Unveiling DHT Holdings (DHT)'s Value: Is It Really Priced Right? A Comprehensive Guide

With a daily gain of 4.56% and a three-month increase of 10.59%, DHT Holdings Inc (NYSE:DHT) has demonstrated robust performance. The company's Earnings Per Share (EPS) (EPS) stands at 1, raising the question: Is the stock fairly valued? This article seeks to answer this question through a detailed valuation analysis of DHT Holdings (NYSE:DHT).

Company Introduction

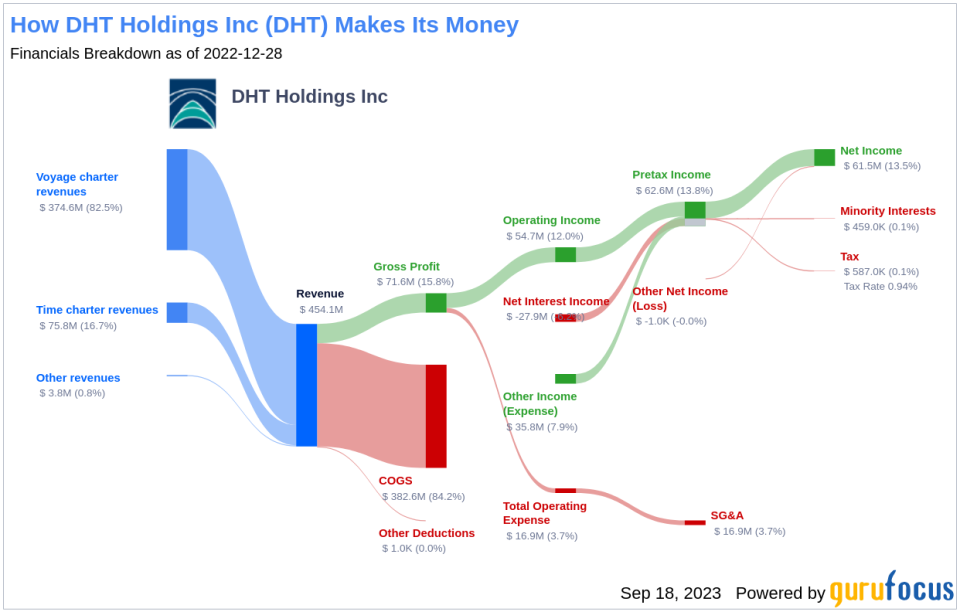

DHT Holdings Inc is a leading crude oil tanker company with an international trading footprint. Its fleet, comprising very large crude carriers (VLCCs) ranging in size from 200,000 to 320,000 deadweight tons, operates in Monaco, Oslo, Norway, and Singapore. With a market capitalization of $1.50 billion and sales of $563.50 million, DHT Holdings (NYSE:DHT) trades at a stock price of $9.41, closely matching its GF Value of $9.17, indicating a fair valuation.

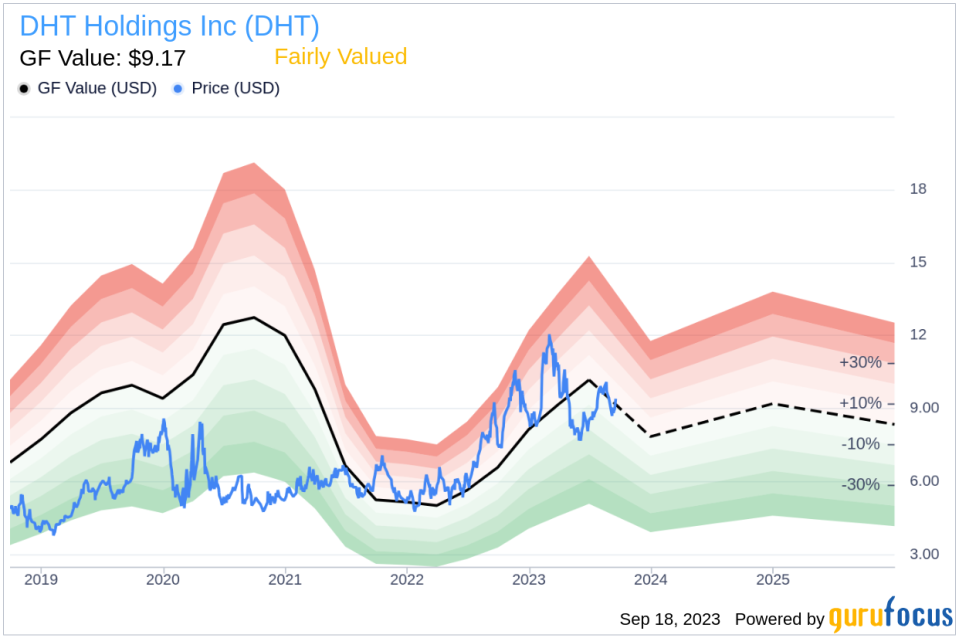

Understanding the GF Value

The GF Value is an exclusive valuation method that calculates a stock's intrinsic value. It relies on historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line offers a snapshot of the stock's ideal trading value. If the stock price significantly deviates from the GF Value Line, it may indicate overvaluation or undervaluation, affecting future returns.

DHT Holdings (NYSE:DHT) is considered fairly valued based on this method. The stock's fair value is derived from historical multiples, an internal adjustment factor based on past business growth, and future performance estimates. A stock price significantly above the GF Value Line may suggest overvaluation and poor future returns, while a price significantly below may hint at undervaluation and higher future returns. Given DHT Holdings' current price of $9.41 per share, the stock appears to be fairly valued.

As DHT Holdings is fairly valued, the long-term return of its stock is expected to align closely with its business growth rate.

Link: These companies may deliver higher future returns at reduced risk.

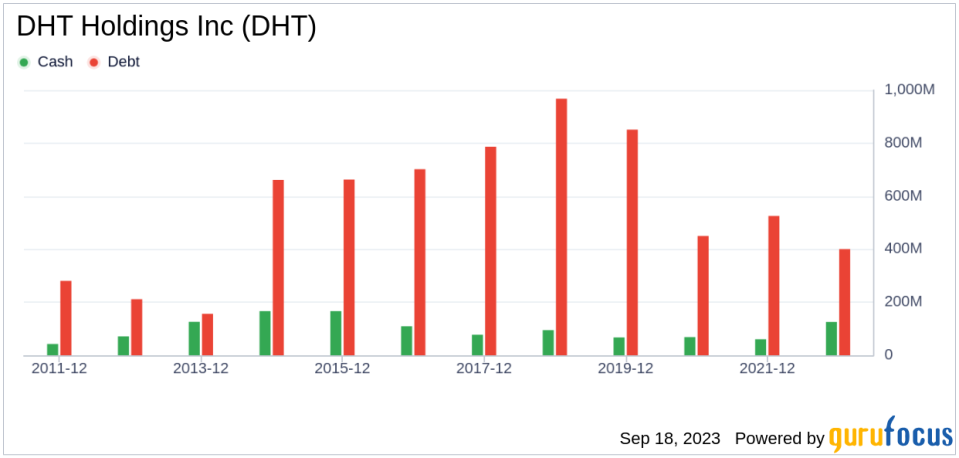

Financial Strength of DHT Holdings

Before investing, it's crucial to assess a company's financial strength. Companies with poor financial strength pose a higher risk of permanent loss. The cash-to-debt ratio and interest coverage provide insights into a company's financial health. DHT Holdings' cash-to-debt ratio of 0.34 is lower than 58.71% of 1027 companies in the Oil & Gas industry. The company's overall financial strength is rated 7 out of 10, indicating fair financial health.

Profitability and Growth of DHT Holdings

Investing in profitable companies, especially those with consistent profitability over the long term, is generally less risky. DHT Holdings has been profitable for 7 out of the past 10 years. Over the past twelve months, the company had a revenue of $563.50 million and an Earnings Per Share (EPS) of $1. Its operating margin is 32.43%, ranking better than 76.64% of 976 companies in the Oil & Gas industry. Overall, DHT Holdings' profitability is ranked 6 out of 10, indicating fair profitability.

Growth is a crucial factor in a company's valuation. The 3-year average annual revenue growth rate of DHT Holdings is -4.7%, ranking lower than 77.48% of 857 companies in the Oil & Gas industry. The 3-year average EBITDA growth rate is -4%, ranking lower than 73.21% of 825 companies in the Oil & Gas industry.

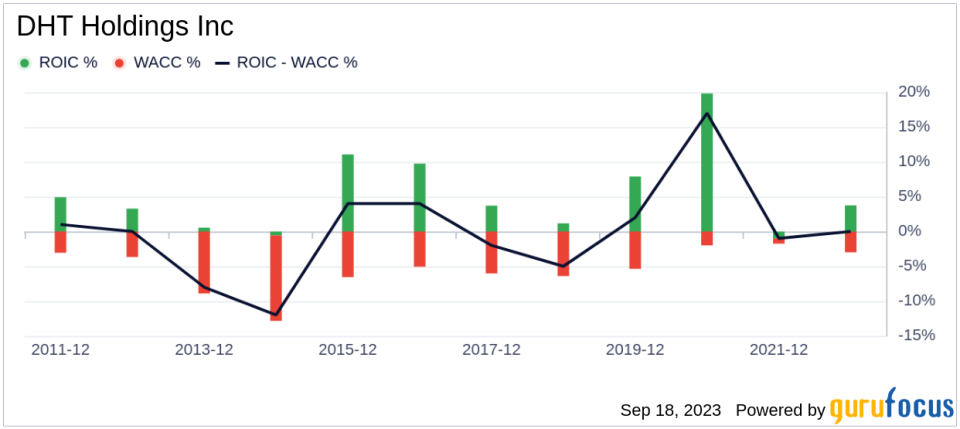

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to the weighted average cost of capital (WACC) is another way to measure profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. When the ROIC is higher than the WACC, it implies the company is creating value for shareholders. For the past 12 months, DHT Holdings's ROIC was 13.36, and its WACC was 5.29.

Conclusion

In conclusion, the stock of DHT Holdings (NYSE:DHT) is believed to be fairly valued. The company's financial condition is fair, and its profitability is fair. However, its growth ranks lower than 73.21% of 825 companies in the Oil & Gas industry. To learn more about DHT Holdings stock, you can check out its 30-Year Financials here.

To find out the high quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.