Unveiling the Investment Potential of Nova Ltd (NVMI): A Comprehensive Analysis of Financial ...

Nova Ltd (NASDAQ:NVMI) has recently been in the spotlight, drawing interest from investors and financial analysts due to its robust financial stance. With shares currently priced at 116.6, Nova Ltd has witnessed a decline of 2.22% over a period, marked against a three-month change of 0.48%. A thorough analysis, underlined by the GuruFocus Score Rating, suggests that Nova Ltd is well-positioned for substantial growth in the near future.

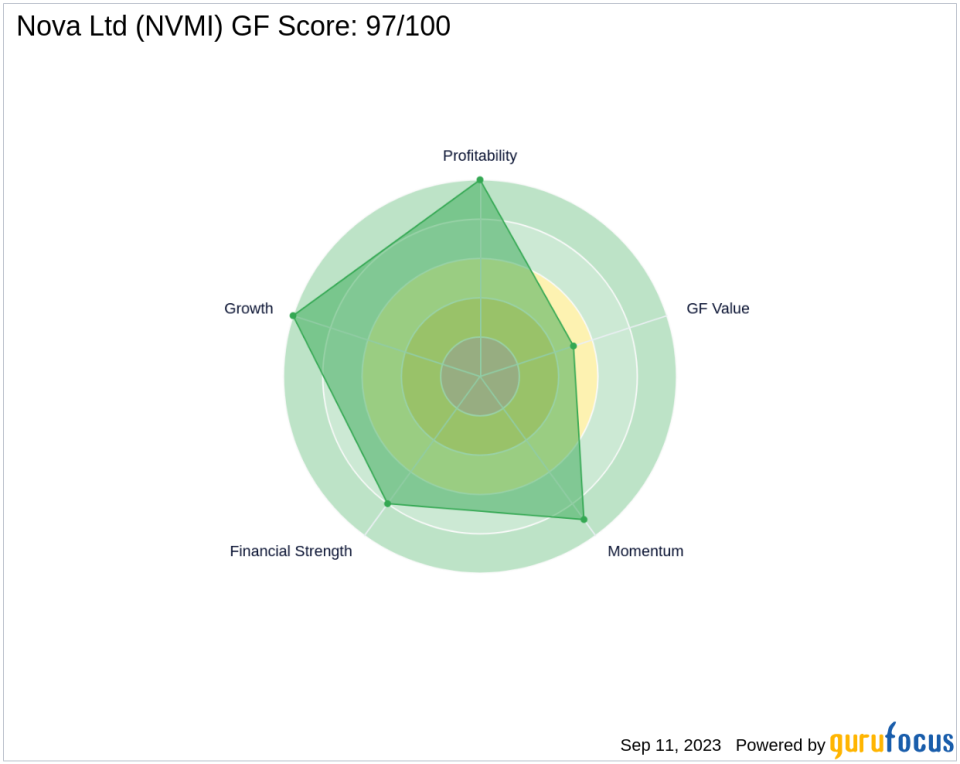

Decoding the GF Score

The GF Score is a stock performance ranking system developed by GuruFocus using five aspects of valuation, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021. The stocks with a higher GF Score generally generate higher returns than those with a lower GF Score. Therefore, when picking stocks, investors should invest in companies with high GF Scores. The GF Score ranges from 0 to 100, with 100 as the highest rank.

1. Financial strength rank: 8/10

2. Profitability rank: 10/10

3. Growth rank: 10/10

4. GF Value rank: 5/10

5. Momentum rank: 9/10

Each one of these components is ranked and the ranks also have positive correlation with the long term performances of stocks. The GF score is calculated using the five key aspects of analysis. Through backtesting, we know that each of these key aspects has a different impact on the stock price performance. Thus, they are weighted differently when calculating the total score. With high ranks in financial strength, profitability, and growth, and decent ranks in GF value and momentum, GuruFocus assigned Nova Ltd the GF Score of 97 out of 100, which signals the highest outperformance potential.

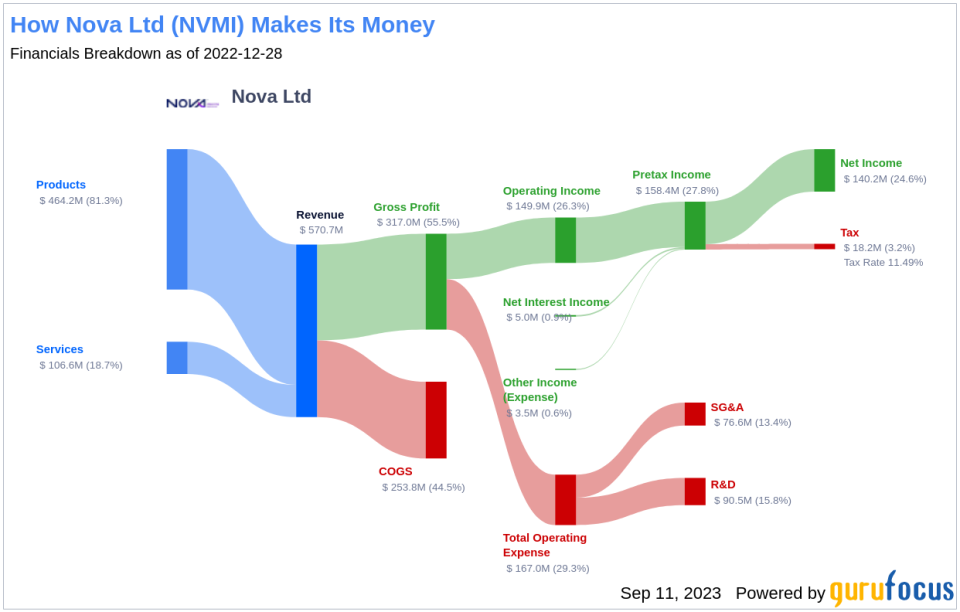

Understanding Nova Ltd's Business

Nova Ltd is a leading semiconductor equipment manufacturer with a market cap of $3.35 billion. The company provides metrology solutions for process control used in semiconductor manufacturing, offering in-line optical and x-ray stand-alone metrology systems, as well as integrated optical metrology systems. The product range consists of Nova 2040, Nova 3090Next, Nova i500 and i500 Plus, Nova T500, Nova T600, Nova V2600, HelioSense 100, Nova Hybrid Metrology solution, NovaMars. The company generates the majority of its revenue from Taiwan, R.O.C. Geographically the company has its business spread across the region of Taiwan, Korea, China, the United States, and Europe. With sales of $550.04 million and an operating margin of 25.51%, Nova Ltd has demonstrated strong financial performance.

Financial Strength Breakdown

According to the Financial Strength rating, Nova Ltd's robust balance sheet exhibits resilience against financial volatility, reflecting prudent management of capital structure. The Interest Coverage ratio for Nova Ltd stands impressively at 106.95, underscoring its strong capability to cover its interest obligations. This robust financial position resonates with the wisdom of legendary investor Benjamin Graham, who favored companies with an interest coverage ratio of at least 5. With an Altman Z-Score of 6.88, Nova Ltd exhibits a strong defense against financial distress, highlighting its robust financial stability. With a favorable Debt-to-Revenue ratio of 0.44, Nova Ltd's strategic handling of debt solidifies its financial health.

Profitability Rank Breakdown

The Profitability Rank shows Nova Ltd's impressive standing among its peers in generating profit. Nova Ltd Operating Margin has increased (9.15%) over the past five years, as shown by the following data: 2018: 24.07; 2019: 16.19; 2020: 20.63; 2021: 27.01; 2022: 26.27. Nova Ltd's strong Predictability Rank of 5.0 stars out of five underscores its consistent operational performance, providing investors with increased confidence.

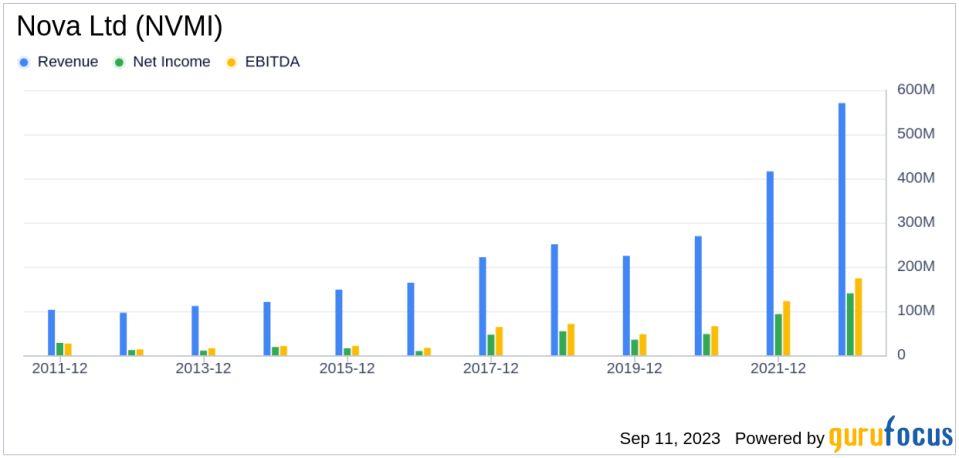

Growth Rank Breakdown

Ranked highly in Growth, Nova Ltd demonstrates a strong commitment to expanding its business. The company's 3-Year Revenue Growth Rate is 31.5%, which outperforms better than 86.21% of 863 companies in the Semiconductors industry. Moreover, Nova Ltd has seen a robust increase in its earnings before interest, taxes, depreciation, and amortization (EBITDA) over the past few years. Specifically, the three-year growth rate stands at 48.7, and the rate over the past five years is 19.7. This trend accentuates the company's continued capability to drive growth.

Conclusion

With its strong financial strength, profitability, and growth metrics, the GuruFocus Score Rating highlights Nova Ltd's unparalleled position for potential outperformance. The company's robust financial health, consistent profitability, and impressive growth trajectory make it a compelling investment opportunity. GuruFocus Premium members can find more companies with strong GF Scores using the following screener link: GF Score Screen

This article first appeared on GuruFocus.