Unveiling the Dividend Performance of New Jersey Resources Corp (NJR)

A comprehensive analysis of the company's dividend history, yield, growth, and sustainability

New Jersey Resources Corp(NYSE:NJR) recently announced a dividend of $0.42 per share, payable on October 2, 2023, with the ex-dividend date set for September 19, 2023. As investors anticipate this upcoming payment, it's crucial to examine the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's unpack New Jersey Resources Corp's dividend performance and assess its sustainability.

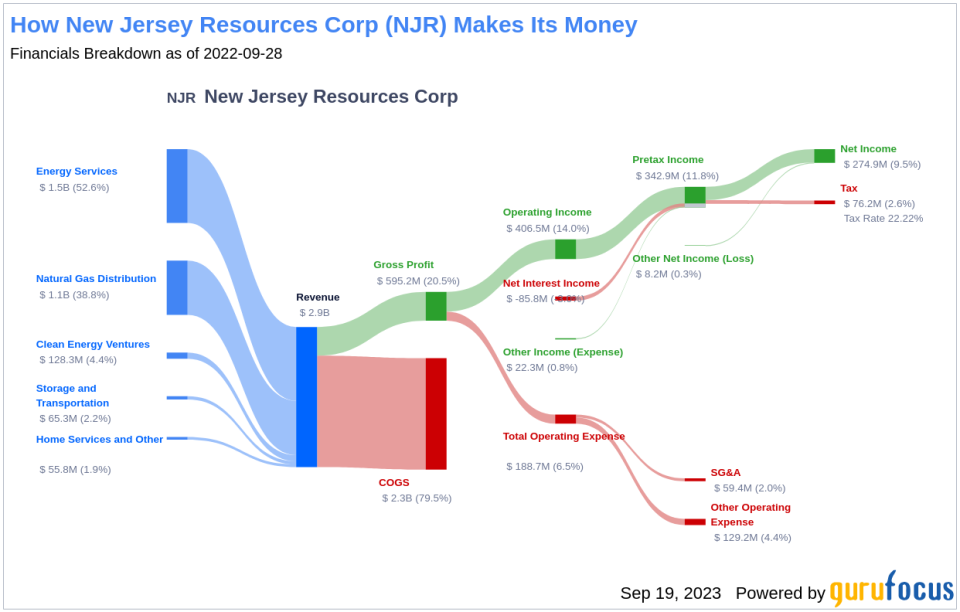

Understanding New Jersey Resources Corp's Operations

Warning! GuruFocus has detected 5 Warning Signs with NJR. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

New Jersey Resources is an energy services holding company with both regulated and nonregulated operations. Its regulated utility, New Jersey Natural Gas, delivers natural gas to more than 570,000 customers in the state. NJR's nonregulated businesses include solar investments primarily in New Jersey and investments in several large midstream gas projects.

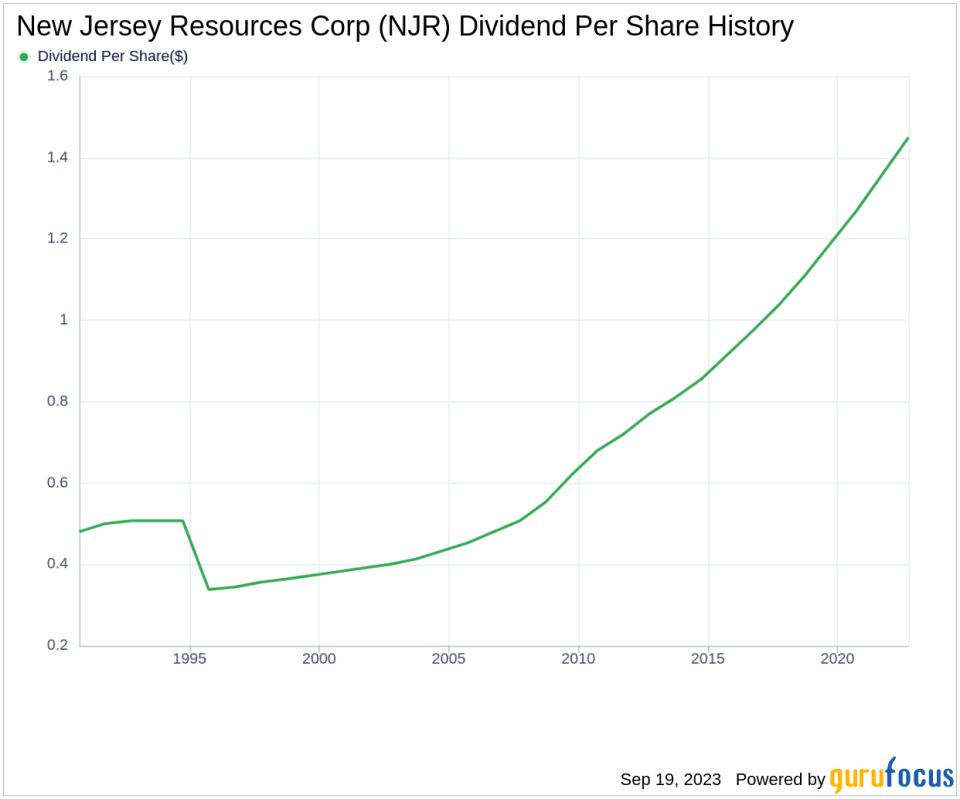

Tracing New Jersey Resources Corp's Dividend History

New Jersey Resources Corp has upheld a consistent dividend payment record since 1989, distributing dividends on a quarterly basis. The company has increased its dividend each year since 1995, earning it the status of a dividend aristocrat, a title bestowed upon companies that have increased their dividend each year for at least the past 28 years.

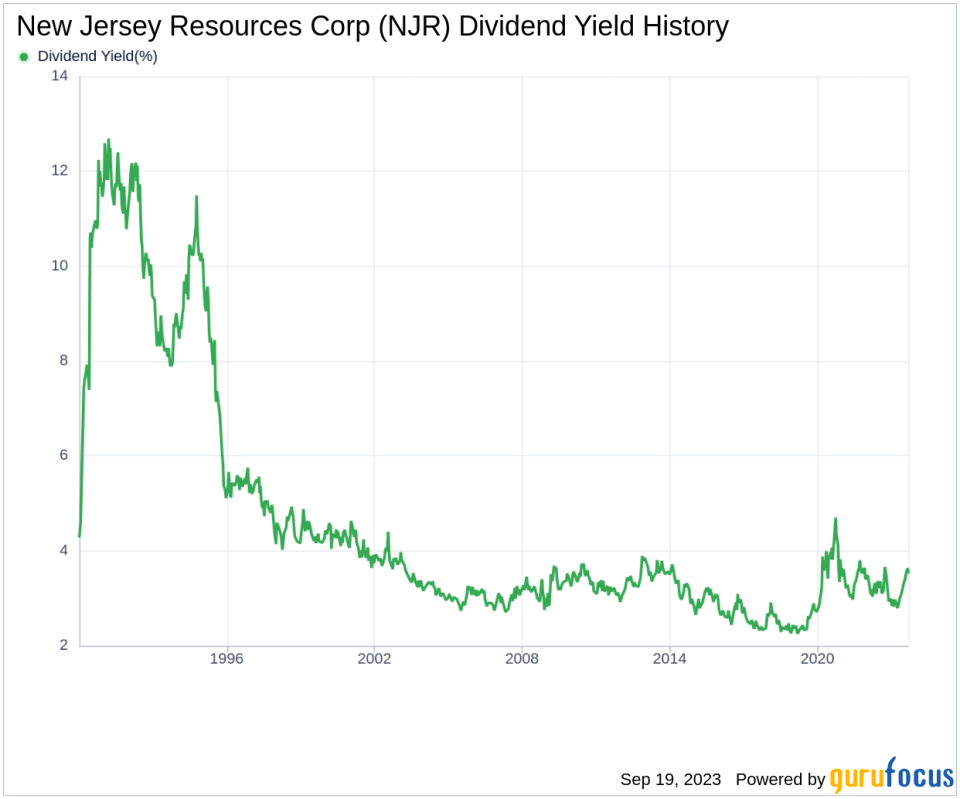

Decoding New Jersey Resources Corp's Dividend Yield and Growth

As of today, New Jersey Resources Corp boasts a 12-month trailing dividend yield of 3.58% and a 12-month forward dividend yield of 3.93%, indicating an anticipated increase in dividend payments over the next 12 months.

Over the past three years, the company's annual dividend growth rate was 6.80%, which rose to 6.90% per year over a five-year horizon. Over the past decade, New Jersey Resources Corp's annual dividends per share growth rate stands at 6.70%.

Based on the company's dividend yield and five-year growth rate, the 5-year yield on cost of New Jersey Resources Corp stock as of today is approximately 4.96%.

Is New Jersey Resources Corp's Dividend Sustainable?

To gauge the sustainability of the dividend, it's essential to examine the company's payout ratio. The dividend payout ratio gives insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, ensuring the availability of funds for future growth and unexpected downturns. As of June 30, 2023, New Jersey Resources Corp's dividend payout ratio is 0.53.

New Jersey Resources Corp's profitability rank of 7 out of 10 as of June 30, 2023, suggests good profitability prospects. The company has reported positive net income for each year over the past decade, further reinforcing its high profitability.

Future Outlook: Growth Metrics

New Jersey Resources Corp's growth rank of 7 out of 10 suggests a good growth trajectory relative to its competitors. The company's revenue has increased by approximately 1.40% per year on average, a rate that underperforms approximately 79.96% of global competitors. However, during the past three years, New Jersey Resources Corp's earnings increased by approximately 27.30% per year on average, a rate that underperforms approximately 18.27% of global competitors. The company's 5-year EBITDA growth rate of 3.00% underperforms approximately 57.27% of global competitors.

Wrapping Up

In conclusion, New Jersey Resources Corp's consistent dividend payments, impressive growth rate, reasonable payout ratio, and satisfactory profitability and growth metrics suggest a promising outlook for dividend investors. While the company's revenue and earnings growth rates may underperform some global competitors, its robust dividend history and yield paint a positive picture for its future. Investors are advised to keep a close eye on these metrics to make informed decisions.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.