Unveiling Kosmos Energy (KOS)'s Value: Is It Really Priced Right? A Comprehensive Guide

Kosmos Energy Ltd (NYSE:KOS) has been making waves in the stock market with a daily gain of 3.22% and a 3-month gain of 39.58%. Its Earnings Per Share (EPS) stands at 0.44. However, the critical question is: Is the stock significantly overvalued? This article aims to provide an in-depth analysis of Kosmos Energy's valuation, encouraging readers to explore the financial intricacies of this intriguing company.

Company Introduction

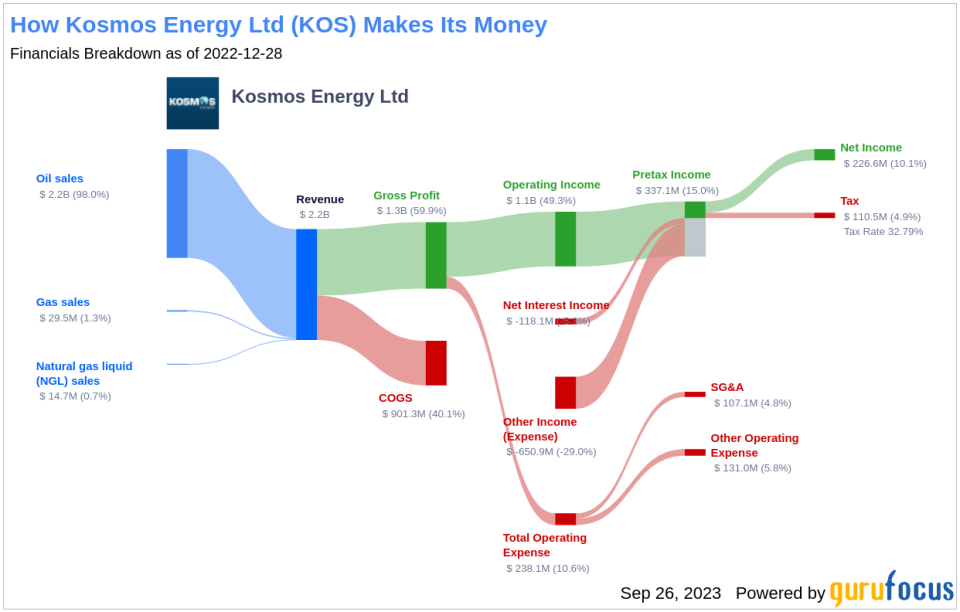

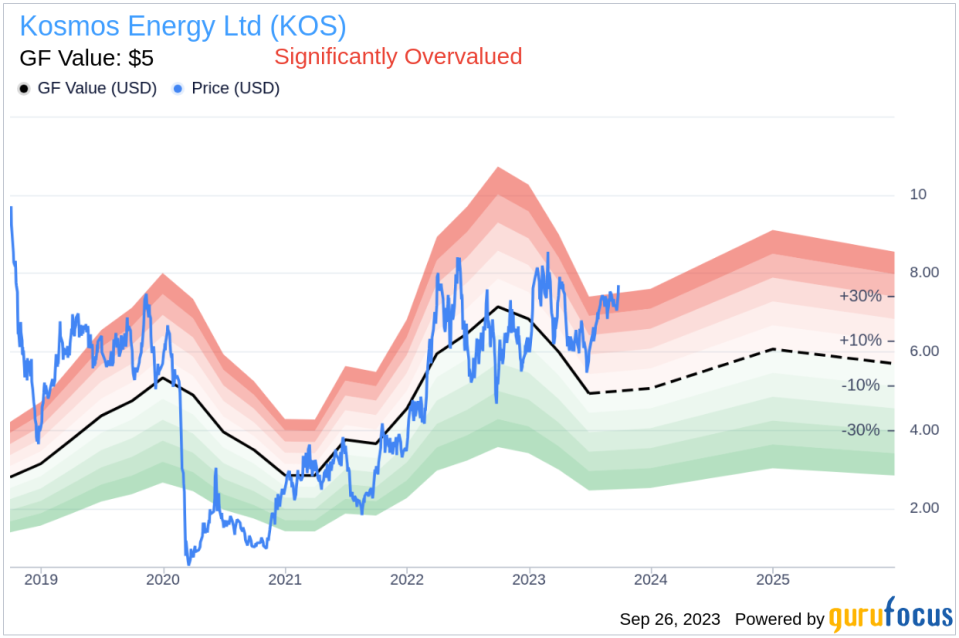

Kosmos Energy Ltd is an independent oil and gas exploration and production company that focuses on frontier and emerging areas along the Atlantic Margin. The company's exploration process is rooted in geologically based approaches, including basin modeling and 3D seismic analysis. Despite its current stock price of $7.7, the GF Value, an estimation of fair value, stands at $5. This discrepancy begs the question of whether Kosmos Energy (NYSE:KOS) is overvalued. The following analysis aims to answer this question by dissecting the company's financial health and performance.

Understanding GF Value

The GF Value is a proprietary measure that estimates a stock's intrinsic value. This measure considers historical trading multiples, a unique GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. The GF Value Line on our summary page provides an overview of the stock's ideal fair trading value. If the stock price is significantly above the GF Value Line, it is considered overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

According to GuruFocus' valuation method, Kosmos Energy's stock appears to be significantly overvalued. This overvaluation might result in a lower long-term return on its stock compared to its future business growth.

Link: These companies may deliver higher future returns at reduced risk.

Assessing Financial Strength

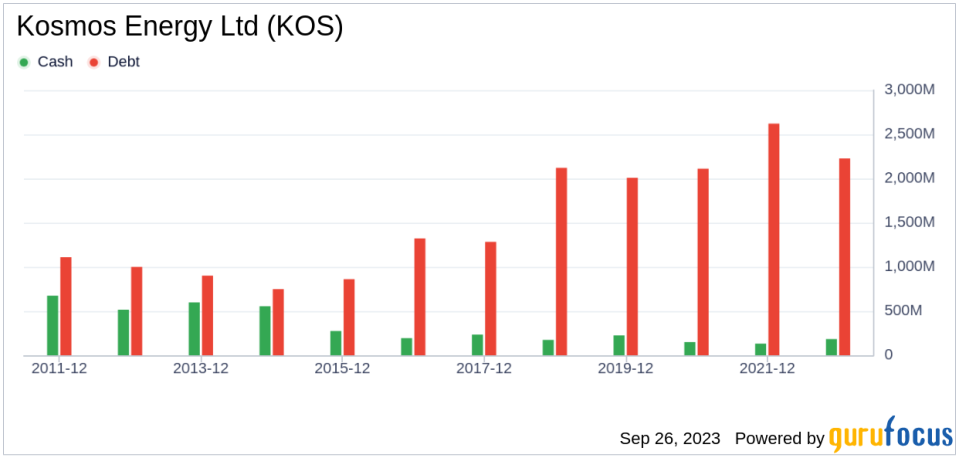

Companies with poor financial strength pose a high risk of permanent capital loss to investors. Avoiding such losses requires comprehensive research and review of a company's financial strength, such as its cash-to-debt ratio and interest coverage. Kosmos Energy's cash-to-debt ratio of 0.04 ranks worse than 87.81% of 1034 companies in the Oil & Gas industry, indicating poor financial strength.

Evaluating Profitability and Growth

Investing in profitable companies, particularly those with consistent profitability over the long term, is less risky. Kosmos Energy has been profitable 2 over the past 10 years, and its operating margin of 44.47% ranks better than 86.48% of 984 companies in the Oil & Gas industry. However, its 3-year average annual revenue growth rate of 8.2% ranks worse than 54.87% of 862 companies in the Oil & Gas industry, indicating a need for improvement in growth.

Comparing ROIC and WACC

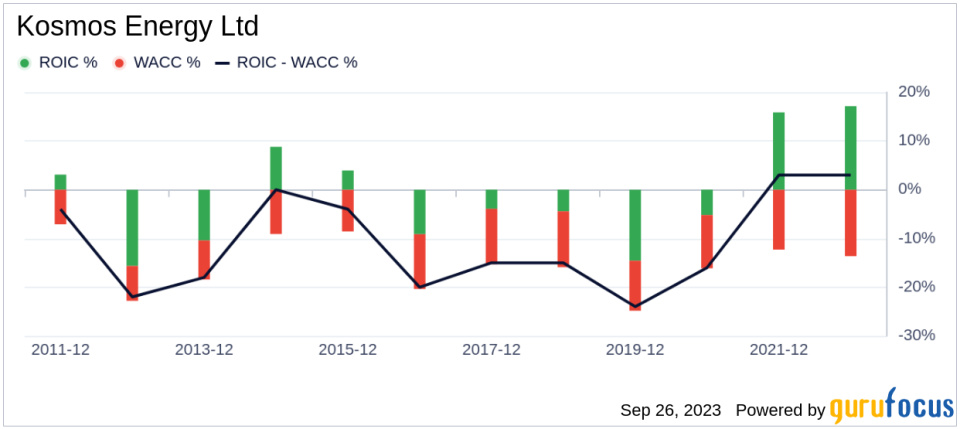

Comparing a company's return on invested capital (ROIC) to its weighted cost of capital (WACC) offers another perspective on its profitability. If the ROIC is higher than the WACC, it indicates that the company is creating value for shareholders. Over the past 12 months, Kosmos Energy's ROIC was 11.05, while its WACC came in at 11.47.

Conclusion

In summary, the stock of Kosmos Energy (NYSE:KOS) appears to be significantly overvalued. The company's financial condition is poor, its profitability is fair, and its growth ranks worse than 64.05% of 829 companies in the Oil & Gas industry. For more information about Kosmos Energy stock, check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.