Unveiling Ironwood Pharmaceuticals (IRWD)'s Value: Is It Really Priced Right? A Comprehensive Guide

Ironwood Pharmaceuticals Inc (NASDAQ:IRWD) recorded a daily gain of 2.76%, although it has experienced a 3-month loss of -9.16%. Despite this, the company reported a Loss Per Share of 6.04. Based on these metrics, one could argue that the stock is modestly undervalued. This article aims to provide a detailed analysis of Ironwood Pharmaceuticals' valuation, encouraging readers to delve into the subsequent sections for a comprehensive understanding.

Company Introduction

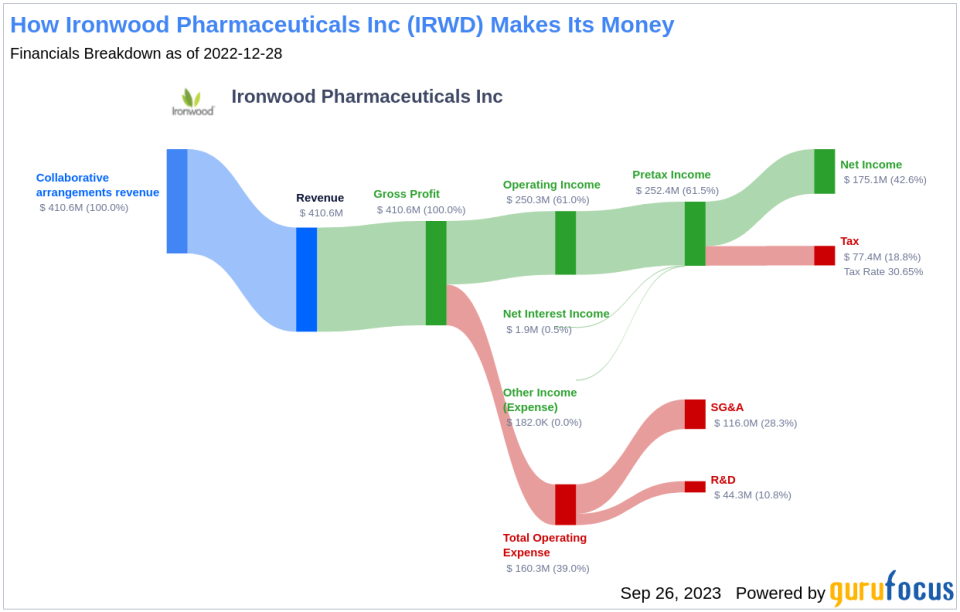

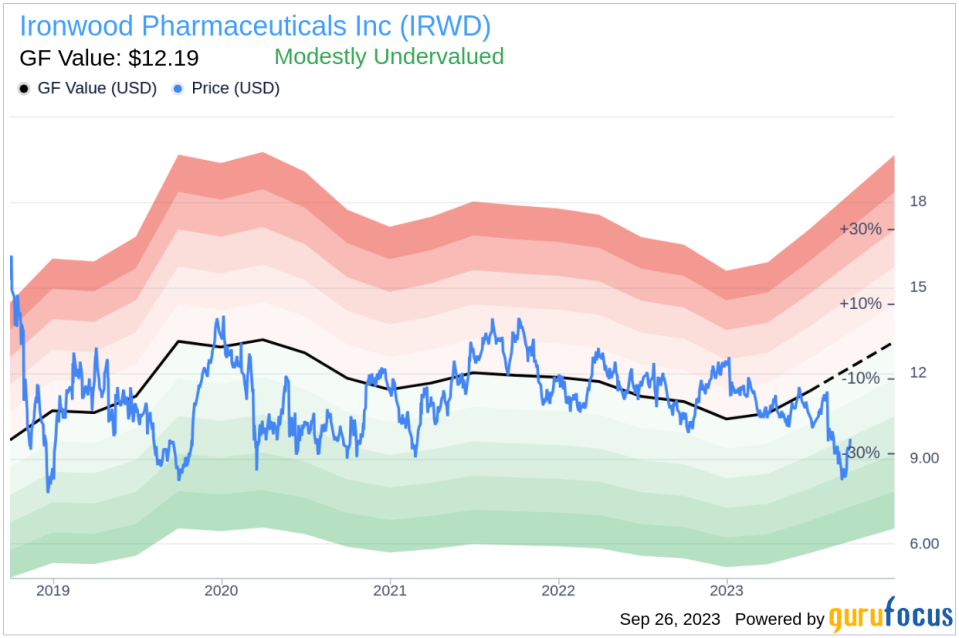

Ironwood Pharmaceuticals Inc (NASDAQ:IRWD) is a specialty and generic drug manufacturing firm that focuses on advancing innovative product opportunities in areas of large unmet need. These areas include irritable bowel syndrome with constipation, chronic idiopathic constipation, hyperuricemia associated with uncontrolled gout, uncontrolled gastroesophageal reflux disease, and vascular and fibrotic diseases. With a market cap of $1.50 billion and a current stock price of $9.69 per share, the company's GF Value stands at $12.19, indicating that the stock might be modestly undervalued.

Summarizing GF Value

The GF Value is a proprietary measure that represents the intrinsic value of a stock. It is calculated based on historical multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. When the stock price is significantly above the GF Value Line, it may be overvalued, indicating poor future returns. Conversely, if the stock price is significantly below the GF Value Line, the stock may be undervalued, suggesting higher future returns. Based on our valuation method, Ironwood Pharmaceuticals appears to be modestly undervalued.

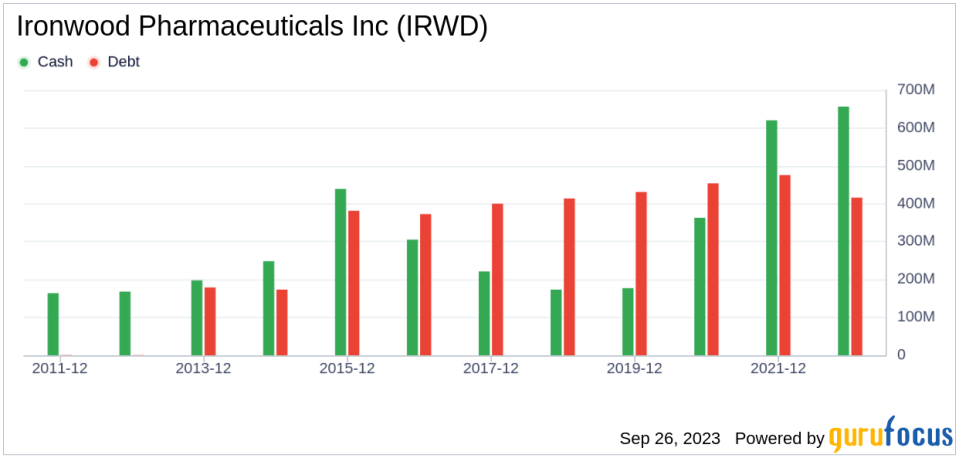

Financial Strength

Investing in companies with poor financial strength can lead to a higher risk of permanent loss of capital. Therefore, it is crucial to thoroughly review a company's financial strength before purchasing its stock. Ironwood Pharmaceuticals has a cash-to-debt ratio of 0.22, which is worse than 74.67% of the companies in the Drug Manufacturers industry. The overall financial strength of Ironwood Pharmaceuticals is ranked 2 out of 10, indicating that the company's financial strength is poor.

Profitability and Growth

Companies that have been consistently profitable over the long term offer less risk for investors. Ironwood Pharmaceuticals has been profitable 4 times over the past 10 years. However, its profitability is ranked 3 out of 10, indicating poor profitability. On the growth front, Ironwood Pharmaceuticals's growth ranks better than 75.99% of the companies in the Drug Manufacturers industry.

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to the weighted average cost of capital (WACC) is another method of determining its profitability. For the past 12 months, Ironwood Pharmaceuticals's ROIC is -206.07, and its WACC is 6.57.

Conclusion

In conclusion, the stock of Ironwood Pharmaceuticals (NASDAQ:IRWD) appears to be modestly undervalued. The company's financial condition is poor, and its profitability is poor. Its growth, however, ranks better than 75.99% of the companies in the Drug Manufacturers industry. To learn more about Ironwood Pharmaceuticals, you can check out its 30-Year Financials here.

To find out high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.