Unveiling Kimberly-Clark (KMB)'s Value: Is It Really Priced Right? A Comprehensive Guide

Kimberly-Clark Corp (NYSE:KMB) has been the talk of the town, with its stock experiencing a daily gain of 1.11%. Despite a 3-month loss of 11.58%, the company's Earnings Per Share (EPS) (EPS) stands at 4.85. This raises an intriguing question: is Kimberly-Clark Corp modestly undervalued? Through this article, we aim to provide a comprehensive valuation analysis of Kimberly-Clark Corp. So, let's delve into the details.

A Snapshot of Kimberly-Clark Corp (NYSE:KMB)

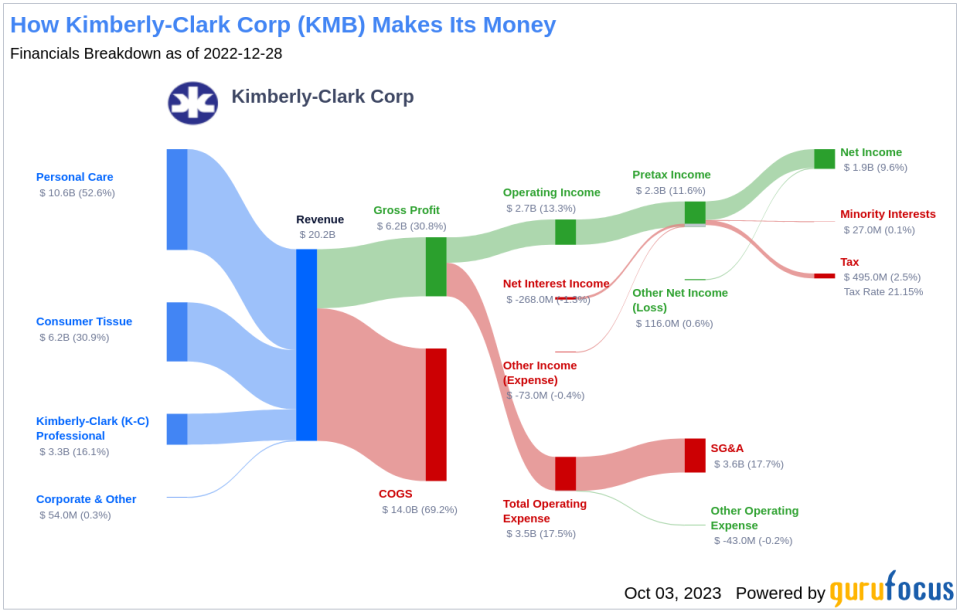

As a leading manufacturer in the tissue and hygiene realm, Kimberly-Clark (NYSE:KMB) boasts more than half of its sales from personal care and another third from tissue products. Its prominent brand mix includes Huggies, Pull-Ups, Kotex, Depend, Kleenex, and Cottonelle. The firm also operates K-C Professional, partnering with businesses to provide safety and sanitary products for the workplace. The company generates just over half its sales in North America and more than 10% in Europe, with the rest primarily concentrated in Asia and Latin America.

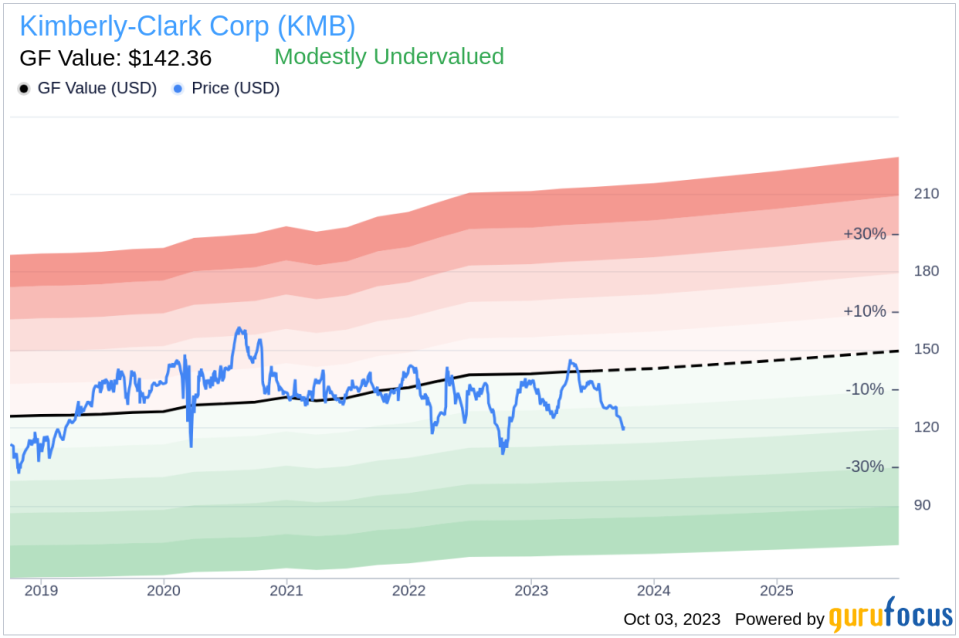

Understanding the GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line represents the fair value at which the stock should ideally be traded. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Kimberly-Clark's current price of $120.33 per share and a market cap of $40.70 billion indicate that the stock is modestly undervalued. This suggests that the long-term return of its stock is likely to be higher than its business growth.

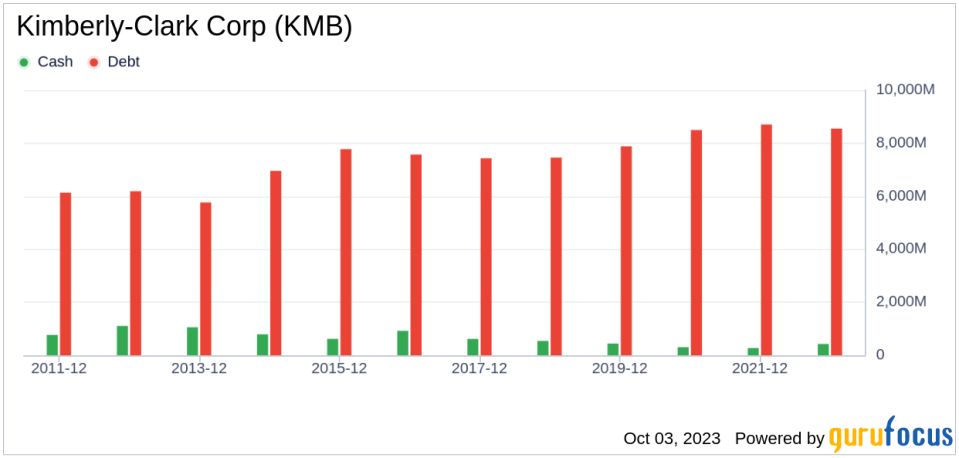

Kimberly-Clark's Financial Strength

Checking the financial strength of a company before buying its stock is crucial to avoid the risk of permanent loss. The cash-to-debt ratio and interest coverage are excellent indicators of a company's financial strength. Kimberly-Clark's cash-to-debt ratio of 0.07 is lower than 82.79% of the companies in the Consumer Packaged Goods industry, indicating fair financial strength.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, is less risky. Kimberly-Clark, with its high profitability and operating margin of 14.38%, is a safer investment than those with low profit margins. However, the average annual revenue growth of Kimberly-Clark is 3.8%, which ranks worse than 59.94% of the companies in the Consumer Packaged Goods industry. The 3-year average EBITDA growth is -3.4%, which ranks worse than 65.83% of the companies in the same industry.

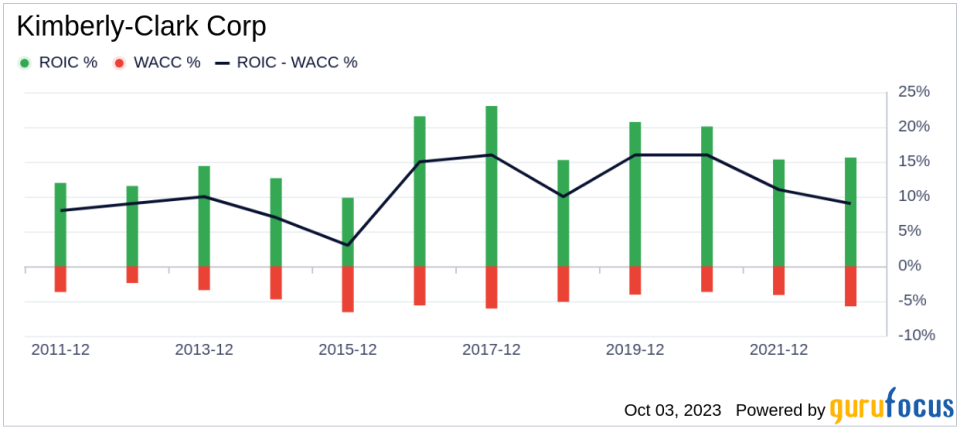

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted cost of capital (WACC) is another way to evaluate its profitability. If the ROIC is higher than the WACC, it indicates that the company is creating value for shareholders. Over the past 12 months, Kimberly-Clark's ROIC was 17.63, while its WACC came in at 5.93.

Conclusion

In summary, the stock of Kimberly-Clark shows every sign of being modestly undervalued. The company's financial condition and profitability are fair, but its growth ranks worse than 65.83% of the companies in the Consumer Packaged Goods industry. For more details about Kimberly-Clark stock, check out its 30-Year Financials here.

To find out high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.