Unveiling Incyte (INCY)'s Value: Is It Really Priced Right? A Comprehensive Guide

Incyte Corp (NASDAQ:INCY) experienced a daily gain of 0.89% and a 3-month loss of -6.29%. The company's Earnings Per Share (EPS) stand at 1.63. But, is the stock significantly undervalued? This article delves into the valuation analysis of Incyte (NASDAQ:INCY) to answer this critical question. Read on to gain a comprehensive understanding of its market value.

A Snapshot of Incyte Corp (NASDAQ:INCY)

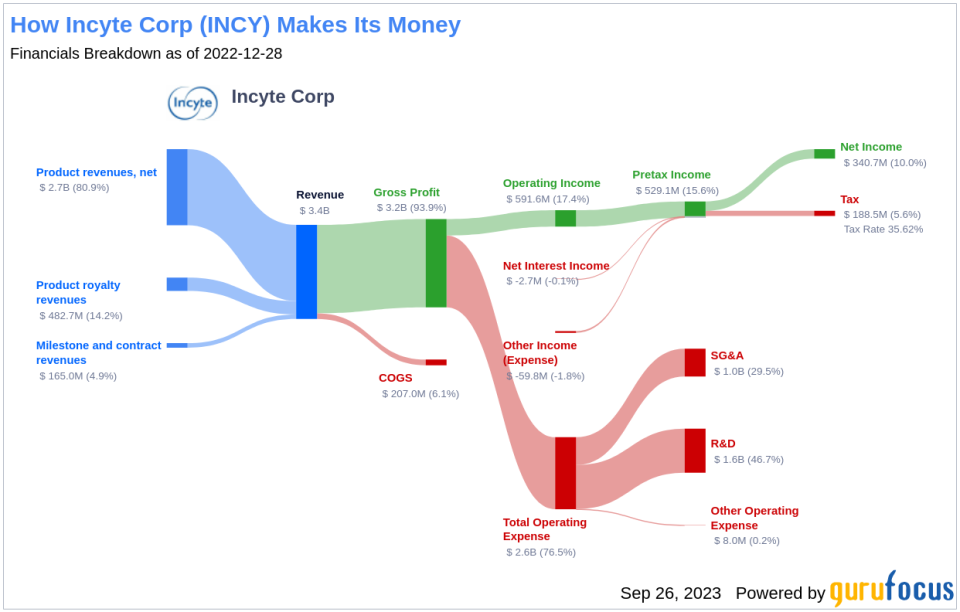

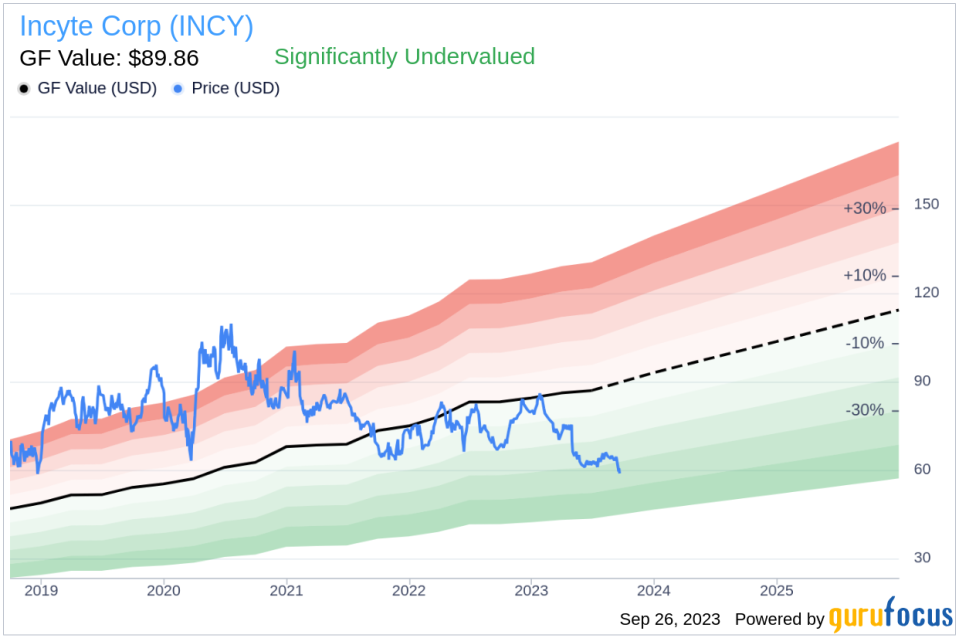

Focusing on the discovery and development of small-molecule drugs, Incyte has a rich portfolio of marketed drugs. Its lead drug, Jakafi, treats two types of rare blood cancer and graft versus host disease. Other marketed drugs include rheumatoid arthritis treatment Olumiant, oncology drugs Iclusig, Pemazyre, Tabrecta, and Monjuvi. The firm's first dermatology product, Opzelura, was approved in 2021 for atopic dermatitis and 2022 for vitiligo. With its stock priced at $59.28 and a fair value (GF Value) of $89.86, Incyte appears to be significantly undervalued.

Understanding the GF Value

The GF Value is a proprietary measure that provides an estimation of a stock's intrinsic value. It is derived from historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. With a market cap of $13.30 billion, Incyte (NASDAQ:INCY) appears to be significantly undervalued according to the GF Value. Consequently, the long-term return of its stock is likely to be much higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Evaluating Incyte's Financial Strength

Investing in companies with poor financial strength carries a higher risk of permanent capital loss. Therefore, a careful review of a company's financial strength is crucial before deciding to invest. Incyte's cash-to-debt ratio is 86.14, which is better than 75.11% of 1531 companies in the Biotechnology industry. This indicates that Incyte's financial strength is strong.

Profitability and Growth of Incyte

Investing in profitable companies, especially those with consistent profitability over the long term, is less risky. Incyte has been profitable 6 times over the past 10 years. Its operating margin is 12.64%, which ranks better than 84.45% of 1055 companies in the Biotechnology industry. However, its 3-year average EBITDA growth is 2.4%, which ranks worse than 53.17% of 1262 companies in the Biotechnology industry.

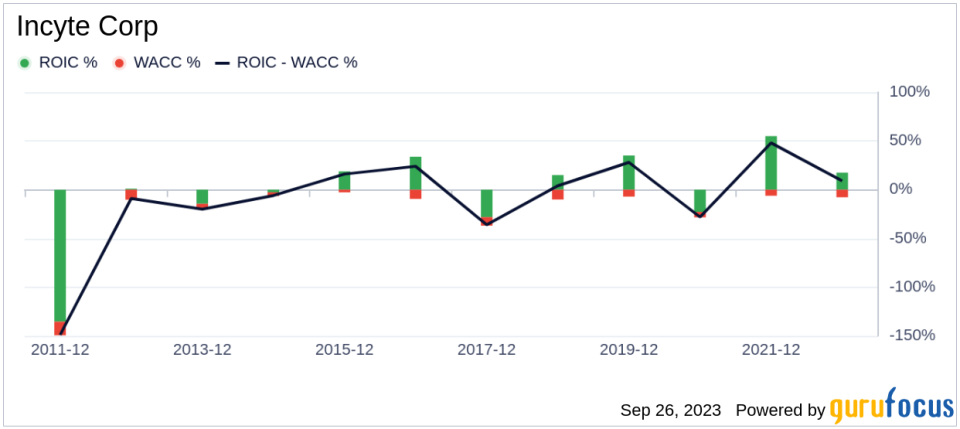

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can also evaluate its profitability. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. Over the past 12 months, Incyte's ROIC was 13.18, while its WACC was 7.88.

Conclusion

In conclusion, Incyte (NASDAQ:INCY) stock appears to be significantly undervalued. The company's strong financial condition and fair profitability make it an attractive investment. However, its growth ranks worse than 53.17% of 1262 companies in the Biotechnology industry. To learn more about Incyte stock, you can check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.