Unveiling Lattice Semiconductor (LSCC)'s Value: Is It Really Priced Right? A Comprehensive Guide

Despite a daily loss of 4.49% and a 3-month loss of 1.91%, Lattice Semiconductor Corp (NASDAQ:LSCC) has reported an Earnings Per Share (EPS) of 1.46. The question that arises is whether the stock is fairly valued. This article provides an in-depth analysis of Lattice Semiconductor's valuation, encouraging readers to delve into the financial health and business performance of the company.

Introduction to Lattice Semiconductor Corp

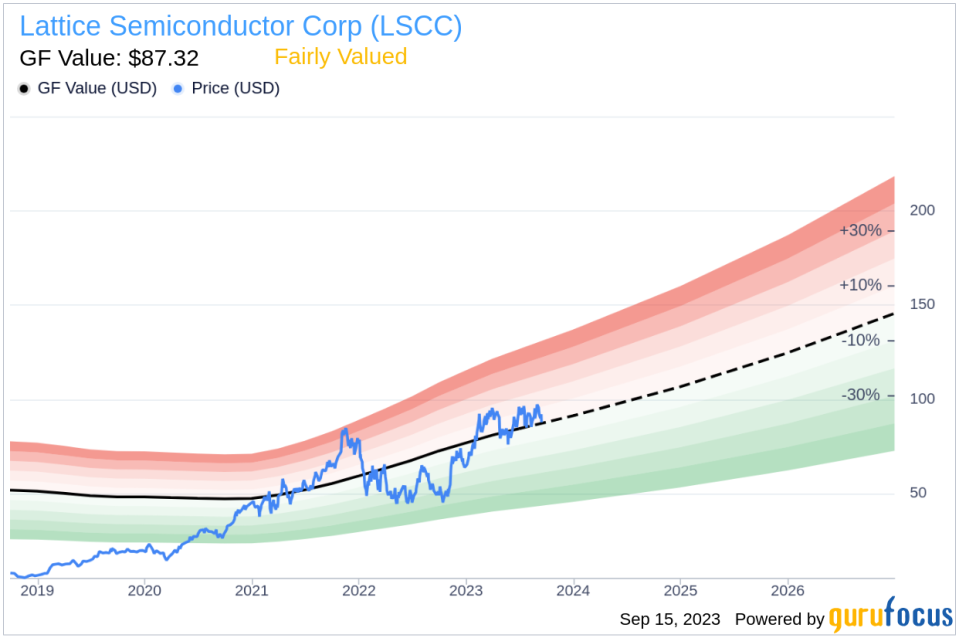

Lattice Semiconductor Corp is a renowned developer of semiconductor technology, offering its innovative products and solutions globally. Despite the majority of sales being derived from customers in Asia, Lattice Semiconductor's influence spans across consumer, communications, and industrial markets. With a current stock price of $88 and a fair value (GF Value) of $87.32, Lattice Semiconductor's valuation calls for a closer examination.

Understanding the GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides an insight into the stock's ideal trading value. If the stock price significantly deviates from the GF Value Line, it indicates potential overvaluation or undervaluation.

For Lattice Semiconductor (NASDAQ:LSCC), the stock appears to be fairly valued. With a market cap of $12.10 billion and a current price of $88 per share, the stock's future return is likely to align with the rate of its business growth.

Financial Strength of Lattice Semiconductor

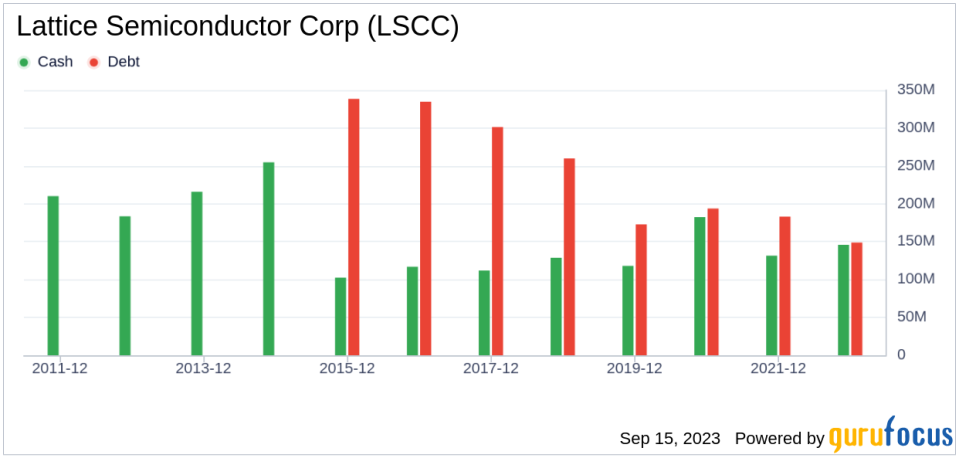

Before investing in a company, it's crucial to assess its financial strength. Companies with poor financial strength pose a higher risk of permanent loss. A look at the cash-to-debt ratio and interest coverage can provide a clear picture of a company's financial health. Lattice Semiconductor's cash-to-debt ratio stands at 1.71, suggesting strong financial strength.

Profitability and Growth of Lattice Semiconductor

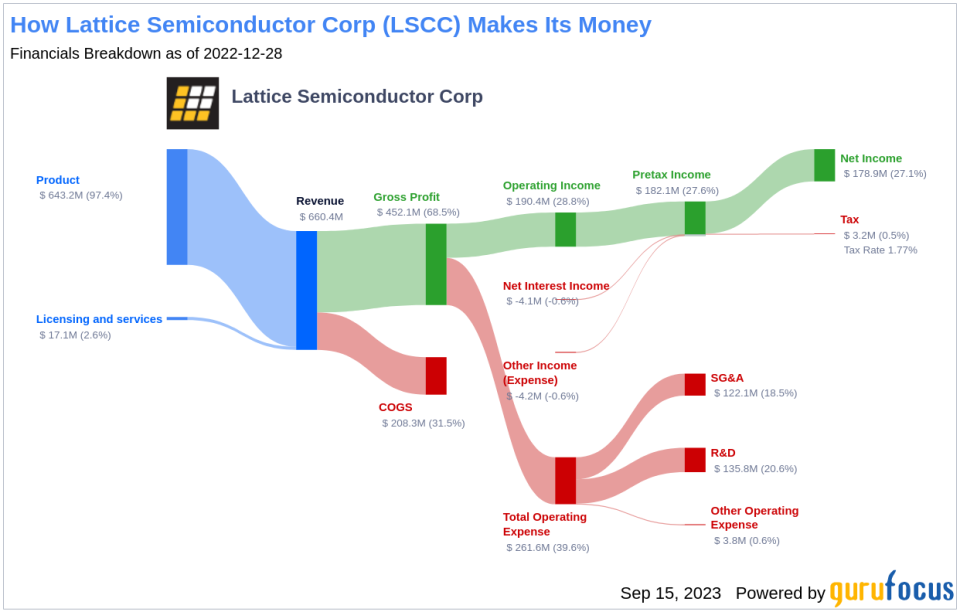

Investing in profitable companies is less risky, especially those with consistent profitability over the long term. Lattice Semiconductor has been profitable for 6 out of the past 10 years, with an operating margin of 30.06%, ranking better than 93.33% of companies in the Semiconductors industry. Moreover, the 3-year average annual revenue growth of Lattice Semiconductor is 16.8%, indicating promising growth prospects.

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) with its weighted average cost of capital (WACC) can provide insights into its profitability. For Lattice Semiconductor, the ROIC stands at 37.29, significantly higher than the WACC of 13.61, indicating a strong return on investment.

Conclusion

In conclusion, Lattice Semiconductor (NASDAQ:LSCC) appears to be fairly valued. The company exhibits strong financial health and promising growth prospects. For more details on Lattice Semiconductor's stock, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.