Unveiling Empire State Realty OP LP (ESBA)'s Value: Is It Really Priced Right? A Comprehensive Guide

Empire State Realty OP LP (ESBA) experienced a 3.43% loss on September 8, 2023, with a 3-month gain of 20.91%. With an Earnings Per Share (EPS) of 0.29, the question we aim to answer is, is the stock modestly undervalued? This article will provide a thorough valuation analysis for potential investors.

Company Introduction

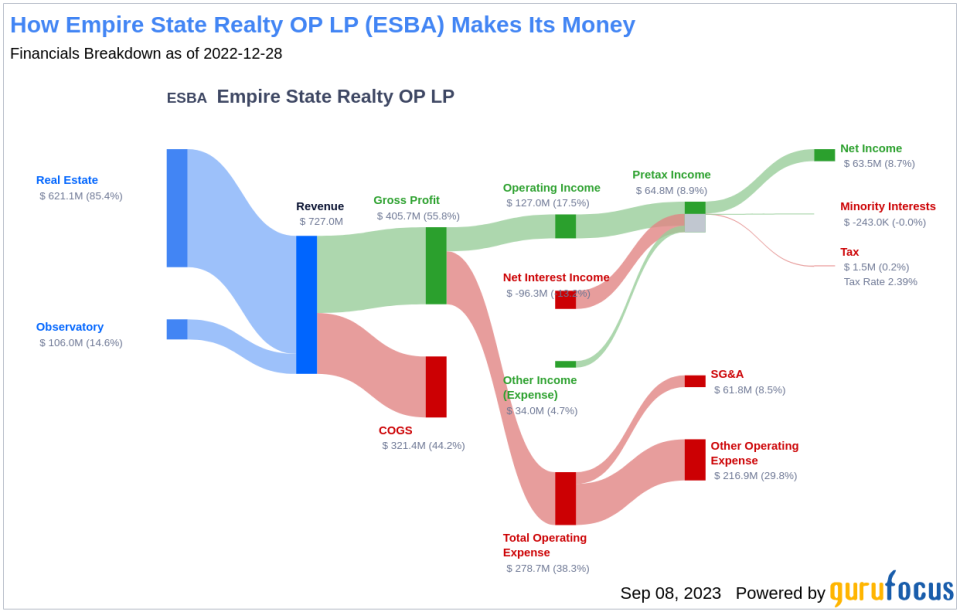

Empire State Realty OP LP is the operating partner of Empire State Realty Inc. The company, along with its partner, manages, acquires and repositions properties in Manhattan and the greater New York metropolitan area. The firm operates in two segments, Real Estate and Observatory. The Real Estate segment focuses on the ownership, management, operation, acquisition, repositioning, and disposition of its real estate assets. The Observatory segment operates the two observatories of the Empire State Building. The company generates maximum revenue from the Real Estate segment.

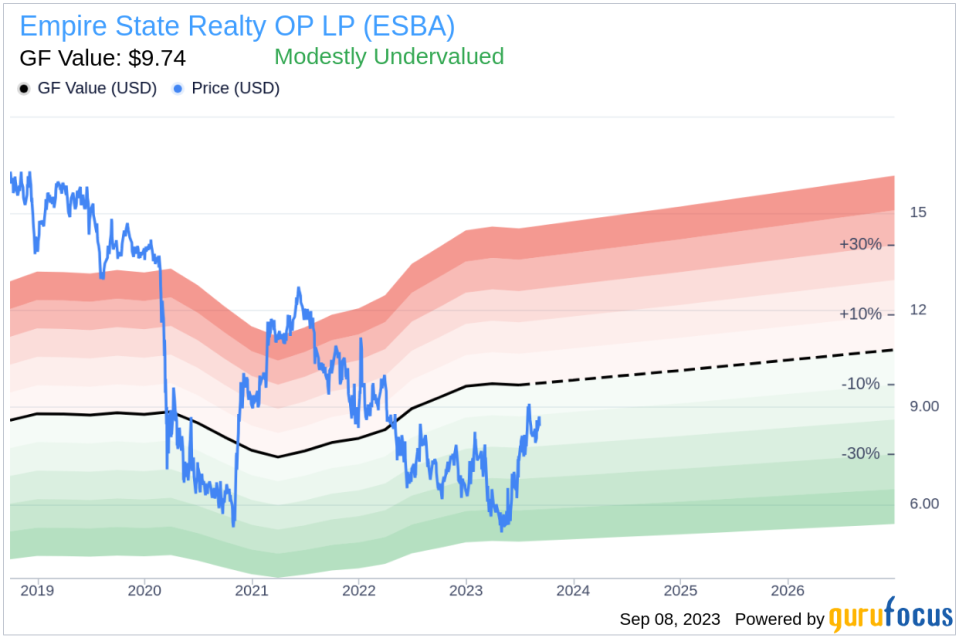

Currently, the company's stock is priced at $8.42, with a GF Value (fair value) of $9.74. This article will delve into the company's value, integrating financial assessment with essential company details.

Understanding GF Value

The GF Value is a proprietary measure of a stock's intrinsic value. It is calculated based on historical multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line on our summary page provides an overview of the fair trading value of the stock.

Empire State Realty OP LP (ESBA) appears to be modestly undervalued based on the GF Value. The stock's current price of $8.42 per share and a market cap of $2.30 billion suggest a modest undervaluation. This implies that the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

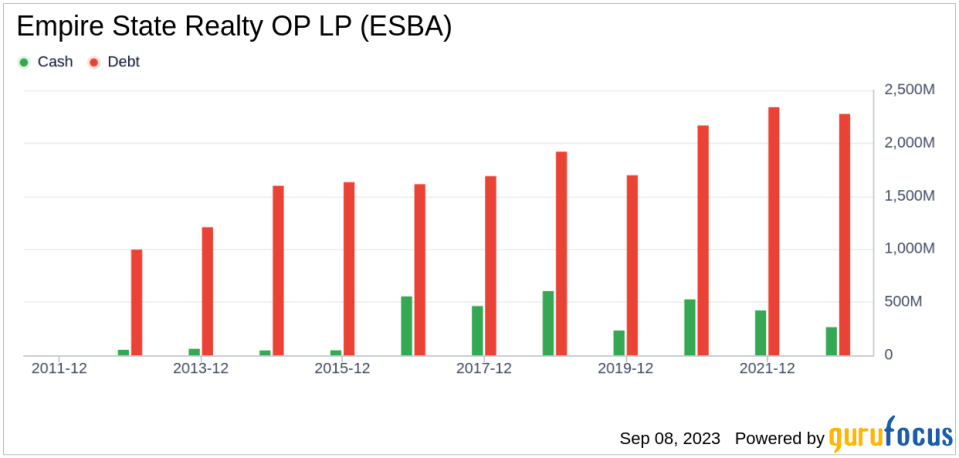

Investing in companies with poor financial strength presents a higher risk of permanent capital loss. Empire State Realty OP LP has a cash-to-debt ratio of 0.14, better than 71.07% of 719 companies in the REITs industry. However, its overall financial strength is ranked 4 out of 10, indicating poor financial health.

Profitability and Growth

Empire State Realty OP LP has been profitable 8 out of the past 10 years. With a revenue of $720.20 million and an Earnings Per Share (EPS) of $0.29 in the past twelve months, its operating margin is 19.18%, ranking worse than 81.2% of 665 companies in the REITs industry. However, its profitability is ranked 7 out of 10, indicating fair profitability.

The company's growth is also noteworthy. The 3-year average annual revenue growth rate is 3.1%, ranking better than 59.87% of 633 companies in the REITs industry. The 3-year average EBITDA growth rate is 6.9%, outperforming 63.99% of 536 companies in the REITs industry.

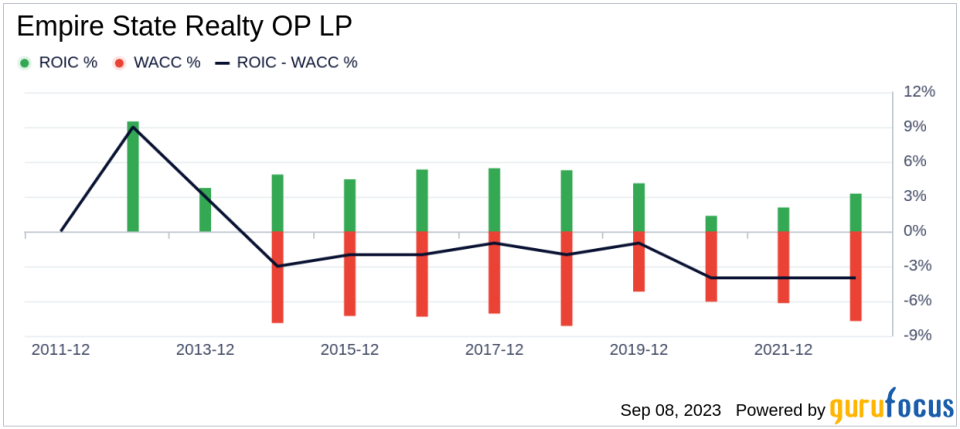

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can also evaluate its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. If ROIC exceeds WACC, the company is likely creating value for its shareholders. Empire State Realty OP LP's ROIC is 3.54 while its WACC came in at 9.89.

Conclusion

In conclusion, Empire State Realty OP LP (ESBA) appears to be modestly undervalued. Despite its poor financial condition, the company shows fair profitability and better growth than 63.99% of companies in the REITs industry. To learn more about Empire State Realty OP LP stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.