Unveiling Herbalife (HLF)'s Value: Is it Really Priced Right? A Comprehensive Guide

Herbalife Ltd (NYSE:HLF) experienced a daily loss of 4.07%, with a 3-month gain of 4.77%. The company's Earnings Per Share (EPS) stands at 2.27. The question arises: Is the stock significantly undervalued? This article aims to provide a detailed valuation analysis to answer this question. Let's delve into the financials of Herbalife.

Company Introduction

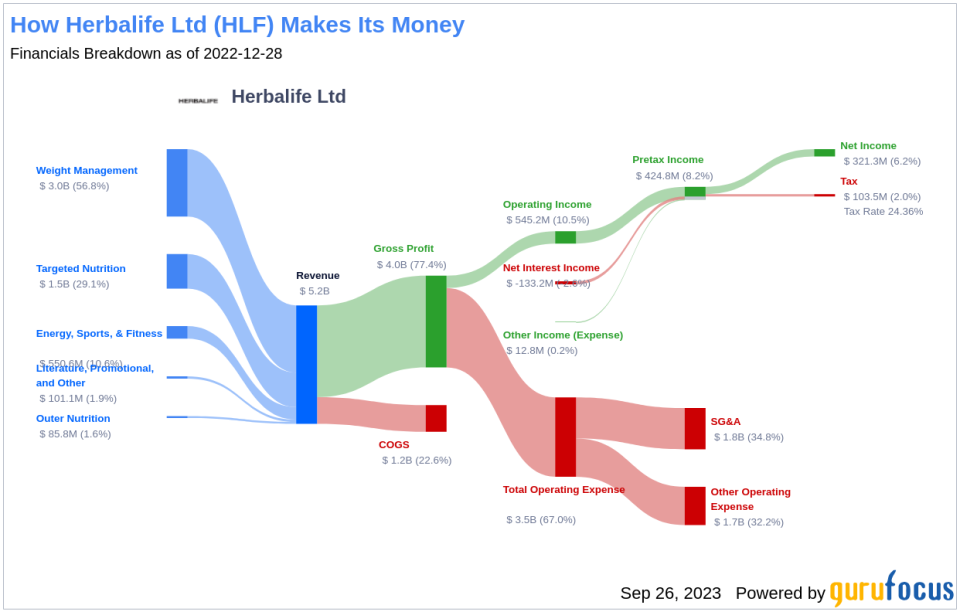

Herbalife Ltd is a globally recognized nutrition company that provides health and wellness products to consumers in 95 markets through their direct-selling business model. With a major revenue stream from weight management products like meal replacement, protein shakes, weight loss enhancers, and healthy snacks, Herbalife has established a strong presence in North America, Mexico, South and Central America, EMEA, Asia-Pacific, and China.

Currently, Herbalife (NYSE:HLF) trades at $13.78 per share, with a market cap of $1.40 billion. However, the GF Value, an estimation of its fair value, stands at $37.67. This significant difference prompts a deeper analysis of the company's intrinsic value.

Understanding GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, computed considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line denotes the stock's ideal fair trading value.

Herbalife's stock is estimated to be significantly undervalued based on the GF Value calculation. Given that the stock price is significantly below the GF Value Line, its future return is likely to be higher. Therefore, the long-term return of Herbalife's stock is likely to be much higher than its business growth.

Herbalife's Financial Strength

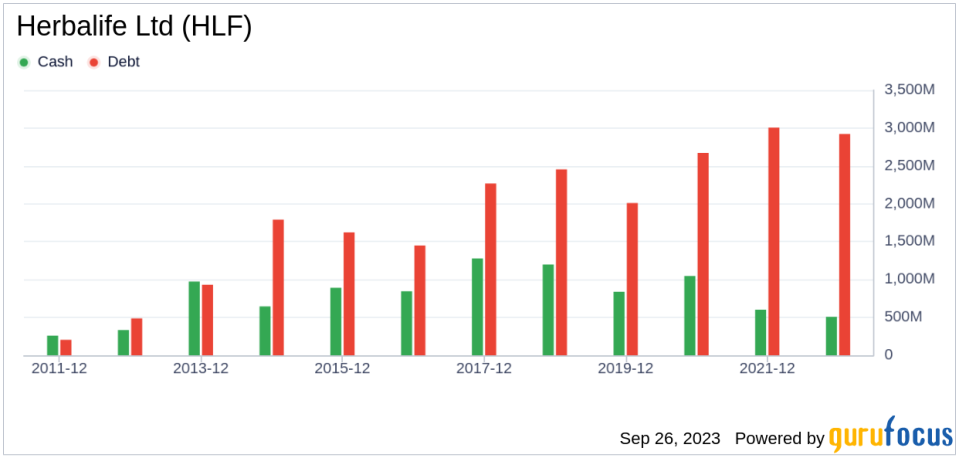

Investing in companies with poor financial strength can lead to a high risk of permanent capital loss. Therefore, it's crucial to review a company's financial strength before investing. Herbalife's cash-to-debt ratio is 0.19, which ranks worse than 67.86% of companies in the Consumer Packaged Goods industry. This indicates that Herbalife's financial strength is relatively poor.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, poses less risk. Herbalife has been profitable 10 over the past 10 years, with an operating margin of 8.53%, which ranks better than 67.25% of companies in the Consumer Packaged Goods industry. This indicates strong profitability.

Moreover, growth is a critical factor in a company's valuation. Herbalife's 3-year average annual revenue growth is 14.9%, which ranks better than 74.01% of companies in the Consumer Packaged Goods industry. The 3-year average EBITDA growth rate is 11.3%, ranking better than 59.06% of companies in the same industry.

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to the weighted average cost of capital (WACC) is another way to determine its profitability. Herbalife's ROIC is 16.08, and its cost of capital is 6.24, indicating that the company is creating value for shareholders.

Conclusion

In conclusion, Herbalife (NYSE:HLF) appears to be significantly undervalued. Despite its poor financial condition, the company demonstrates strong profitability and above-average growth in the Consumer Packaged Goods industry. For more details about Herbalife's financials, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, visit the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.