Unveiling Iamgold (IAG)'s True Worth: A Comprehensive Guide to Its Market Value

Iamgold Corp (NYSE:IAG) experienced a daily loss of -3.05%, with a 3-month loss of -14.15%. Despite these figures, the company posted Earnings Per Share (EPS) of 0.03. This leads us to the question: Is Iamgold (NYSE:IAG) fairly valued? In this analysis, we will delve into Iamgold's valuation, financial strength, profitability, and growth to answer this question. We invite you to read on for a comprehensive understanding of the company's market value.

Company Overview

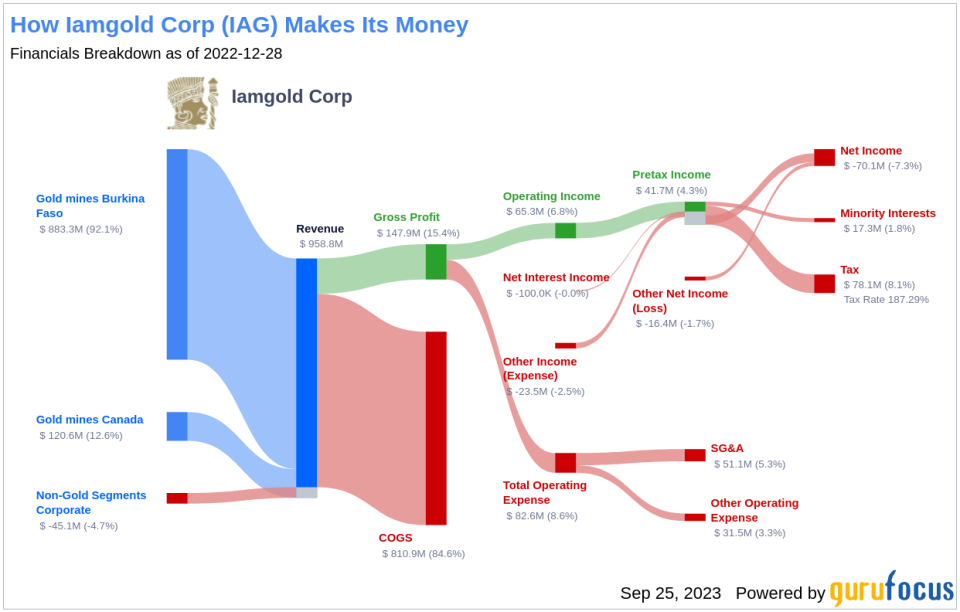

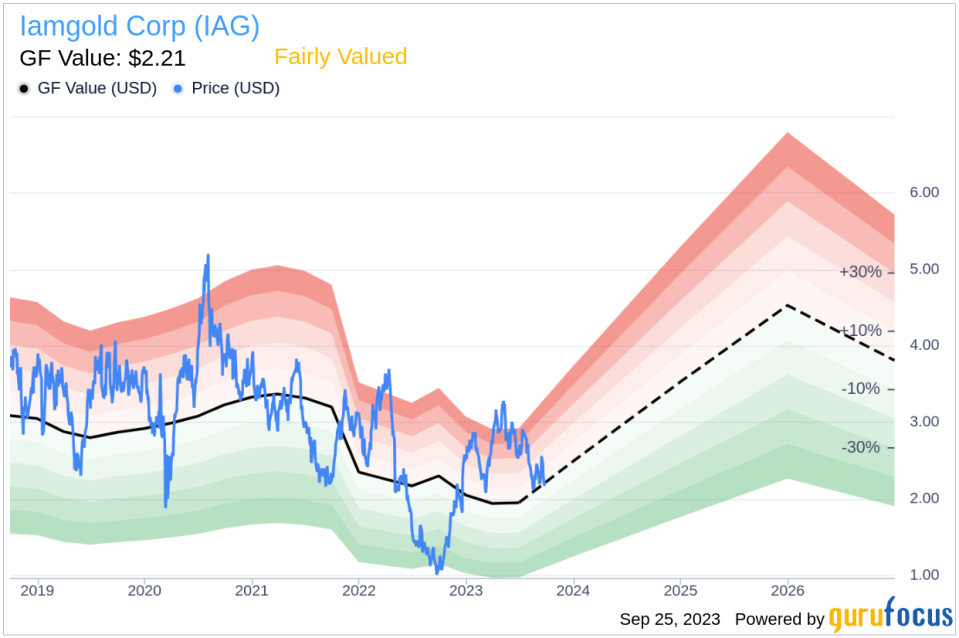

Iamgold Corp is a mid-tier gold mining company with operations in North America, South America, and West Africa. The company is developing potential mining districts that encompass operating mines and construction, development, and exploration projects. Its operating mines include Essakane in Burkina Faso, Rosebel in Suriname, and Westwood in Canada. Iamgold's strategic assets are complemented by the Cote Gold construction project in Canada, the Boto Gold development project in Senegal, as well as greenfield and brownfield exploration projects in various countries. With a current share price of $2.19, Iamgold's market cap stands at $1.10 billion, closely aligning with its GF Value of $2.21, indicating that the stock is fairly valued.

Understanding GF Value

The GF Value is a proprietary measure that reflects the intrinsic value of a stock. It is derived from historical trading multiples, an adjustment factor based on the company's past performance and growth, and future business performance estimates. The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at.

Our analysis shows that Iamgold (NYSE:IAG) is fairly valued. The GF Value estimates the stock's fair value based on three key factors: historical multiples, an internal adjustment based on the company's past business growth, and analyst estimates of future business performance. If the stock's share price is significantly above the GF Value Line, the stock may be overvalued and have poor future returns. Conversely, if the stock's share price is significantly below the GF Value Line, the stock may be undervalued and have high future returns. As such, because Iamgold is fairly valued, the long-term return of its stock is likely to be close to the rate of its business growth.

Link: These companies may deliever higher future returns at reduced risk.This article first appeared on GuruFocus.