Unveiling Global Payments (GPN)'s Value: Is It Really Priced Right? A Comprehensive Guide

Global Payments Inc (NYSE:GPN) has seen a daily gain of 2.94%, with a 3-month gain of 25.65%. With an Earnings Per Share (EPS) of 3, the question arises: is the stock modestly undervalued? This article presents a valuation analysis of Global Payments, providing a deeper insight into its intrinsic value. We invite you to explore the following analysis.

Company Introduction

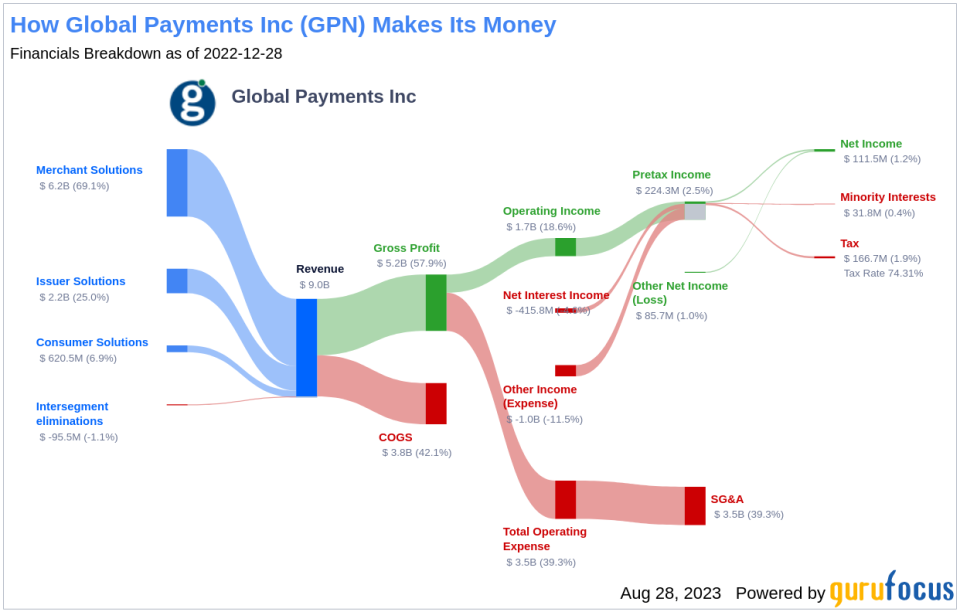

Global Payments is a leading provider of payment processing and software solutions, focusing on serving small and midsize merchants. The company operates in 30 countries and generates about one fourth of its revenue from outside North America, primarily in Europe and Asia. In 2019, Global Payments merged with Total System Services in an all-stock deal that gave Total System Services shareholders 48% of the combined company's shares. The merger added issuer processing operations.

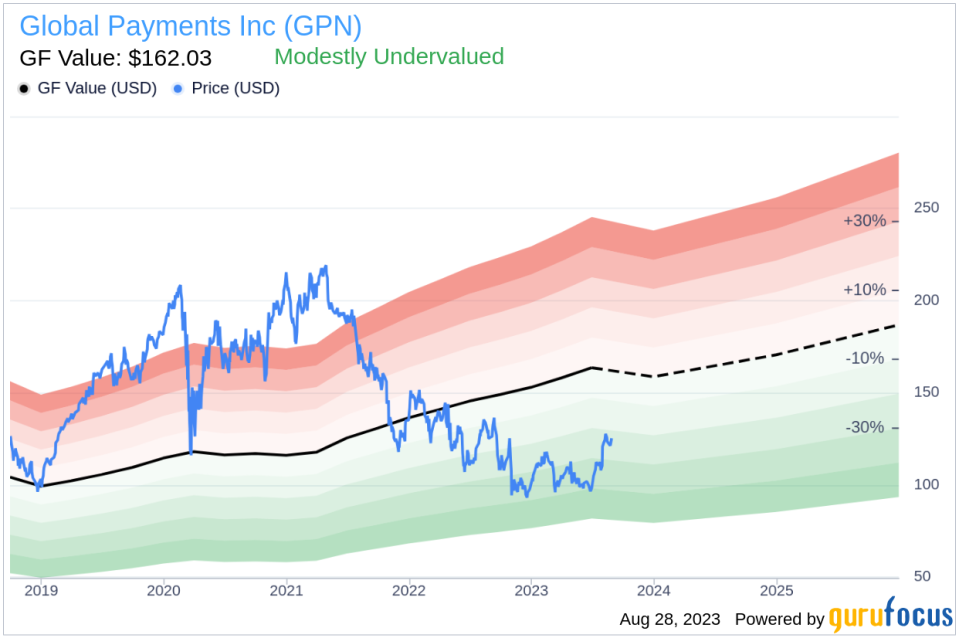

Comparing the stock price and the GF Value, an estimation of fair value, provides a deeper exploration of the company's value. This approach ingeniously integrates financial assessment with essential company details.

GF Value Summary

The GF Value represents the current intrinsic value of a stock derived from our exclusive method. The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at. It is calculated based on three factors:

Historical multiples (PE Ratio, PS Ratio, PB Ratio and Price-to-Free-Cash-Flow) that the stock has traded at.

GuruFocus adjustment factor based on the company's past returns and growth.

Future estimates of the business performance.

We believe the GF Value Line is the fair value that the stock should be traded at. The stock price will most likely fluctuate around the GF Value Line. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher.

Global Payments (NYSE:GPN) is estimated to be modestly undervalued based on GuruFocus' valuation method. GF Value estimates the stock's fair value based on three key factors: historical multiples, an internal adjustment based on the company's past business growth, and analyst estimates of future business performance. If the stock's share price is significantly above the GF Value Line, the stock may be overvalued and have poor future returns. On the other hand, if the stock's share price is significantly below the GF Value Line, the stock may be undervalued and have high future returns. At its current price of $125.29 per share, Global Payments has a market cap of $32.60 billion and the stock is estimated to be modestly undervalued.

Because Global Payments is relatively undervalued, the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

This article first appeared on GuruFocus.