Unveiling the Dividend Performance of Camping World Holdings Inc: A Comprehensive Analysis

Exploring Dividend History, Yield, Growth, and Sustainability

Camping World Holdings Inc (NYSE:CWH) recently announced a dividend of $0.13 per share, to be paid on September 29, 2023, with the ex-dividend date set for September 13, 2023. As investors anticipate this forthcoming payment, it's an opportune time to delve into the company's dividend history, yield, and growth rates. Leveraging data from GuruFocus, we will examine Camping World Holdings Inc's dividend performance and assess its sustainability.

Understanding Camping World Holdings Inc

Warning! GuruFocus has detected 8 Warning Signs with CWH. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

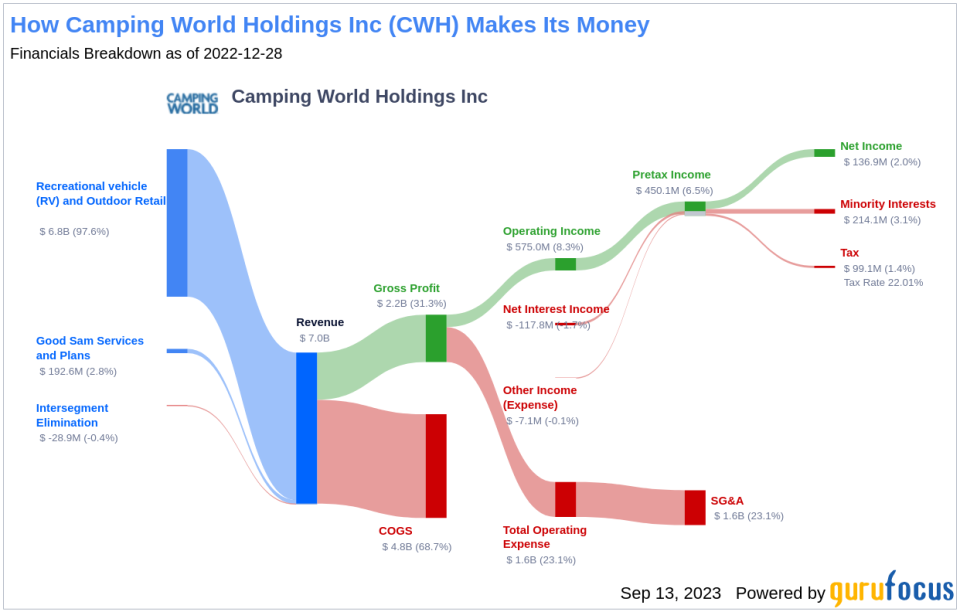

Camping World Holdings Inc is a leading retailer of RVs and associated products and services. The company operates through two reportable segments: Good Sam Services and Plans, which includes sales of emergency roadside assistance plans, insurance programs, travel assist programs, extended vehicle service contracts, consumer shows, and publications; and RV and Outdoor Retail, which involves the sale of new and used RVs, RV service and collision work, RV parts, accessories, outdoor products, equipment, gear, and supplies.

A Glimpse at Camping World Holdings Inc's Dividend History

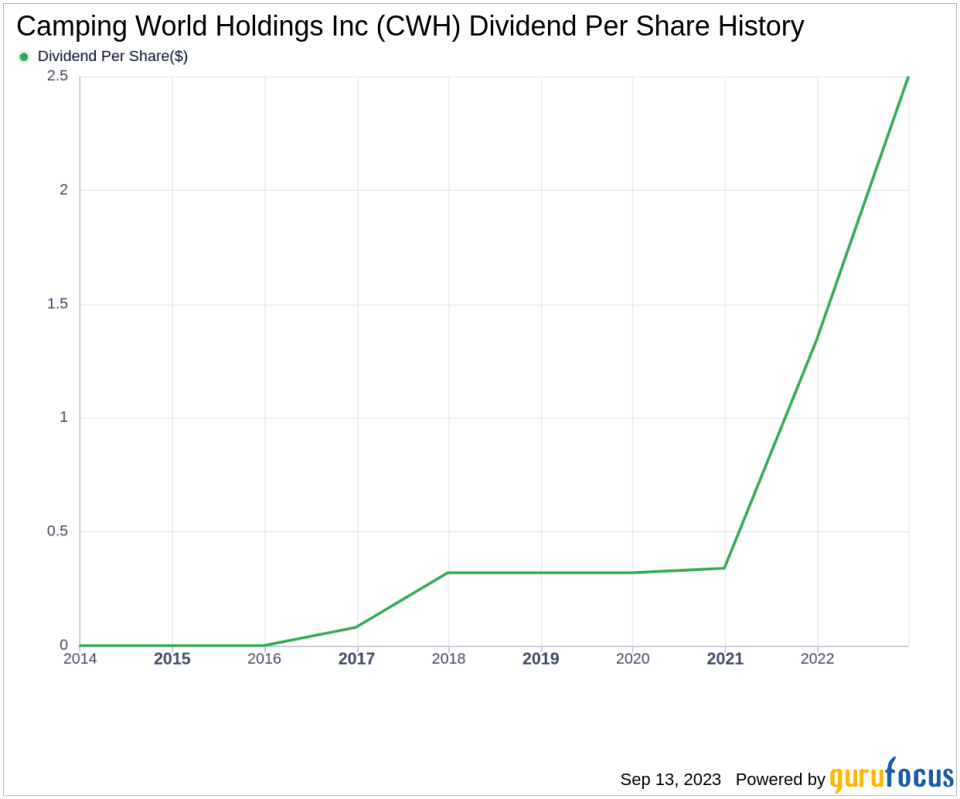

Camping World Holdings Inc has maintained a consistent dividend payment record since 2016, with dividends currently distributed on a quarterly basis. The following chart depicts the company's annual Dividends Per Share for tracking historical trends.

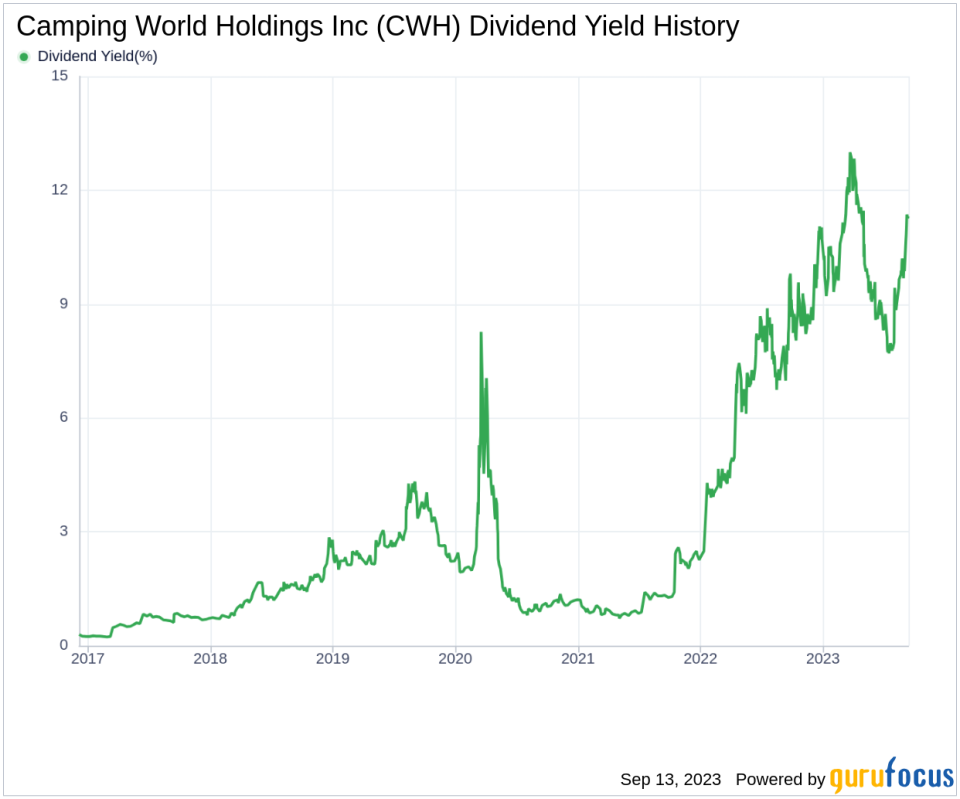

Breaking Down Camping World Holdings Inc's Dividend Yield and Growth

As of today, Camping World Holdings Inc currently has a 12-month trailing dividend yield of 11.31% and a 12-month forward dividend yield of 2.27%. This suggests an expectation of decreased dividend payments over the next 12 months. Over the past three years, Camping World Holdings Inc's annual dividend growth rate was 98.40%. When extended to a five-year horizon, this rate decreased to 51.90% per year. Consequently, the 5-year yield on cost of Camping World Holdings Inc stock as of today is approximately 91.46%.

The Sustainability Question: Payout Ratio and Profitability

To gauge the sustainability of the dividend, it's crucial to evaluate the company's payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of June 30, 2023, Camping World Holdings Inc's dividend payout ratio is 2.72, suggesting potential sustainability issues. However, Camping World Holdings Inc's profitability rank of 7 out of 10 indicates good profitability prospects, with the company reporting net profit in 9 out of the past 10 years.

Growth Metrics: The Future Outlook

Robust growth metrics are essential for the sustainability of dividends. Camping World Holdings Inc's growth rank of 7 out of 10 suggests a good growth trajectory relative to its competitors. The company's revenue per share, combined with the 3-year revenue growth rate, indicates a strong revenue model. Camping World Holdings Inc's revenue has increased by approximately 7.50% per year on average, a rate that outperforms approximately 56.29% of global competitors.

Concluding Remarks

While Camping World Holdings Inc's dividend payments, growth rate, and profitability show promising signs, the sustainability of its dividends is a matter of concern due to its high payout ratio. Therefore, investors should closely monitor the company's financial performance and strategic initiatives to make informed decisions. GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.