Unveiling the Dividend Dynamics of MDU Resources Group Inc

An in-depth analysis of the dividend performance and sustainability of MDU Resources Group Inc

MDU Resources Group Inc (NYSE:MDU) recently announced a dividend of $0.13 per share, payable on 2023-10-01, with the ex-dividend date set for 2023-09-13. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's deep dive into MDU Resources Group Inc's dividend performance and assess its sustainability.

Understanding MDU Resources Group Inc's Operations

Warning! GuruFocus has detected 5 Warning Signs with MDU. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

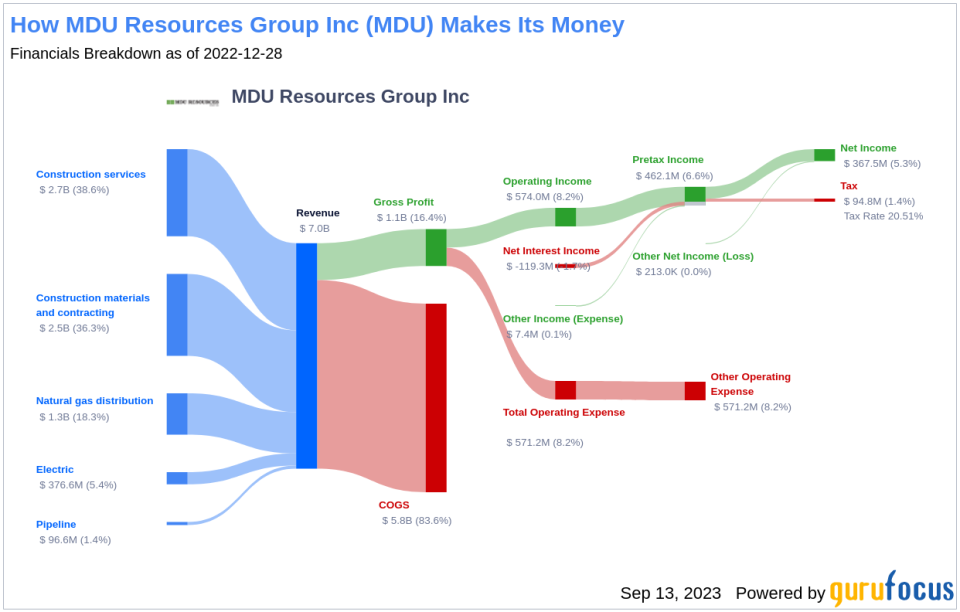

MDU Resources Group Inc operates in five business segments, including Electric, Natural Gas Distribution, Pipeline, Construction Materials and Contracting, and Construction Services. The company generates, transmits, and distributes electricity, distributes natural gas, provides natural gas transportation and underground storage services, and mines, processes and sells construction aggregates. It also produces and sells asphalt mix, supplies ready-mixed concrete, and offers construction services.

A Glimpse at MDU Resources Group Inc's Dividend History

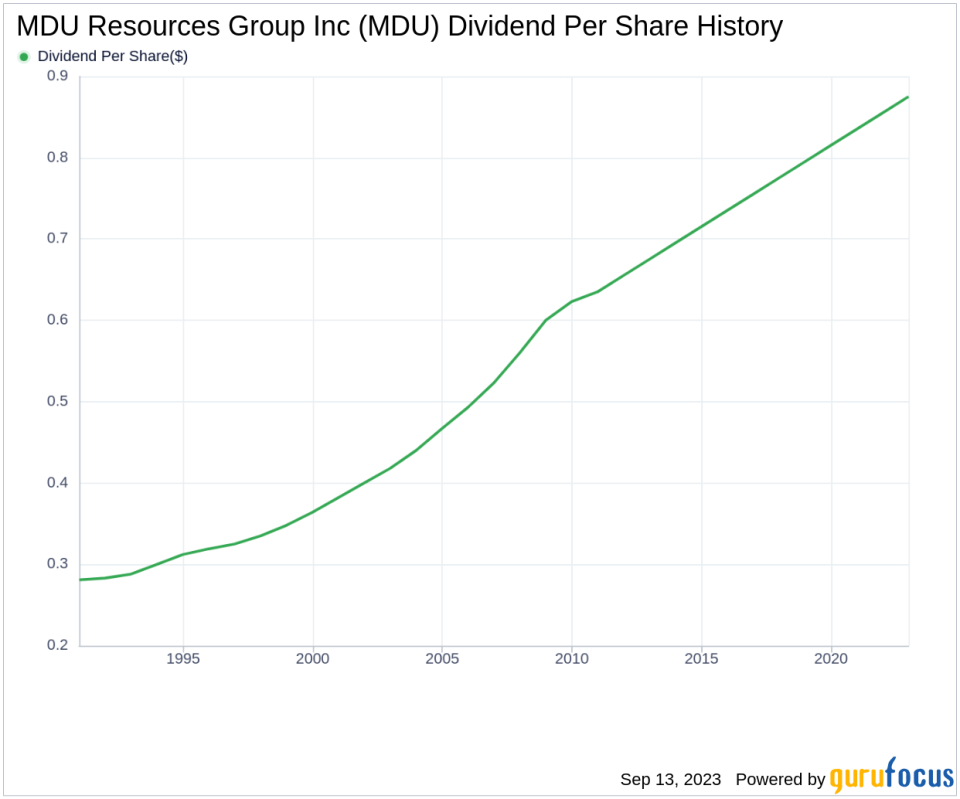

MDU Resources Group Inc has maintained a consistent dividend payment record since 1982, with dividends currently distributed on a quarterly basis. The company has increased its dividend each year since 1982, earning it the status of a dividend aristocrat. This distinction is given to companies that have increased their dividend each year for at least the past 41 years.

Assessing MDU Resources Group Inc's Dividend Yield and Growth

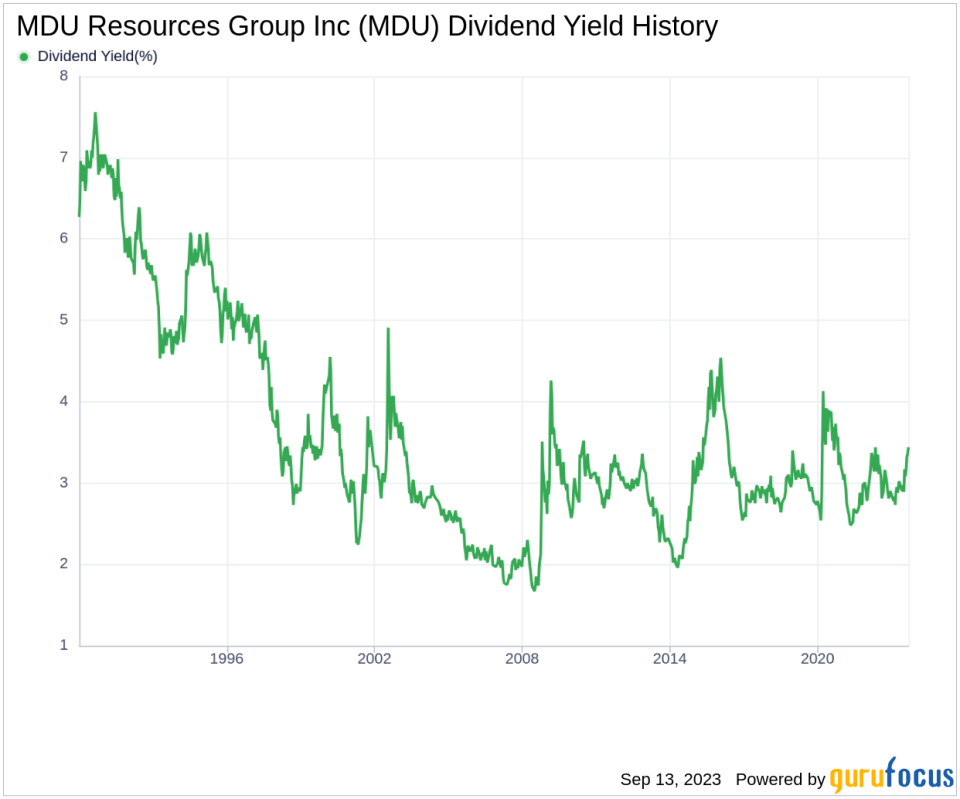

According to today's data, MDU Resources Group Inc has a 12-month trailing dividend yield of 4.47% and a 12-month forward dividend yield of 2.52%. This suggests an expectation of decreased dividend payments over the next 12 months. Over the past three years, the company's annual dividend growth rate was 2.40%, which increased to 2.50% per year over a five-year horizon. Over the past decade, the annual dividends per share growth rate stands at 2.60%.

Evaluating Dividend Sustainability: Payout Ratio and Profitability

The sustainability of a dividend can be assessed by evaluating the company's payout ratio. MDU Resources Group Inc's dividend payout ratio as of 2023-06-30 is 0.36, suggesting that the company retains a significant part of its earnings for future growth and unexpected downturns. The company's profitability rank of 7 out of 10 suggests good profitability prospects, with the company reporting net profit in 9 out of the past 10 years.

Future Outlook: Growth Metrics

MDU Resources Group Inc's growth rank of 7 out of 10 suggests a good growth trajectory relative to its competitors. The company's robust revenue per share and 3-year revenue growth rate of 8.50% per year, which outperforms approximately 58.71% of global competitors, indicates a strong revenue model. Furthermore, the company's 3-year EPS growth rate of 2.30% per year, which outperforms approximately 32.79% of global competitors, showcases its capability to grow its earnings, a critical component for sustaining dividends in the long run.

Conclusion

In conclusion, MDU Resources Group Inc's consistent dividend payments, strong growth rate, low payout ratio, and good profitability and growth metrics suggest that the company's dividends are sustainable in the long run. However, investors should keep a close eye on the company's growth metrics and profitability to ensure the sustainability of its dividends. GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.