Unveiling LGI Homes (LGIH)'s Value: Is It Really Priced Right? A Comprehensive Guide

LGI Homes Inc (NASDAQ:LGIH) recently experienced a daily loss of 3.42%, contributing to a 3-month loss of 13.83%. Despite these figures, it boasts an Earnings Per Share (EPS) of 8.69. The question we seek to answer is: Is LGI Homes (NASDAQ:LGIH) fairly valued at this point in time? In the following analysis, we'll delve into the company's financials, operations, and growth prospects to provide a comprehensive valuation assessment.

An Overview of LGI Homes Inc (NASDAQ:LGIH)

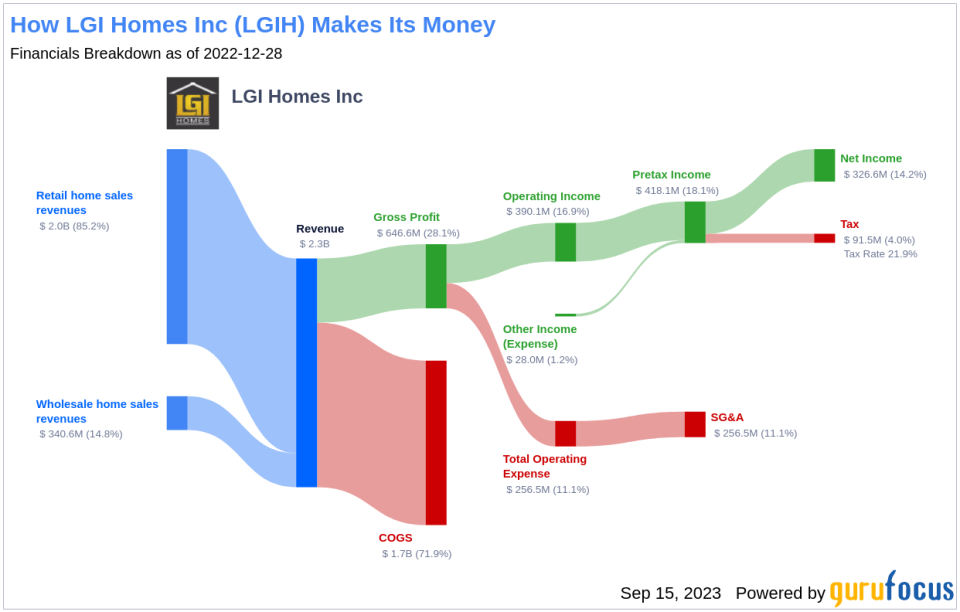

LGI Homes Inc is a key player in the design, construction, and sale of new homes across various markets. The company's offerings range from entry-level homes, including both detached homes and townhomes, to luxury series homes sold under the Terrata Homes brand. LGI Homes prides itself on providing an array of floor plans in each community, featuring upgrades like granite countertops, appliances, and ceramic tile flooring.

The company's stock price currently stands at $113.49, while its GF Value estimates a fair value of $116.7. This suggests that LGI Homes' stock is fairly valued at present. To better understand this valuation, we'll explore the company's financial performance and prospects in the following sections.

Understanding the GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor derived from the company's past performance and growth, and future business performance estimates. The GF Value Line provides a snapshot of the ideal fair trading value for the stock.

If the stock price is significantly above the GF Value Line, it could be overvalued, likely resulting in poor future returns. Conversely, if the stock price is significantly below the GF Value Line, it could be undervalued, potentially leading to higher future returns. Based on the current price of $113.49 per share, LGI Homes appears to be fairly valued.

As LGI Homes is fairly valued, the long-term return of its stock is likely to be close to the rate of its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength of LGI Homes

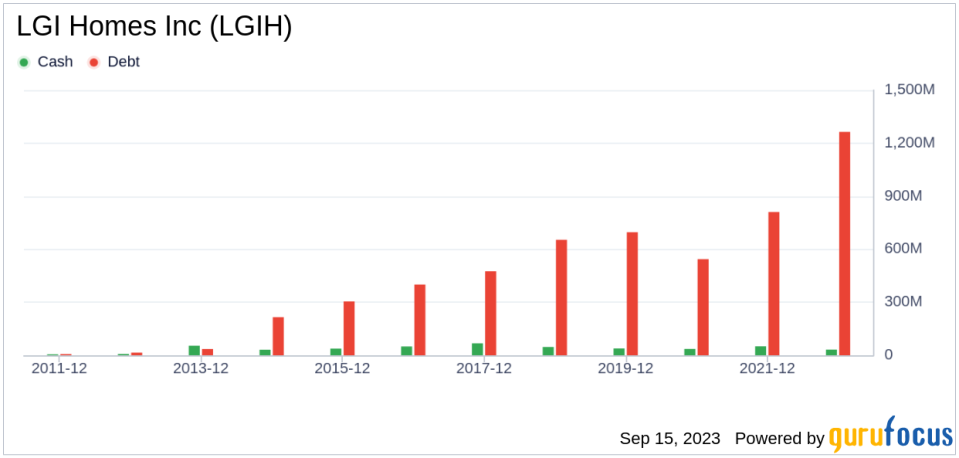

Companies with poor financial strength pose a high risk of permanent capital loss. To mitigate this risk, investors must scrutinize a company's financial strength before purchasing shares. Factors such as the cash-to-debt ratio and interest coverage offer valuable insights into a company's financial robustness.

LGI Homes has a cash-to-debt ratio of 0.04, ranking lower than 97.17% of 106 companies in the Homebuilding & Construction industry. The overall financial strength of LGI Homes is 5 out of 10, indicating fair financial health.

Profitability and Growth of LGI Homes

Investing in profitable companies, especially those with consistent profitability over the long term, is typically less risky. High-profit margin companies are generally safer investments than those with low-profit margins. LGI Homes has been profitable for 10 of the past 10 years. Over the past twelve months, the company had a revenue of $2.20 billion and an Earnings Per Share (EPS) of $8.69. Its operating margin is 10.45%, which ranks better than 55.05% of 109 companies in the Homebuilding & Construction industry. Overall, LGI Homes' profitability is ranked 9 out of 10, indicating strong profitability.

Growth is a crucial factor in a company's valuation. Research by GuruFocus has found that growth is closely correlated with the long-term performance of a company's stock. If a company's business is growing, the company usually creates value for its shareholders, especially if the growth is profitable. On the other hand, if a company's revenue and earnings are declining, the value of the company will decrease. LGI Homes's 3-year average revenue growth rate is better than 54.9% of 102 companies in the Homebuilding & Construction industry. LGI Homes's 3-year average EBITDA growth rate is 24.6%, which ranks better than 67.02% of 94 companies in the Homebuilding & Construction industry.

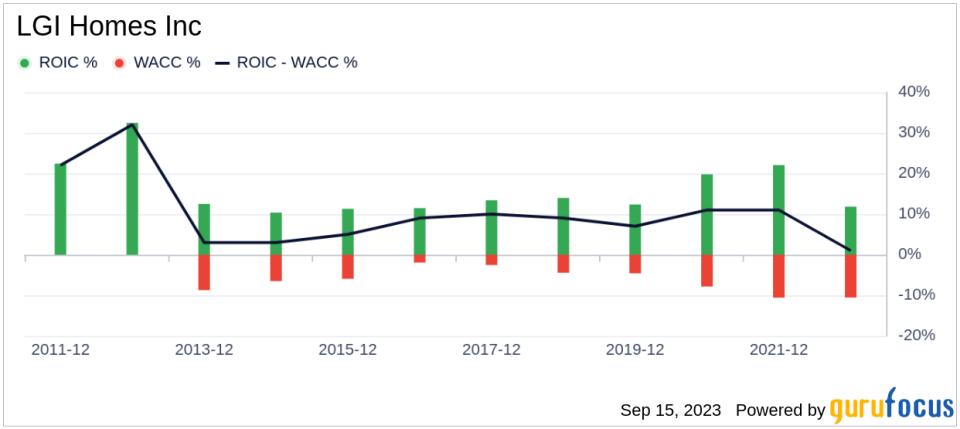

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) and the weighted average cost of capital (WACC) provides another perspective on its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. Ideally, the ROIC should be higher than the WACC. For the past 12 months, LGI Homes's ROIC is 6.22, and its WACC is 9.98.

Conclusion

In conclusion, LGI Homes (NASDAQ:LGIH) appears to be fairly valued based on our comprehensive analysis. The company's financial condition is fair, its profitability is strong, and its growth ranks better than 67.02% of 94 companies in the Homebuilding & Construction industry. To learn more about LGI Homes stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.