Unveiling International Game Technology PLC (IGT)'s Value: Is It Really Priced Right? A ...

International Game Technology PLC (NYSE:IGT) recently experienced a daily gain of 9.83%, and a three-month gain of 7.01%. The company's Earnings Per Share (EPS) (EPS) stands at 1.33. However, despite these positive figures, the question remains: Is the stock modestly overvalued? This article aims to provide a balanced and comprehensive valuation analysis of International Game Technology PLC (NYSE:IGT) to answer this question. Read on to gain valuable insights into the company's financial health and future prospects.

Company Introduction

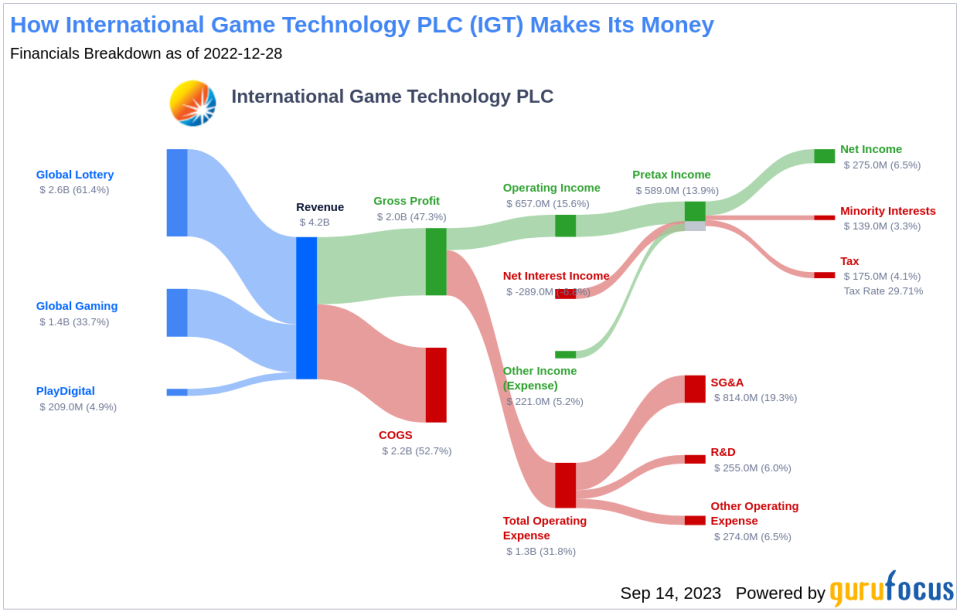

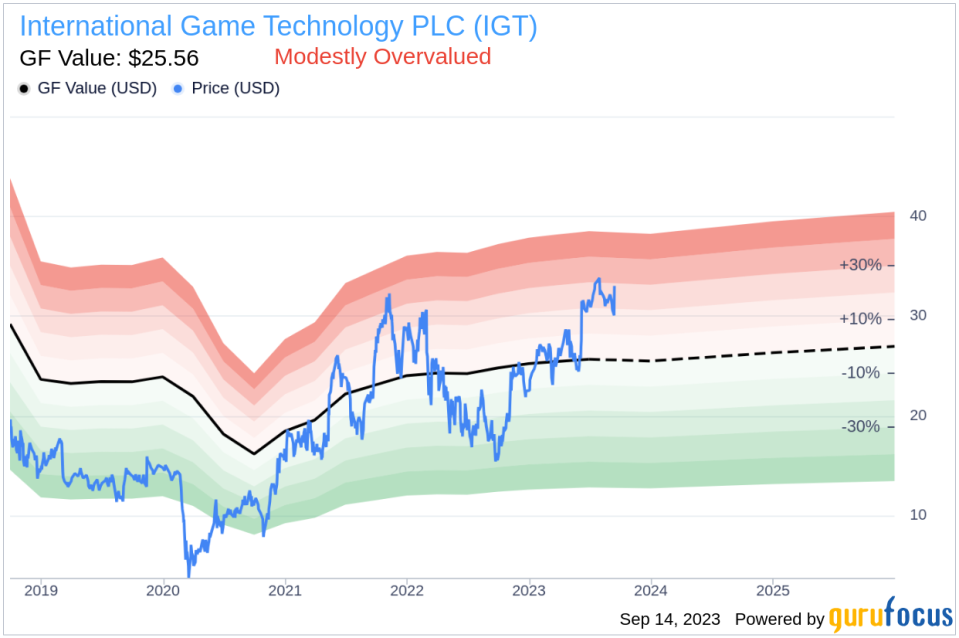

International Game Technology PLC (NYSE:IGT) is a leading gaming company that offers entertaining and responsible gaming experiences across all channels. The company's operations span across Global Lottery, Global Gaming, and Digital & Betting segments, with a significant portion of its revenue derived from the United States. As of September 14, 2023, the company's stock price stands at $33.02, with a market cap of $6.60 billion. However, according to our GF Value, the estimated fair value of the stock is $25.56, indicating that the stock might be modestly overvalued.

Understanding GF Value

The GF Value is a unique measure that estimates the intrinsic value of a stock, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The calculation suggests that the fair trading value of International Game Technology PLC (NYSE:IGT) stock might be lower than its current price, indicating a modest overvaluation.

Our analysis shows that the stock is likely to deliver lower long-term returns due to its overvaluation, despite the company's business growth.

Link: These companies may deliever higher future returns at reduced risk.

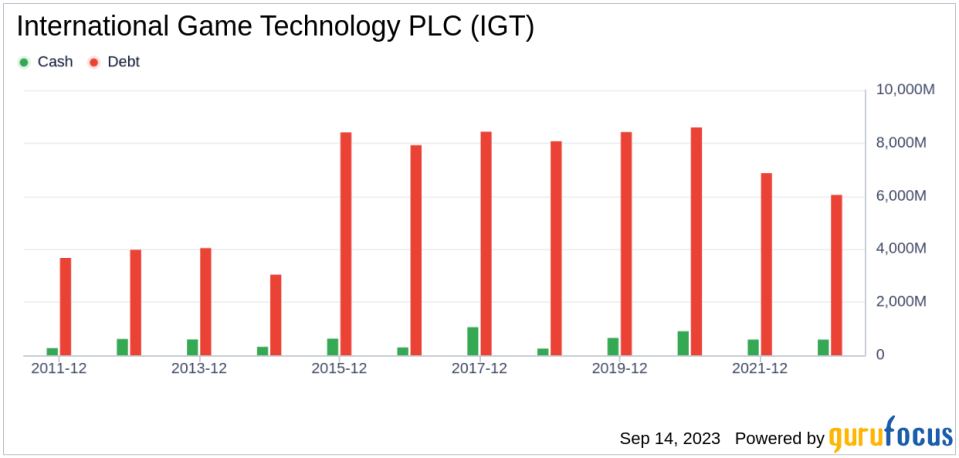

Financial Strength

International Game Technology PLC's financial strength is a critical factor to consider for investors to avoid permanent capital loss. The company's cash-to-debt ratio is 0.08, which ranks lower than 82.79% of 825 companies in the Travel & Leisure industry, indicating poor financial strength.

Profitability and Growth

International Game Technology PLC's profitability and growth are also essential factors to consider. The company has been profitable for 5 out of the past 10 years, with a revenue of $4.30 billion and an EPS of $1.33 in the past 12 months. Its operating margin of 16.09% is better than 73.66% of companies in the Travel & Leisure industry. However, the company's 3-year average revenue growth rate is better than only 58.93% of companies in the industry, and its 3-year average EBITDA growth rate is 4.9%, ranking better than 51.15% of companies in the industry.

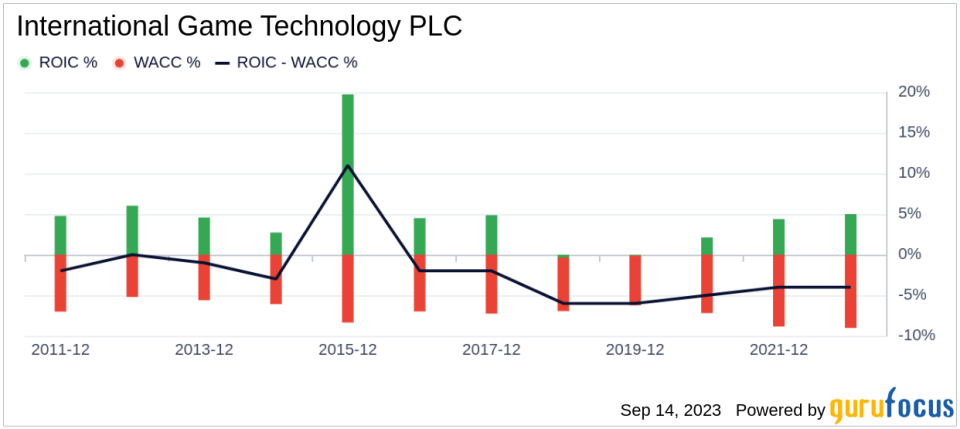

ROIC vs WACC

Comparing the company's Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC) also provides valuable insights into its profitability. For the past 12 months, International Game Technology PLC's ROIC is 4.37, while its WACC is 8.98, indicating a potential risk for investors.

Conclusion

Based on our comprehensive analysis, International Game Technology PLC (NYSE:IGT) appears to be modestly overvalued. The company's financial condition is poor, and its profitability is fair. However, its growth ranks better than 51.15% of companies in the Travel & Leisure industry. To learn more about International Game Technology PLC's financials, check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.