Unveiling Martin Marietta Materials (MLM)'s True Worth: A Comprehensive Guide

With a daily loss of 3.97% and a 3-month gain of 5.71%, Martin Marietta Materials Inc (NYSE:MLM) has been a topic of interest among investors. The company's Earnings Per Share (EPS) stand at 15.24, sparking the question: is the stock fairly valued? This article aims to provide a detailed valuation analysis of Martin Marietta Materials. Read on to uncover insights into the company's intrinsic value.

Company Overview

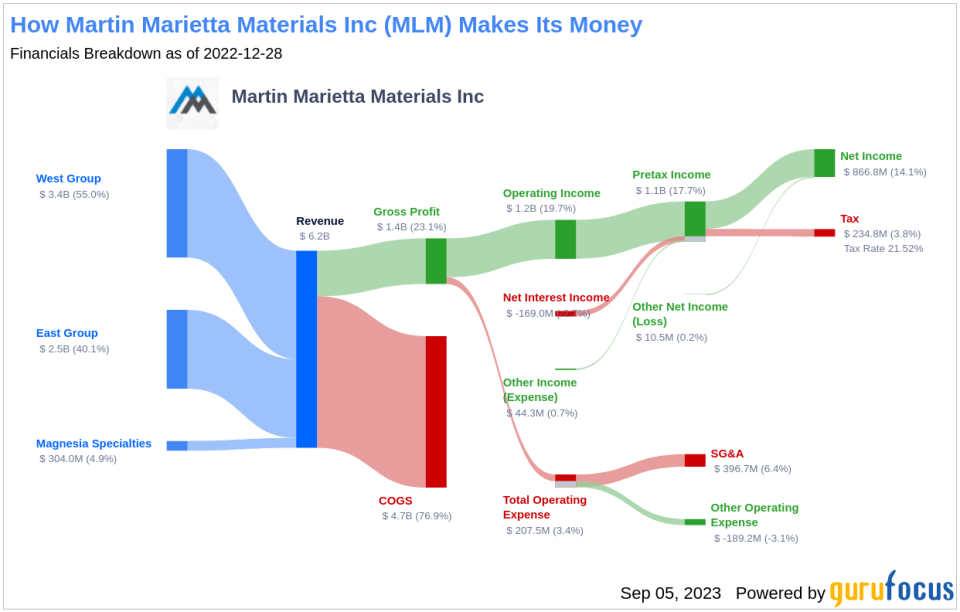

Martin Marietta Materials Inc, one of the largest producers of construction aggregates in the United States, has a rich history and robust operations. The company sold 207 million tons of aggregates in 2022, with its primary markets being Texas, Colorado, North Carolina, Georgia, and Florida. Martin Marietta Materials also produces cement and uses its aggregates in its asphalt and ready-mixed concrete businesses. The company's magnesia specialties business produces magnesia-based chemical products and dolomitic lime.

With a current stock price of $439.24 and a market cap of $27.10 billion, the company's valuation seems to align closely with its GF Value of $430.36, indicating that the stock could be fairly valued.

An Overview of GF Value

The GF Value is a proprietary measure that represents the current intrinsic value of a stock. This value is derived from historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. If a stock's price is significantly above the GF Value Line, it is likely overvalued, and its future return may be poor. Conversely, if it is significantly below the GF Value Line, its future return could be higher.

Considering these factors, Martin Marietta Materials appears to be fairly valued. As such, the long-term return of its stock is likely to align closely with the rate of its business growth.

Financial Strength

Companies with weak financial strength pose a high risk of permanent capital loss to investors. To avoid this, it's crucial to review a company's financial strength before purchasing shares. Key indicators of financial strength include the cash-to-debt ratio and interest coverage. Martin Marietta Materials has a cash-to-debt ratio of 0.08, which ranks worse than 85.2% of 358 companies in the Building Materials industry. The overall financial strength of Martin Marietta Materials is 5 out of 10, indicating fair financial strength.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, is generally less risky. Martin Marietta Materials has been profitable 10 years over the past decade. Over the past twelve months, the company had a revenue of $6.50 billion and Earnings Per Share (EPS) of $15.24. Its operating margin is 20.63%, which ranks better than 86.81% of 364 companies in the Building Materials industry. Overall, the profitability of Martin Marietta Materials is ranked 9 out of 10, indicating strong profitability.

Growth is a crucial factor in a company's valuation. A faster-growing company creates more value for shareholders, especially if the growth is profitable. The 3-year average annual revenue growth of Martin Marietta Materials is 9.3%, which ranks better than 64.61% of 356 companies in the Building Materials industry. The 3-year average EBITDA growth rate is 12.4%, which ranks better than 70.4% of 321 companies in the same industry.

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) is another way to evaluate its profitability. If the ROIC is higher than the WACC, it indicates that the company is creating value for shareholders. Over the past 12 months, Martin Marietta Materials' ROIC was 7.56, while its WACC came in at 8.65.

Conclusion

In summary, the stock of Martin Marietta Materials appears to be fairly valued. The company's financial condition is fair, and its profitability is strong. Its growth ranks better than 70.4% of 321 companies in the Building Materials industry. To learn more about Martin Marietta Materials stock, you can check out its 30-Year Financials here.

To find out the high quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.