Unveiling Grupo Aeroportuario del Pacifico SAB de CV (PAC)'s Value: Is It Really Priced Right? ...

Grupo Aeroportuario del Pacifico SAB de CV (NYSE:PAC) has been experiencing a daily loss of -5.95% and a 3-month loss of -6.31%. Despite these losses, the company boasts an Earnings Per Share (EPS) of 10.09. This raises the question: is the stock significantly undervalued? In this article, we delve into a detailed valuation analysis of PAC to answer this question. We invite you to continue reading for an insightful exploration of the company's value.

Company Overview

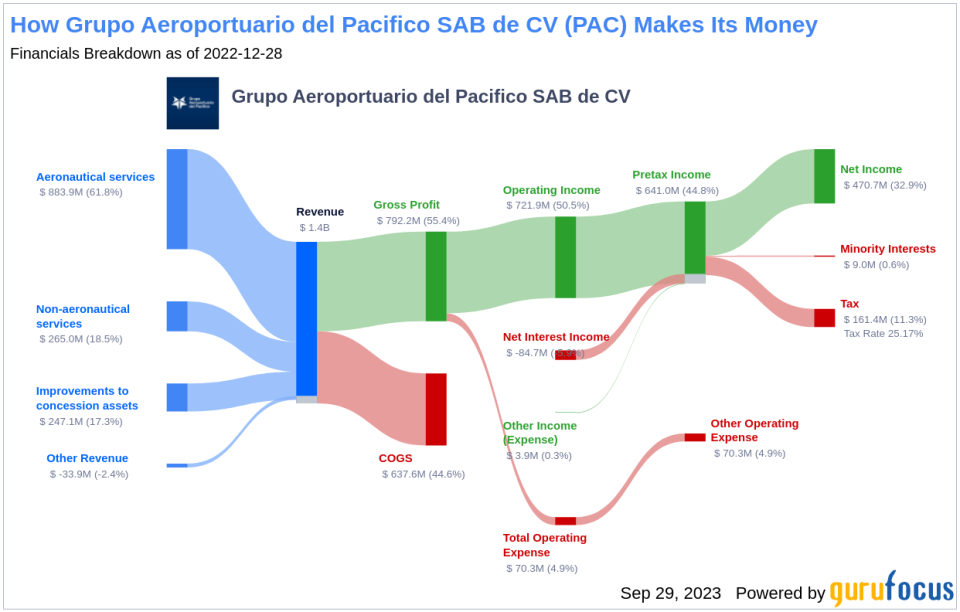

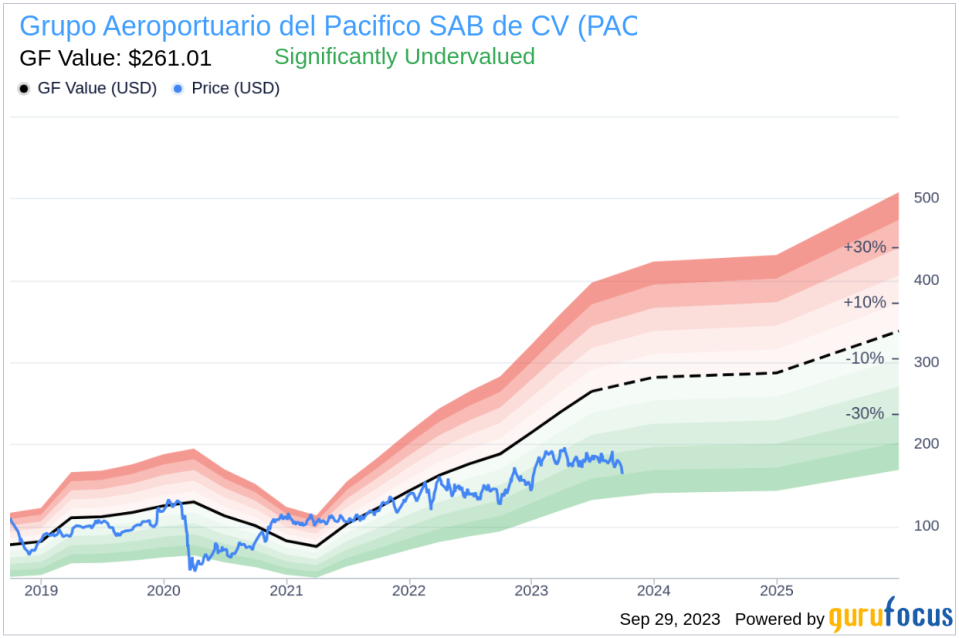

Grupo Aeroportuario del Pacifico SAB de CV is a key player in the construction, development, and operation of airports in Mexico. With a diverse portfolio including Guadalajara, Tijuana, Puerto Vallarta, and San Jose del Cabo among others, the company generates maximum revenue from the Guadalajara segment. The current stock price is $164.37, significantly lower than the GF Value of $261.01, indicating that the stock may be undervalued.

Understanding the GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line on our summary page provides an overview of the fair value at which the stock should ideally be traded. If the stock price significantly deviates from the GF Value Line, it may indicate overvaluation or undervaluation, thus influencing future returns.

For Grupo Aeroportuario del Pacifico SAB de CV (NYSE:PAC), the GF Value suggests that the stock is significantly undervalued. This implies that the long-term return of its stock is likely to be much higher than its business growth.

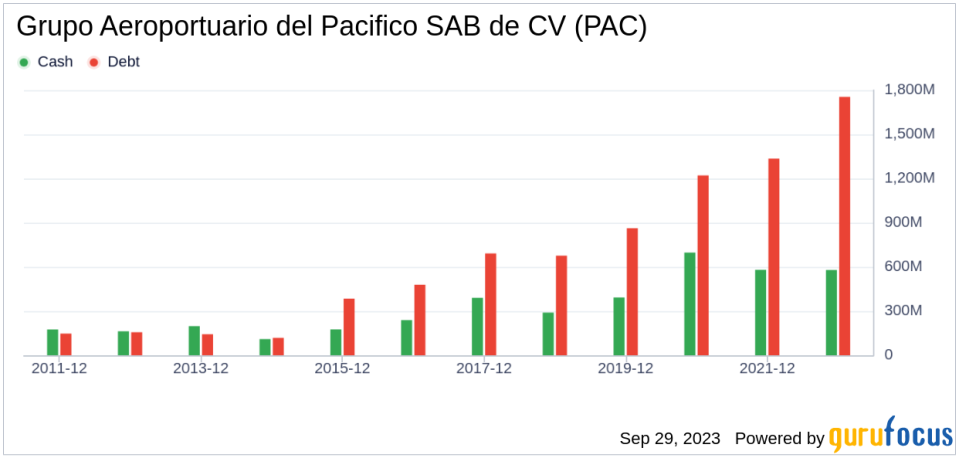

Financial Strength of Grupo Aeroportuario del Pacifico SAB de CV

Investing in companies with low financial strength can pose a risk of permanent capital loss. Therefore, it's crucial to carefully review a company's financial strength before deciding to buy shares. Grupo Aeroportuario del Pacifico SAB de CV has a cash-to-debt ratio of 10000, ranking it better than 99.89% of 940 companies in the Transportation industry. Based on this, GuruFocus ranks Grupo Aeroportuario del Pacifico SAB de CV's financial strength as 8 out of 10, suggesting a strong balance sheet.

Profitability and Growth of Grupo Aeroportuario del Pacifico SAB de CV

Investing in profitable companies usually carries less risk. Grupo Aeroportuario del Pacifico SAB de CV has been profitable for 10 years over the past 10 years. With an operating margin of 48.32%, it ranks better than 97.69% of 952 companies in the Transportation industry. The company's growth also ranks better than 81.22% of 916 companies in the Transportation industry, with an average annual revenue growth of 20.4% and a 3-year average EBITDA growth of 19.5%.

ROIC vs WACC

Return on invested capital (ROIC) and weighted average cost of capital (WACC) are crucial indicators of a company's profitability. Grupo Aeroportuario del Pacifico SAB de CV's ROIC of 20.62 is significantly higher than its WACC of 13.34, indicating value creation for its shareholders.

Conclusion

In conclusion, the stock of Grupo Aeroportuario del Pacifico SAB de CV (NYSE:PAC) appears to be significantly undervalued. The company has strong financial strength and profitability, and its growth ranks better than most companies in the Transportation industry. To learn more about Grupo Aeroportuario del Pacifico SAB de CV stock, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, visit GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.