Unveiling the Dividend Prospects of LTC Properties Inc

A comprehensive analysis of LTC Properties Inc's dividend performance and sustainability

LTC Properties Inc(NYSE:LTC) recently announced a dividend of $0.19 per share, payable on 2023-09-29, with the ex-dividend date set for 2023-09-20. As investors anticipate this forthcoming payment, it's crucial to examine the company's dividend history, yield, and growth rates. Using GuruFocus data, let's delve into LTC Properties Inc's dividend performance and evaluate its sustainability.

Understanding LTC Properties Inc

Warning! GuruFocus has detected 6 Warning Signs with LTC. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

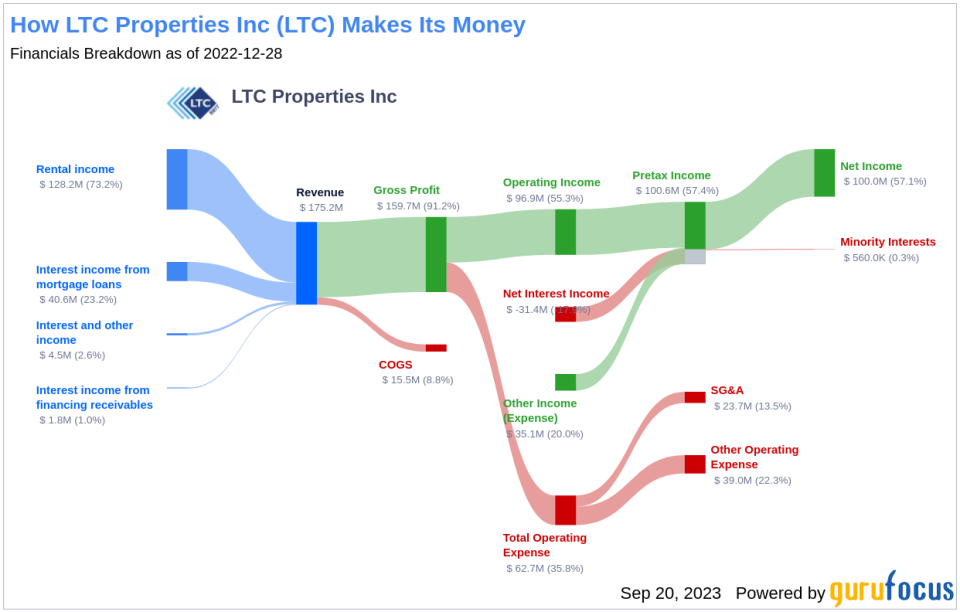

LTC Properties Inc is a healthcare facility real estate investment trust. The company operates one segment that invests in healthcare facilities through mortgage loans, property lease transactions, and other investments. All of its revenue is generated in the United States. LTC is an active capital provider in the seniors housing and healthcare real estate industry, working closely with its operating partners to create a growing pipeline of projects.

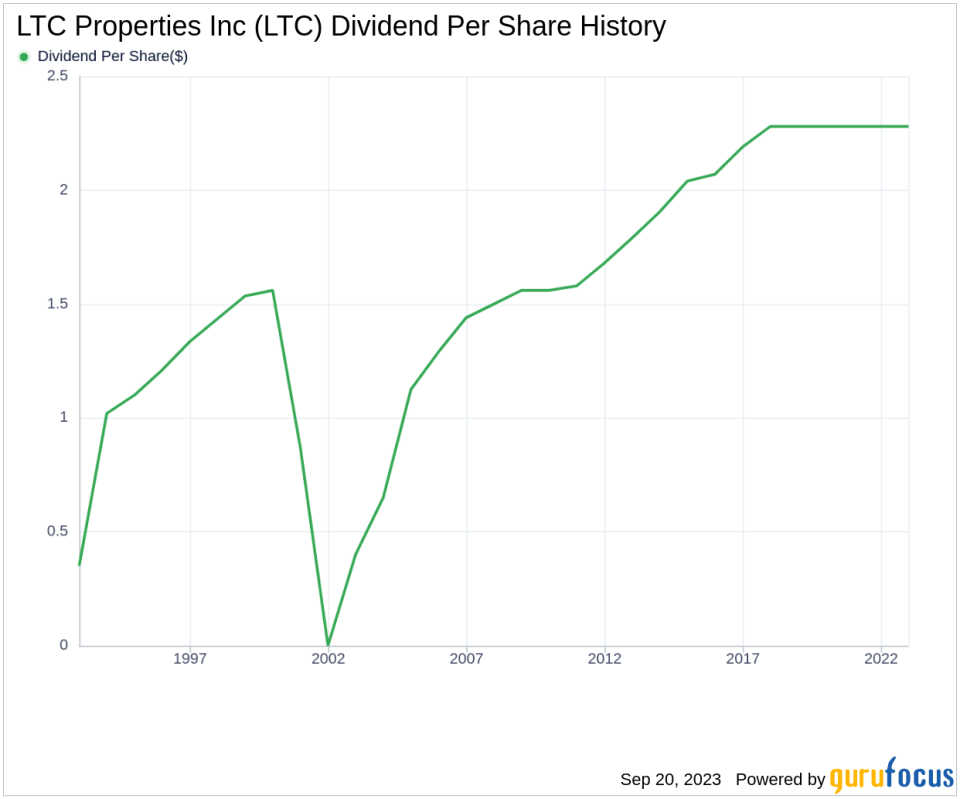

A Look at LTC Properties Inc's Dividend History

LTC Properties Inc has maintained a consistent dividend payment record since 2002, with dividends currently distributed on a monthly basis. The company has increased its dividend each year since 2002, earning it the status of a dividend achiever, a title given to companies that have increased their dividend each year for at least the past 21 years. The chart below shows the annual Dividends Per Share for tracking historical trends.

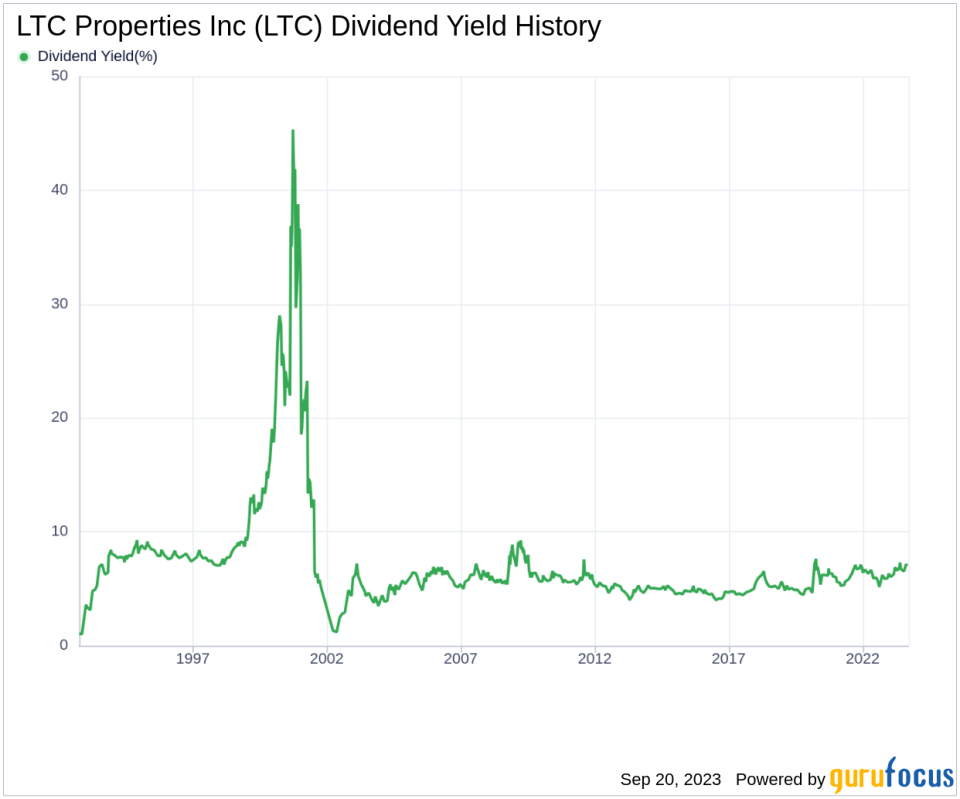

Dissecting LTC Properties Inc's Dividend Yield and Growth

As of today, LTC Properties Inc has a 12-month trailing dividend yield of 7.13% and a 12-month forward dividend yield of 7.13%. This suggests an expectation of same dividend payments over the next 12 months. Over the past decade, the company's annual dividends per share growth rate is at 2.30%. Based on the dividend yield and five-year growth rate, the 5-year yield on cost of LTC Properties Inc stock as of today is approximately 7.13%.

Can LTC Properties Inc's Dividend be Sustained?

To assess the sustainability of the dividend, one needs to evaluate the company's payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of 2023-06-30, LTC Properties Inc's dividend payout ratio is 1.34, which may suggest that the company's dividend may not be sustainable.

LTC Properties Inc's profitability rank of 8 out of 10 as of 2023-06-30 suggests good profitability prospects. The company has reported positive net income for each year over the past decade, further solidifying its high profitability.

Assessing LTC Properties Inc's Growth Prospects

To ensure the sustainability of dividends, a company must have robust growth metrics. LTC Properties Inc's growth rank of 8 out of 10 suggests that the company's growth trajectory is good relative to its competitors. However, the company's 3-year EPS growth rate and 5-year EBITDA growth rate underperform approximately 41.98% and 76.98% of global competitors, respectively.

Conclusion

While LTC Properties Inc has a commendable dividend history, its high dividend payout ratio raises concerns about the sustainability of future dividends. However, its strong profitability rank and growth prospects offer some reassurance. Investors should monitor the company's growth metrics and profitability closely to make informed decisions. GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.