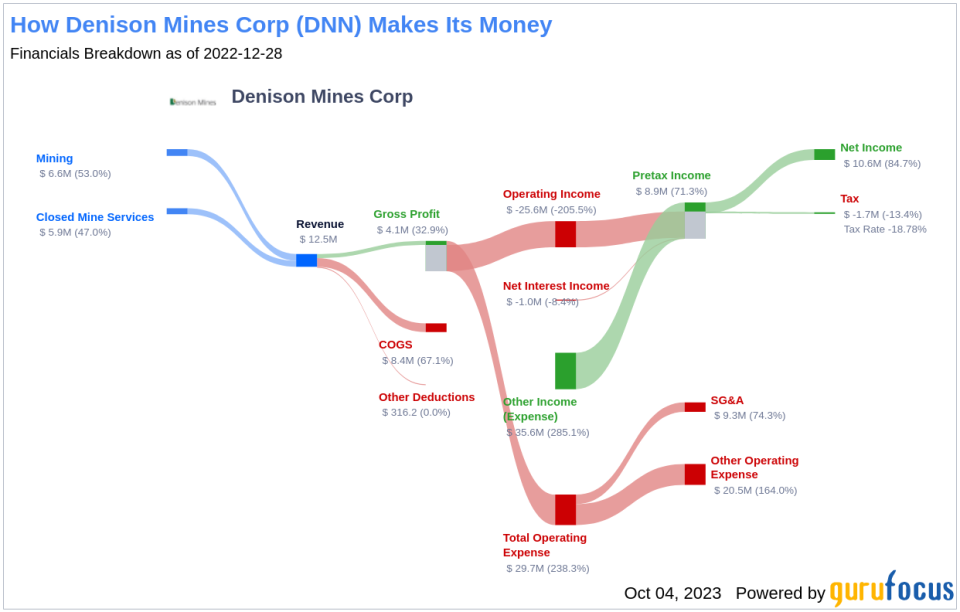

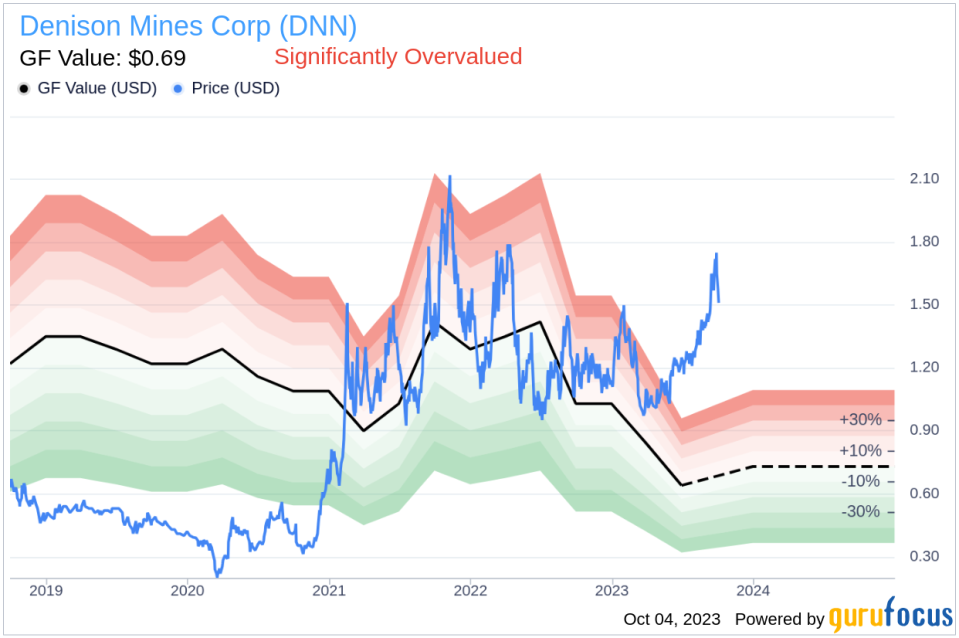

Denison Mines Corp is a uranium exploration and development company with a focus on the Athabasca Basin region of northern Saskatchewan, Canada. With an effective 95% interest in its flagship Wheeler River Uranium Project, Denison Mines stands as a significant player in the region. The company also offers mine decommissioning and environmental services through its Closed Mines group. Despite its current stock price of $1.51 per share, the GF Value estimates its fair value at $0.69, suggesting that the stock could be significantly overvalued.

Understanding the GF Value

The GF Value is an exclusive measure of a stock's intrinsic value, calculated considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

According to GuruFocus Value calculation, Denison Mines (DNN) appears to be significantly overvalued. At its current price of $1.51 per share and the market cap of $1.30 billion, Denison Mines stock seems to be priced higher than its intrinsic value. This overvaluation suggests that the long-term return of its stock is likely to be much lower than its future business growth.

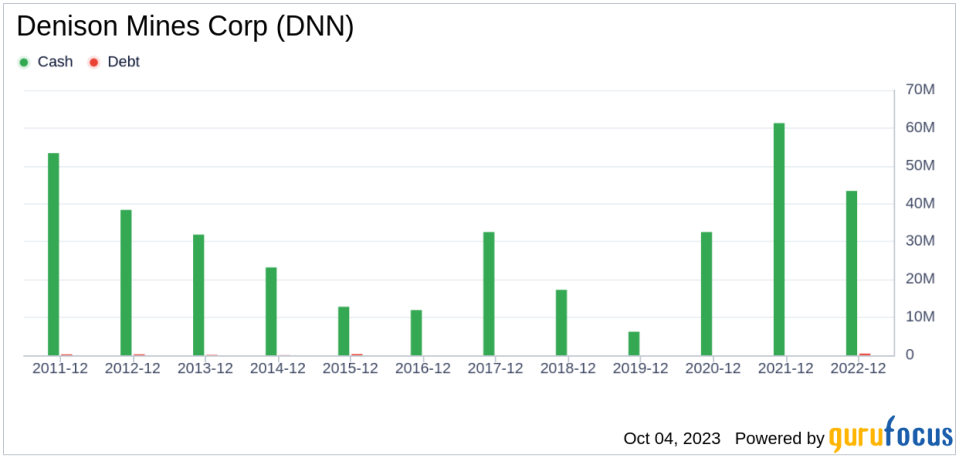

Financial Strength

Companies with poor financial strength offer investors a high risk of permanent capital loss. To avoid this, it's crucial to review a company's financial strength before purchasing shares. Key indicators of financial strength include the cash-to-debt ratio and interest coverage. Denison Mines has a cash-to-debt ratio of 106.97, ranking better than 73.71% of 175 companies in the Other Energy Sources industry. This indicates that the financial strength of Denison Mines is strong.

Profitability and Growth

Investing in profitable companies carries less risk, especially in companies that have demonstrated consistent profitability over the long term. Denison Mines has been profitable 2 years over the past 10 years. However, its operating margin of -369.9% is worse than 95.31% of 128 companies in the Other Energy Sources industry. This suggests that Denison Mines's profitability is poor.

Growth is a critical factor in the valuation of a company. The faster a company is growing, the more likely it is to be creating value for shareholders. However, the 3-year average annual revenue growth rate of Denison Mines is -8.4%, ranking worse than 90.76% of 119 companies in the Other Energy Sources industry. This indicates that the company's growth prospects are relatively weak.

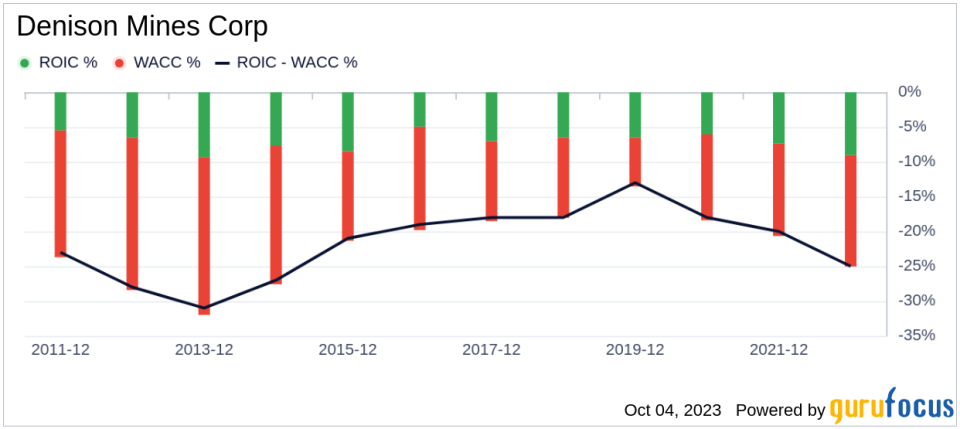

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted cost of capital (WACC) is a useful way to assess its profitability. If the ROIC is higher than the WACC, it indicates that the company is creating value for shareholders. Over the past 12 months, Denison Mines's ROIC was -7.38, while its WACC came in at 16.11, suggesting that the company is not creating value for shareholders.

Conclusion

Overall, Denison Mines (DNN) stock appears to be significantly overvalued. The company's financial condition is strong, but its profitability is poor, and its growth ranks worse than 0% of 138 companies in the Other Energy Sources industry. To learn more about Denison Mines stock, you can check out its 30-Year Financials here.

To find out high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.