Unveiling Grupo Simec SAB de CV (SIM)'s Value: Is It Really Priced Right? A Comprehensive Guide

Grupo Simec SAB de CV (SIM) recently experienced a daily gain of 6.29%, despite a 3-month loss of -5.86%. With an Earnings Per Share (EPS) of 1.16, questions arise regarding the stock's fair valuation. This article provides a comprehensive valuation analysis, shedding light on whether Grupo Simec SAB de CV (SIM) is fairly valued or not.

Company Overview

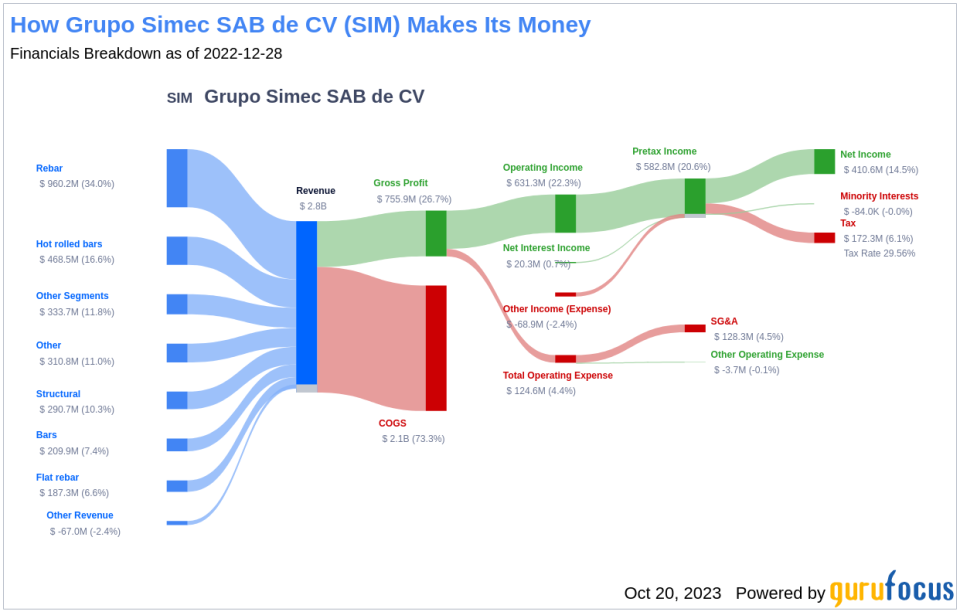

Grupo Simec SAB de CV is a diversified manufacturer, processor, and distributor of special bar quality (SBQ) steel and structural steel products. The company enjoys a significant market presence in the United States, Brazil, and Mexico. Its SBQ products are widely used in various engineered end-user applications, including axles, hubs, and crankshafts for automobiles and light trucks, machine tools, and off-highway equipment. Meanwhile, its structural steel products are mainly used in non-residential construction and other construction applications.

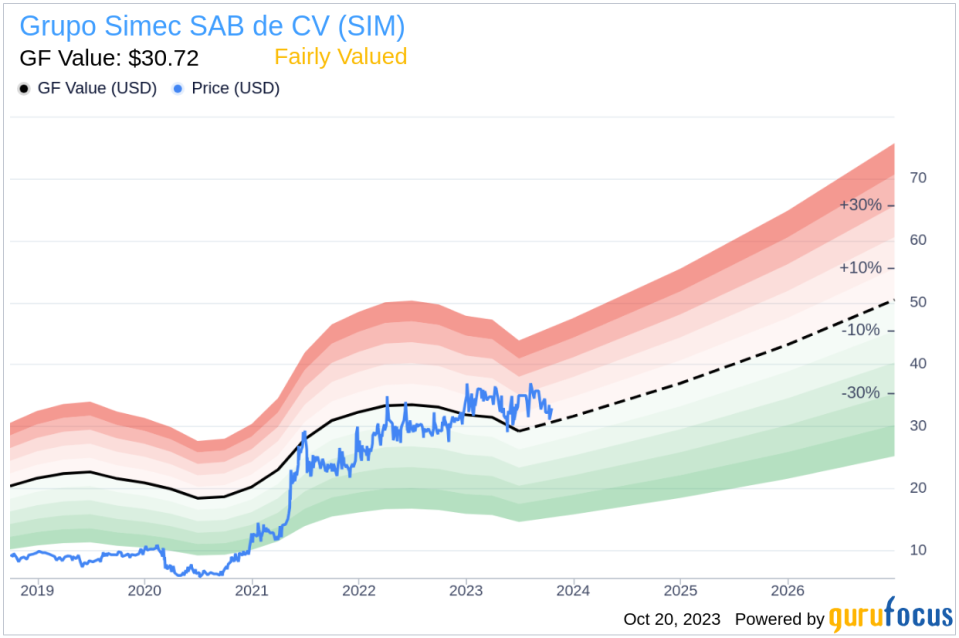

Understanding the GF Value

The GF Value is an intrinsic value of a stock derived from a proprietary method. This value is based on historical multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. The GF Value Line provides a fair value at which the stock should ideally be traded. If the stock price is significantly above the GF Value Line, it is likely overvalued and may yield poor future returns. Conversely, if it is significantly below the GF Value Line, it may be undervalued, and its future returns could be higher.

Grupo Simec SAB de CV's GF Value

Based on GuruFocus valuation, Grupo Simec SAB de CV (SIM) is estimated to be fairly valued. The stock's fair value is derived from historical multiples, an internal adjustment based on past business growth, and analyst estimates of future business performance. Currently, at a price of $32.95 per share, Grupo Simec SAB de CV has a market cap of $5.10 billion. Given that the stock is fairly valued, the long-term return of its stock is likely to be close to the rate of its business growth.

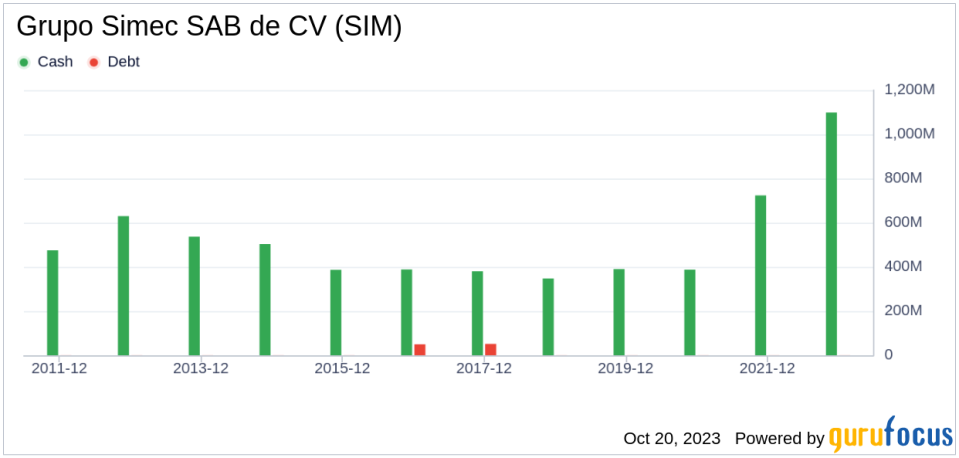

Financial Strength

Investing in companies with low financial strength could result in permanent capital loss. Therefore, it is crucial to review a company's financial strength before buying shares. Grupo Simec SAB de CV has a cash-to-debt ratio of 4034.96, ranking better than 92.89% of 591 companies in the Steel industry. Based on this, GuruFocus ranks Grupo Simec SAB de CV's financial strength as 10 out of 10, suggesting a strong balance sheet.

Profitability and Growth

Companies that have been consistently profitable over the long term offer less risk for investors. Grupo Simec SAB de CV has been profitable 8 over the past 10 years. Over the past twelve months, the company had a revenue of $2.50 billion and an Earnings Per Share (EPS) of $1.16. Its operating margin is 20.36%, which ranks better than 92.92% of 607 companies in the Steel industry. Overall, the profitability of Grupo Simec SAB de CV is ranked 8 out of 10, indicating strong profitability.

One of the most important factors in the valuation of a company is growth. The average annual revenue growth of Grupo Simec SAB de CV is16.8%, which ranks better than 70.51% of 590 companies in the Steel industry. The 3-year average EBITDA growth is 64.2%, which ranks better than 86.8% of 515 companies in the Steel industry.

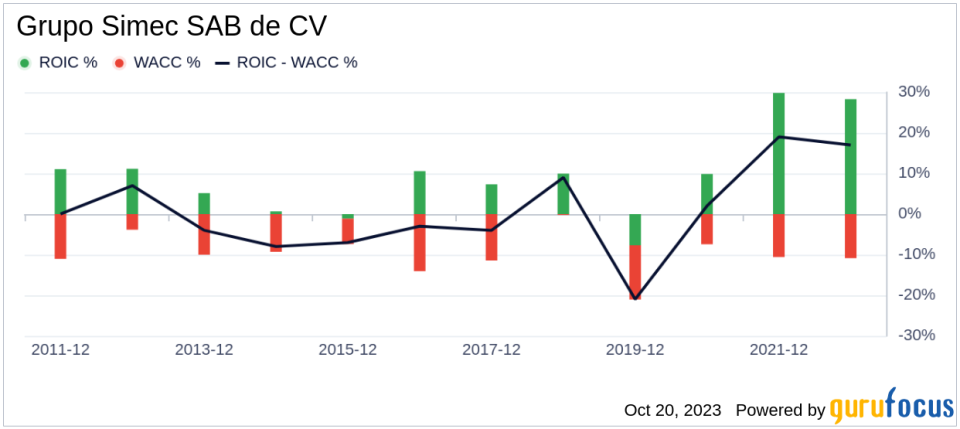

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can also evaluate its profitability. Return on invested capital (ROIC) measures how well a company generates cash flow relative to the capital it has invested in its business. The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. If the return on invested capital exceeds the weighted average cost of capital, the company is likely creating value for its shareholders. During the past 12 months, Grupo Simec SAB de CV's ROIC is 14.54 while its WACC came in at 10.98.

Conclusion

In conclusion, Grupo Simec SAB de CV (SIM) is estimated to be fairly valued. The company's financial condition is strong, and its profitability is strong. Its growth ranks better than 86.8% of 515 companies in the Steel industry. To learn more about Grupo Simec SAB de CV stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.