Unveiling Hollysys Automation Technologies (HOLI)'s Value: Is It Really Priced Right? A ...

Hollysys Automation Technologies Ltd (NASDAQ:HOLI) experienced a daily loss of -2.12%, with a 3-month gain of 9.45%. The company's Earnings Per Share (EPS) stands at 1.73. The question that arises is: Is the stock Fairly Valued? This analysis aims to provide an in-depth look into the company's valuation. Keep reading to understand more about the company's financial health and prospects.

Introducing Hollysys Automation Technologies

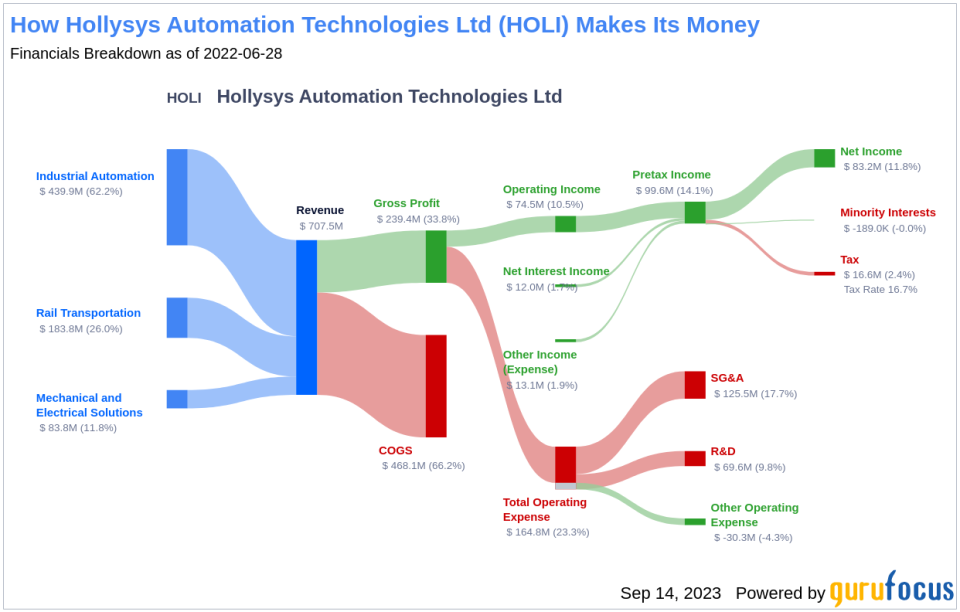

Hollysys Automation Technologies Ltd is a China-based company specializing in automation and control technologies and products. The company operates through three segments: IA, Rail, and M&E, providing a diverse range of solutions. With most of its sales generated from the domestic Chinese market, Hollysys Automation Technologies has established a significant presence in the industry. Comparing the stock price with the GF Value, an estimation of fair value, provides a deeper insight into the company's valuation.

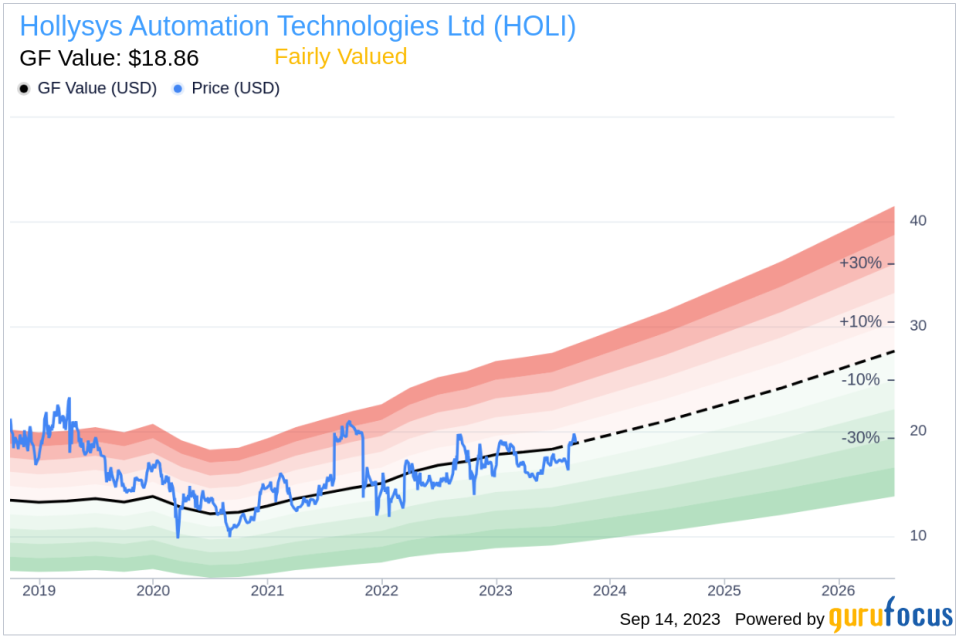

Understanding the GF Value

The GF Value is a unique measure that represents the intrinsic value of a stock. It is calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line on the summary page provides an overview of the stock's fair value. If the stock price is significantly above the GF Value Line, it is overvalued, indicating poor future returns. Conversely, if it is significantly below the GF Value Line, it is undervalued, suggesting high future returns.

According to GuruFocus, the stock of Hollysys Automation Technologies appears to be fairly valued. The current price of $18.93 per share gives Hollysys Automation Technologies a market cap of $1.20 billion. Thus, the long-term return of its stock is likely to be close to the rate of its business growth.

Link: These companies may deliver higher future returns at reduced risk.

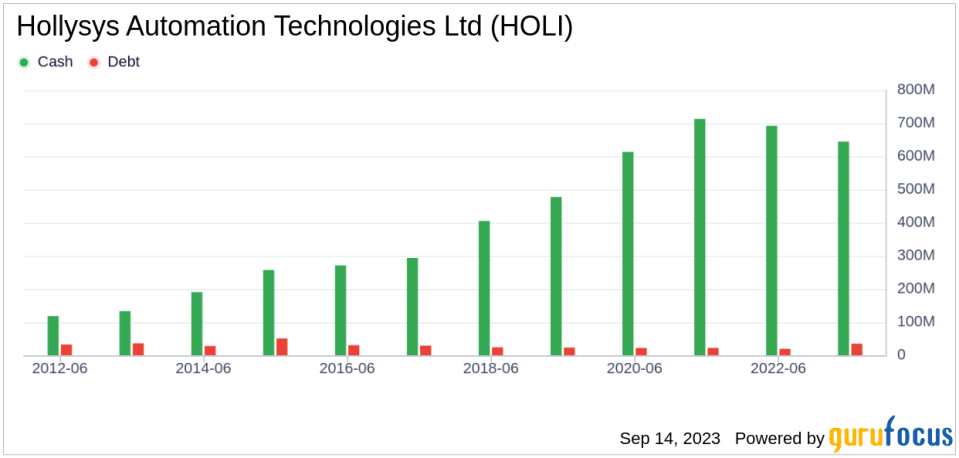

Assessing Financial Strength

Companies with poor financial strength pose a high risk of permanent capital loss to investors. To avoid this, it's crucial to research and review a company's financial strength before purchasing shares. Hollysys Automation Technologies boasts a cash-to-debt ratio of 18.43, ranking better than 79.89% of 2839 companies in the Industrial Products industry. The overall financial strength of Hollysys Automation Technologies is 9 out of 10, indicating strong financial health.

Profitability and Growth

Investing in profitable companies carries less risk, especially those that have demonstrated consistent profitability over the long term. Hollysys Automation Technologies has been profitable for 10 years over the past 10 years. During the past 12 months, the company had revenues of $777.40 million and Earnings Per Share (EPS) of $1.73. Its operating margin of 11.96% is better than 74.35% of 2858 companies in the Industrial Products industry. Overall, GuruFocus ranks Hollysys Automation Technologies's profitability as strong.

Growth is a crucial factor in the valuation of a company. A faster-growing company creates more value for shareholders, especially if the growth is profitable. The 3-year average annual revenue growth of Hollysys Automation Technologies is 14.7%, which ranks better than 72.02% of 2734 companies in the Industrial Products industry. However, the 3-year average EBITDA growth rate is 5.8%, ranking worse than 56.95% of 2423 companies in the Industrial Products industry.

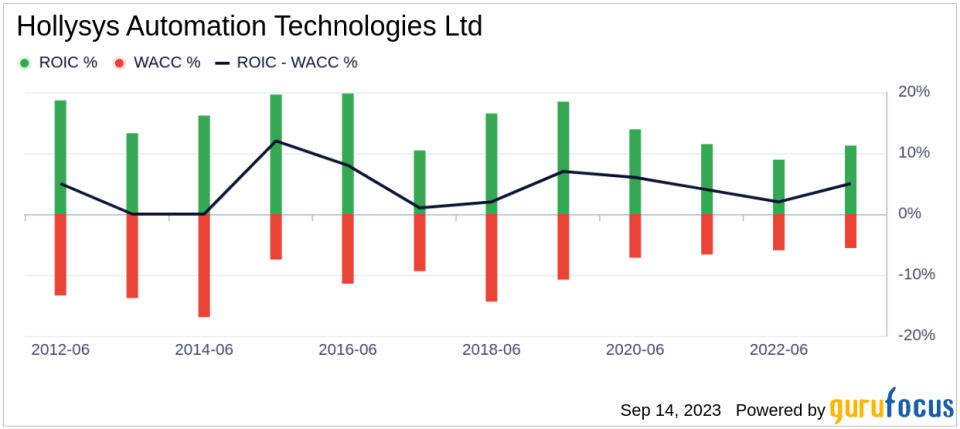

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted cost of capital (WACC) is another way to evaluate its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. The WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. If the ROIC is higher than the WACC, it indicates that the company is creating value for shareholders. Over the past 12 months, Hollysys Automation Technologies's ROIC was 11.04, while its WACC came in at 6.78.

Conclusion

In summary, the stock of Hollysys Automation Technologies appears to be fairly valued. The company's financial condition is strong, and its profitability is strong. Its growth ranks worse than 56.95% of 2423 companies in the Industrial Products industry. To learn more about Hollysys Automation Technologies stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.