Unveiling Lattice Semiconductor's Value: Is It Really Priced Right? A Comprehensive Guide

Lattice Semiconductor Corp (NASDAQ:LSCC) closed at a price of $79.55, recording a day's loss of -5.12%. Over the past three months, the company's stock has declined by -15.87%. Despite these figures, the company's Earnings Per Share (EPS) stands at 1.46. This raises an important question: Is Lattice Semiconductor's stock modestly undervalued? In the following analysis, we will delve into the valuation of Lattice Semiconductor and provide an answer to this question.

An Overview of Lattice Semiconductor Corp

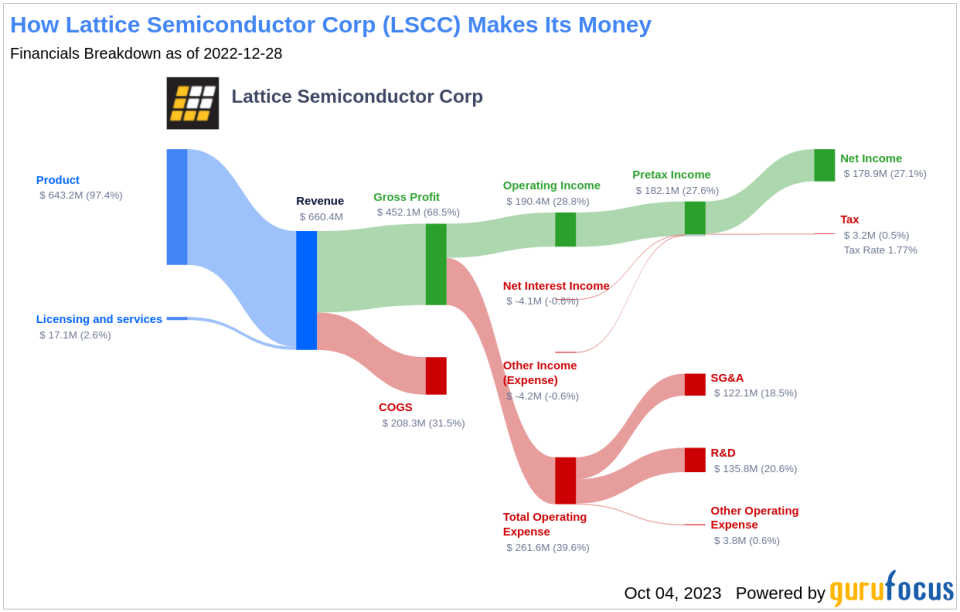

Lattice Semiconductor Corp is a leading developer of semiconductor technology, offering its products, solutions, and licenses to customers worldwide. The company operates primarily in the consumer, communications, and industrial markets. Its product lines consist of programmable logic devices, video connectivity application-specific standard products, and wave devices. These offerings help its customers build technology that utilizes more computing power, higher resolution video, and reduced energy consumption.

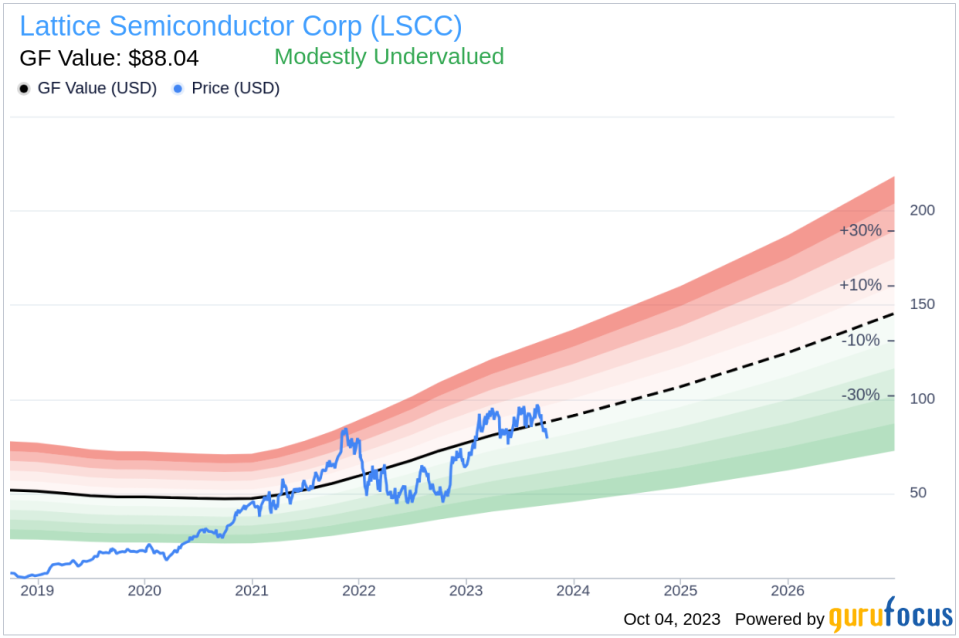

Understanding the GF Value of Lattice Semiconductor

The GF Value is a proprietary measure that estimates the intrinsic value of a stock. It considers historical trading multiples, an adjustment factor based on the company's past returns and growth, and future business performance estimates. The GF Value Line indicates the ideal fair trading value of the stock. If the stock price significantly deviates from the GF Value Line, it may be overvalued or undervalued, affecting its future returns.

Currently, Lattice Semiconductor (NASDAQ:LSCC) appears to be modestly undervalued. The company's market cap stands at $11 billion, and its stock price of $79.55 per share is below the GF Value of $88.04. This implies that the long-term return of its stock is likely to be higher than its business growth.

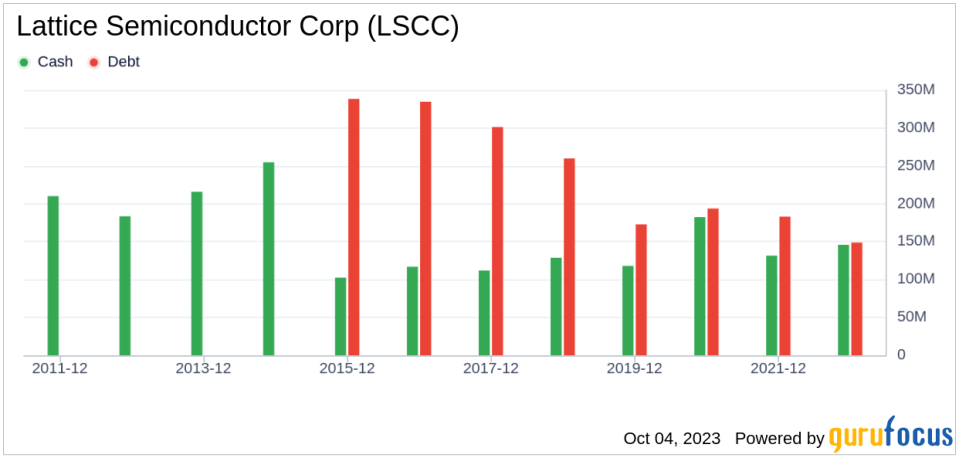

Evaluating Lattice Semiconductor's Financial Strength

Investing in companies with low financial strength can result in permanent capital loss. Therefore, it's crucial to review a company's financial strength before investing. Lattice Semiconductor's cash-to-debt ratio stands at 1.71, lower than 53.54% of 904 companies in the Semiconductors industry. Despite this, GuruFocus ranks Lattice Semiconductor's financial strength as 9 out of 10, indicating a strong balance sheet.

Assessing Lattice Semiconductor's Profitability and Growth

Profitable companies, especially those with consistent profitability over the long term, pose less risk for investors. Lattice Semiconductor has been profitable 6 out of the past 10 years. The company's operating margin of 30.06% ranks better than 93.29% of 954 companies in the Semiconductors industry. Furthermore, Lattice Semiconductor's 3-year average revenue growth rate is better than 62.13% of 874 companies in the Semiconductors industry.

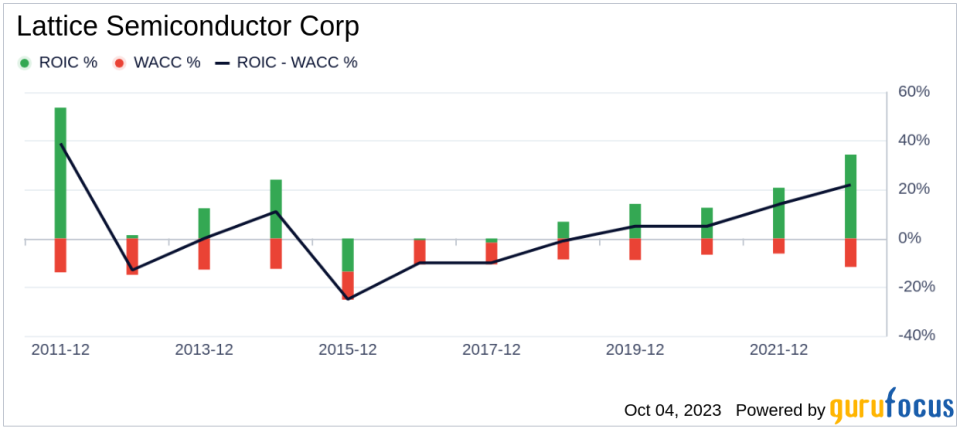

ROIC Vs WACC: A Measure of Profitability

Comparing a company's return on invested capital (ROIC) to its weighted cost of capital (WACC) can provide insights into its profitability. If the ROIC is higher than the WACC, it indicates that the company is creating value for shareholders. Lattice Semiconductor's ROIC stands at 37.29, significantly higher than its WACC of 13.99.

Conclusion

In conclusion, Lattice Semiconductor (NASDAQ:LSCC) appears to be modestly undervalued. The company's strong financial condition, fair profitability, and above-average growth make it a promising investment. For more information about Lattice Semiconductor's stock, you can check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.