Unveiling Fidelity National Financial Inc's Dividend Prospects

An In-depth Analysis of Dividend Performance and Sustainability

Fidelity National Financial Inc (NYSE:FNF) recently announced a dividend of $0.45 per share, payable on 2023-09-29, with the ex-dividend date set for 2023-09-14. As investors anticipate this upcoming payment, it's crucial to examine the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's delve into Fidelity National Financial Inc's dividend performance and assess its sustainability.

What Does Fidelity National Financial Inc Do?

Warning! GuruFocus has detected 8 Warning Sign with FNF. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

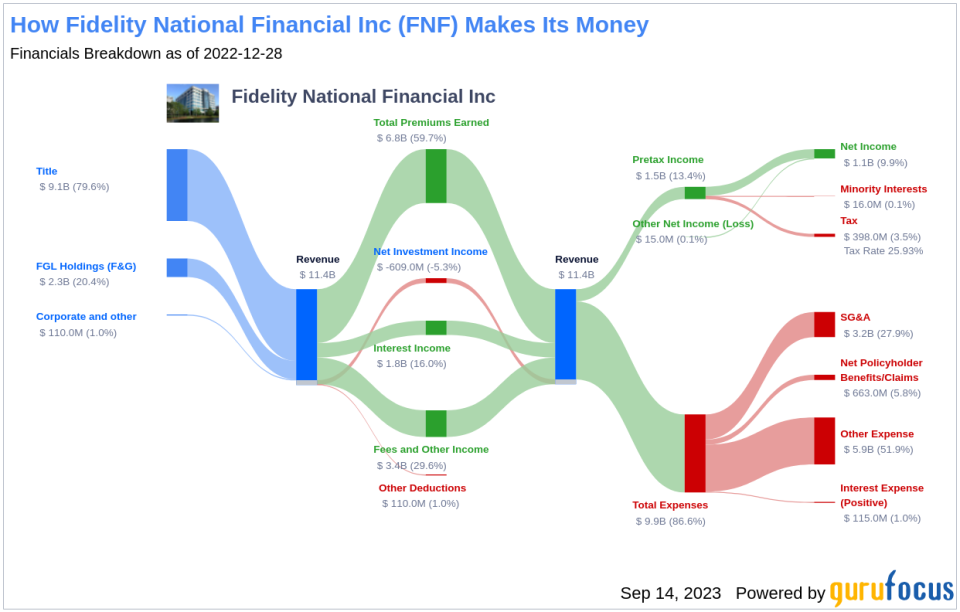

Fidelity National Financial Inc provides title insurance, escrow, and other title-related services. It operates in three segments: Title, F&G, Corporate and Other. The title segment, which generates the majority of the company's revenue, encompasses the operations of title insurance underwriters and related businesses. These businesses offer title insurance and escrow and other title-related services including trust activities, trustee sales guarantees, and home warranty products. The company primarily operates within the United States.

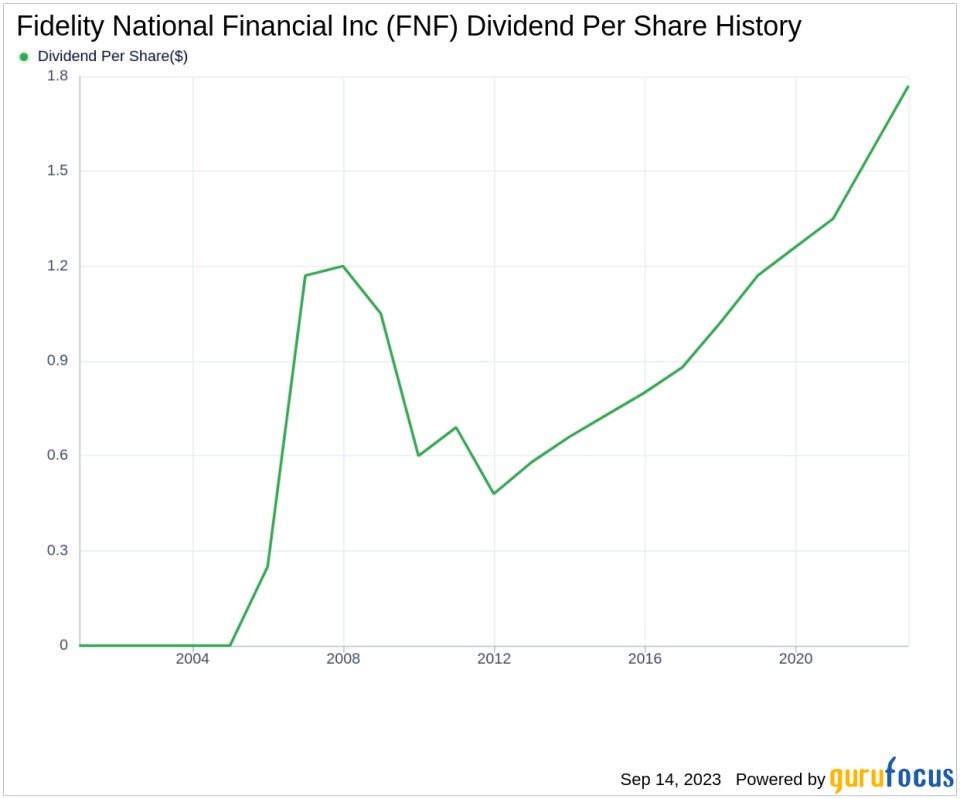

A Glimpse at Fidelity National Financial Inc's Dividend History

Since 2005, Fidelity National Financial Inc has maintained a consistent dividend payment record, distributing dividends on a quarterly basis. The company has increased its dividend each year since 2011, earning it the status of a dividend achiever. This title is bestowed upon companies that have consistently increased their dividend each year for at least the past 12 years.

Breaking Down Fidelity National Financial Inc's Dividend Yield and Growth

As of today, Fidelity National Financial Inc boasts a 12-month trailing dividend yield of 4.19% and a 12-month forward dividend yield of 4.21%, indicating an expectation of increased dividend payments over the next 12 months. Over the past three years, the company's annual dividend growth rate was 12.00%, decreasing slightly to 11.10% per year over a five-year horizon. Over the past decade, the company's annual dividends per share growth rate stands at an impressive 11.60%.

The Sustainability Question: Payout Ratio and Profitability

The dividend payout ratio is a crucial metric in assessing the sustainability of a company's dividend. As of 2023-06-30, Fidelity National Financial Inc's dividend payout ratio is 1.32, suggesting potential sustainability concerns. However, the company's profitability rank of 7 out of 10, coupled with consistent positive net income over the past decade, indicates solid profitability prospects.

Growth Metrics: The Future Outlook

Fidelity National Financial Inc's growth rank of 7 out of 10 suggests a promising growth trajectory. The company's strong revenue per share and 3-year revenue growth rate of 10.60% per year outperform approximately 74.45% of global competitors. Additionally, the company's 3-year EPS growth rate of 2.30% per year and 5-year EBITDA growth rate of 22.50% outperform approximately 49.45% and 84.86% of global competitors, respectively.

Conclusion

In conclusion, while Fidelity National Financial Inc's high dividend payout ratio may raise sustainability concerns, the company's strong profitability and growth metrics provide a positive outlook. With consistent dividend growth, robust revenue growth, and solid earnings prowess, Fidelity National Financial Inc presents a compelling case for dividend-focused investors.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.