Unveiling MACOM Technology Solutions Holdings (MTSI)'s Value: Is It Really Priced Right? A ...

With a daily gain of 3.54%, a 3-month gain of 36.98%, and an Earnings Per Share (EPS) of 4.3, MACOM Technology Solutions Holdings Inc (NASDAQ:MTSI) has been drawing attention in the stock market. However, the burning question remains: is the stock significantly overvalued? This comprehensive analysis aims to answer that question by exploring MTSI's valuation, financial strength, profitability, and growth.

Company Introduction

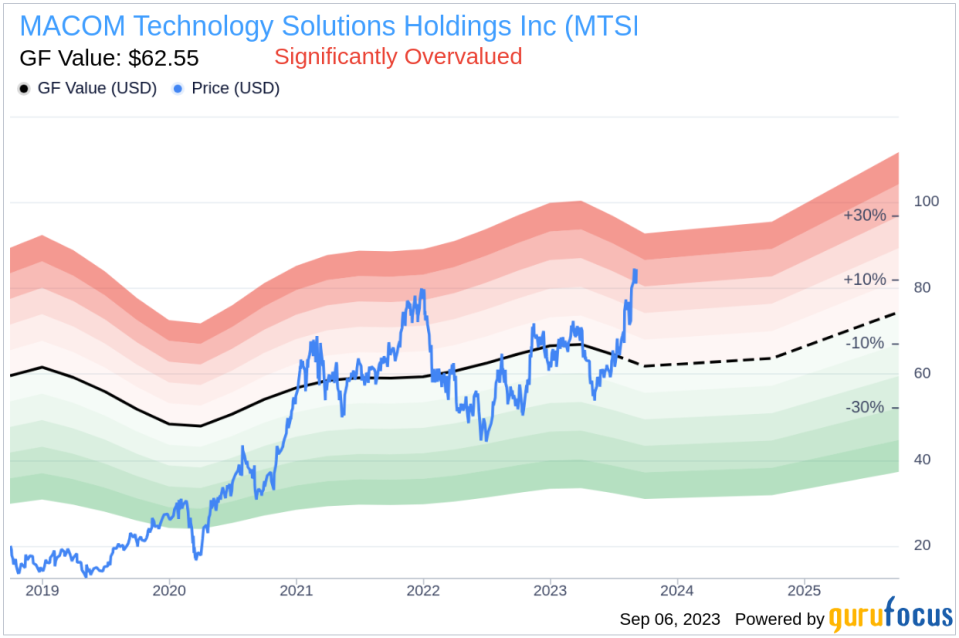

MACOM Technology Solutions Holdings Inc is a leading provider of analog, digital, and mixed-signal semiconductor solutions to original equipment manufacturers and distributors. These solutions are found in systems for industrial, medical, scientific, and test and measurement markets. With a market cap of $6 billion and a stock price of $83.91 per share, MTSI's valuation significantly overshadows its GF Value of $62.55, indicating a potential overvaluation. This discrepancy paves the way for a deeper exploration of the company's intrinsic value.

Summarizing GF Value

The GF Value is a proprietary measure that estimates a stock's fair value based on historical multiples, an internal adjustment based on the company's past returns and growth, and future business performance estimates. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Based on GuruFocus' valuation method, MTSI appears to be significantly overvalued. This could mean that the long-term return of MTSI's stock is likely to be much lower than its future business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

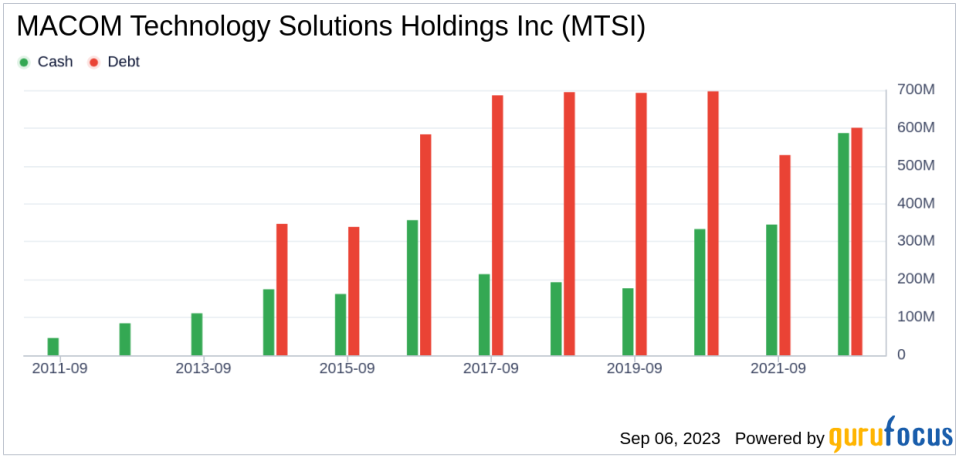

Investing in companies with low financial strength could result in permanent capital loss. Therefore, a careful review of a company's financial strength is crucial before deciding to buy shares. MTSI has a cash-to-debt ratio of 0.97, which ranks worse than 66.03% of 895 companies in the Semiconductors industry. Despite this, GuruFocus ranks MTSI's financial strength as 8 out of 10, indicating a strong balance sheet.

Profitability and Growth

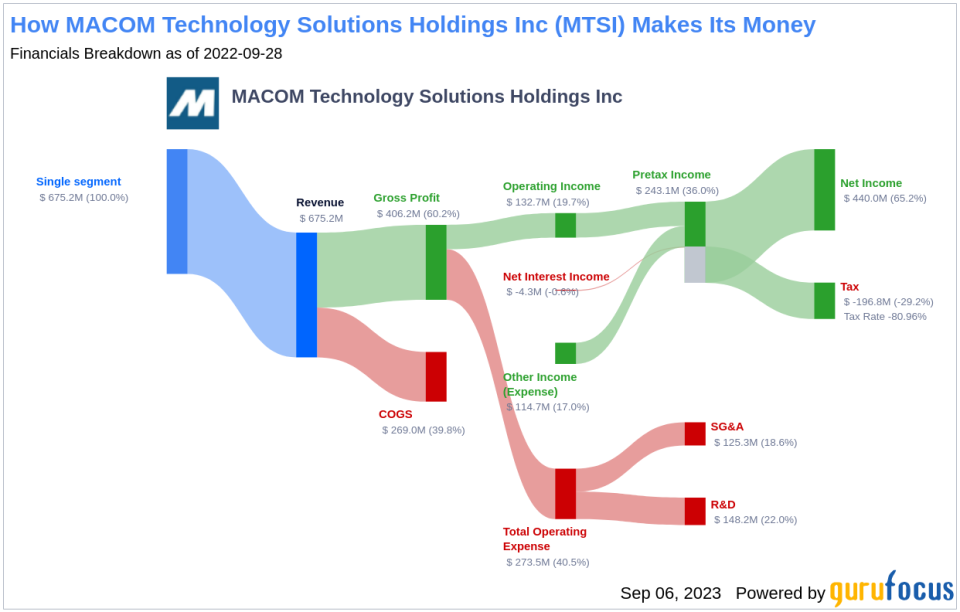

Investing in profitable companies, especially those that have demonstrated consistent profitability over the long term, poses less risk. MTSI has been profitable 5 over the past 10 years. Over the past twelve months, the company had a revenue of $676.20 million and an Earnings Per Share (EPS) of $4.3. Its operating margin is 19.05%, which ranks better than 80.38% of 938 companies in the Semiconductors industry. Overall, GuruFocus ranks the profitability of MTSI at 5 out of 10, indicating fair profitability.

Growth is a crucial factor in the valuation of a company. MTSI's 3-year average annual revenue growth is 7.6%, which ranks worse than 60.95% of 863 companies in the Semiconductors industry. The 3-year average EBITDA growth rate is 0%, which ranks worse than 0% of 767 companies in the Semiconductors industry.

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) and the Weighted Average Cost of Capital (WACC) can provide insights into its profitability. For the past 12 months, MTSI's return on invested capital is 33.4, and its cost of capital is 11.52.

Conclusion

Overall, MTSI stock shows every sign of being significantly overvalued. Despite its strong financial condition and fair profitability, its growth ranks worse than 0% of 767 companies in the Semiconductors industry. For more details about MTSI's stock, you can check out its 30-Year Financials here.

To find out high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.