Unveiling LG Display Co (LPL)'s Value: Is It Really Priced Right? A Comprehensive Guide

LG Display Co Ltd (NYSE:LPL) experienced a daily loss of -4.07%, with a 3-month loss of -22.51%. The company reported a Loss Per Share of 5.28. This begs the question: is the stock modestly undervalued? The following analysis provides an in-depth look at the company's valuation, inviting readers to explore its financial health and market potential.

Company Introduction

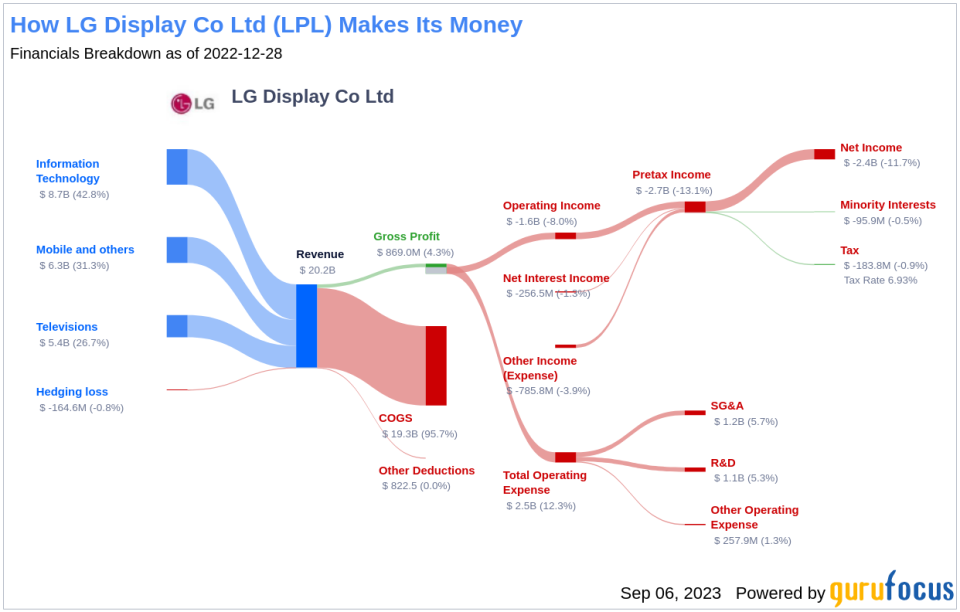

LG Display Co Ltd, based in South Korea, specializes in developing, manufacturing, and selling TFT-LCD and OLED display panels. Its products cater to a range of devices, including notebook computers, monitors, televisions, smartphones, and tablets. The company operates globally, with subsidiaries in the United States, Germany, Japan, Taiwan, China, and Singapore. This international presence allows LG Display Co to generate the majority of its revenue from overseas markets, with the remainder coming from South Korea.

With a current stock price of $4.95 per share and a market cap of $3.50 billion, the company's valuation is a point of interest for investors. This valuation will be examined in relation to the company's GF Value, an estimation of fair value. To gain a clearer understanding of the company's financial health, let's delve deeper into its financial performance.

Understanding GF Value

The GF Value is an exclusive measure of a stock's intrinsic value. It is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line provides an overview of the stock's ideal fair trading value.

According to GuruFocus Value calculation, LG Display Co (NYSE:LPL) is considered modestly undervalued. This estimation suggests that, at its current price, the stock is likely to offer a higher long-term return than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Assessing Financial Strength

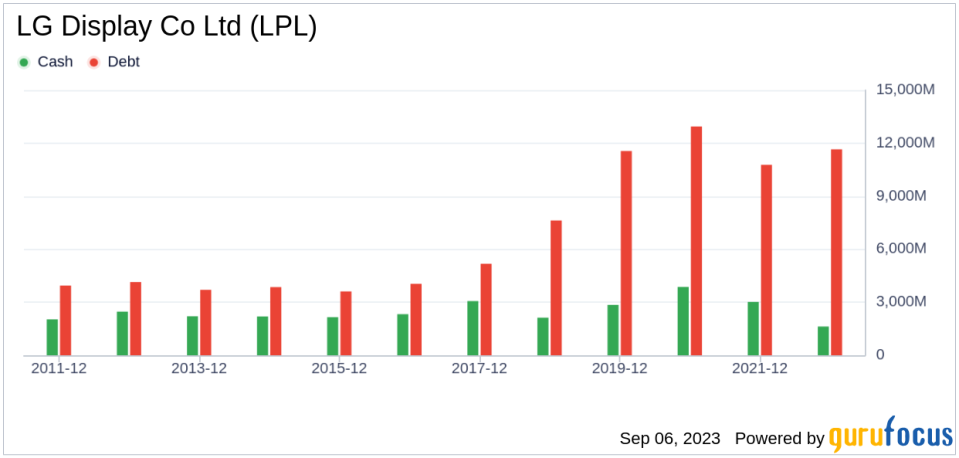

Investing in companies with low financial strength could lead to permanent capital loss. Therefore, it's crucial to review a company's financial strength before deciding to buy shares. LG Display Co's cash-to-debt ratio of 0.14 ranks lower than 92.01% of companies in the Hardware industry, suggesting a poor balance sheet.

Profitability and Growth

Investing in profitable companies typically carries less risk. LG Display Co has been profitable for 6 out of the past 10 years, with revenues of $17.50 billion during the past 12 months. However, its operating margin of -14.64% ranks lower than 84.76% of companies in the Hardware industry, indicating fair profitability.

Growth is a crucial factor in the valuation of a company. LG Display Co's 3-year average revenue growth rate is lower than 51.81% of companies in the Hardware industry. However, its 3-year average EBITDA growth rate of 43.2% ranks better than 85.98% of companies in the industry.

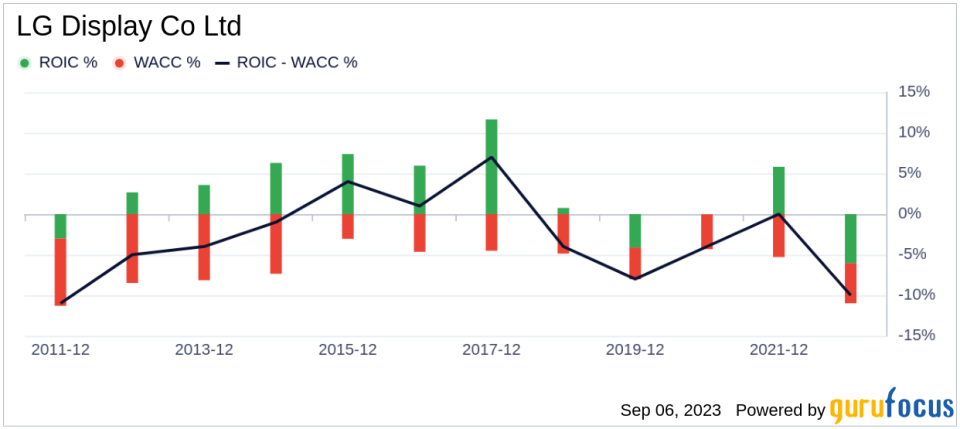

Evaluating ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can provide insights into its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay to finance its assets. Over the past 12 months, LG Display Co's ROIC was -9.25, while its WACC was 5.15, indicating a potential value creation for its shareholders.

Conclusion

Overall, LG Display Co (NYSE:LPL) stock appears to be modestly undervalued. Despite its poor financial condition, the company's profitability is fair, and its growth ranks better than 85.98% of companies in the Hardware industry. For more insights into LG Display Co stock, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, consider exploring the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.