Unveiling Molina Healthcare's True Worth: A Comprehensive Guide

Despite a daily loss of -3.79%, Molina Healthcare Inc (NYSE:MOH) has seen a 13.32% gain over the past three months. Its Earnings Per Share (EPS) currently stands at 15.78. The question remains: Is the stock modestly undervalued? This article provides an extensive analysis of Molina Healthcare's valuation, inviting readers to delve into the financial metrics and company data that could influence its stock's intrinsic value.

A Brief Overview of Molina Healthcare Inc (NYSE:MOH)

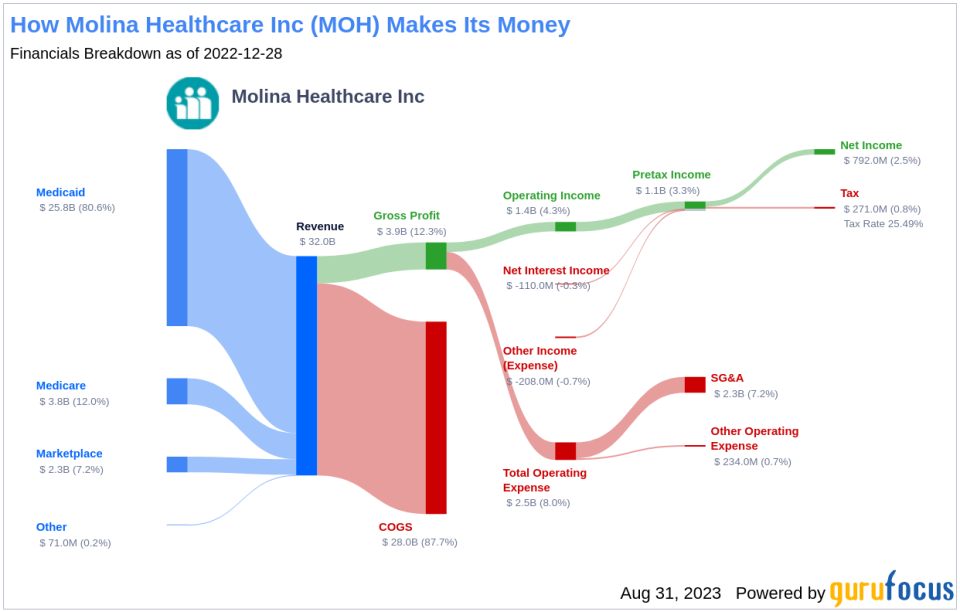

Molina Healthcare Inc offers healthcare plans primarily focused on Medicaid-related solutions for low-income families and individuals. Its health plans are managed by a network of subsidiaries, each licensed as a health maintenance organization (HMO). Besides its Health Plans segment, Molina also operates a Medicaid, Medicare, and Marketplace segment, representing government-funded or sponsored programs under their management information systems. The company's Medicaid plans receive revenue on a per-member per-month basis from state government agencies, while its Medicare Advantage plans receive revenue from managed care plans contracted with the Centers for Medicaid and Medicare (CMS). Molina also provides plans through health insurance exchanges.

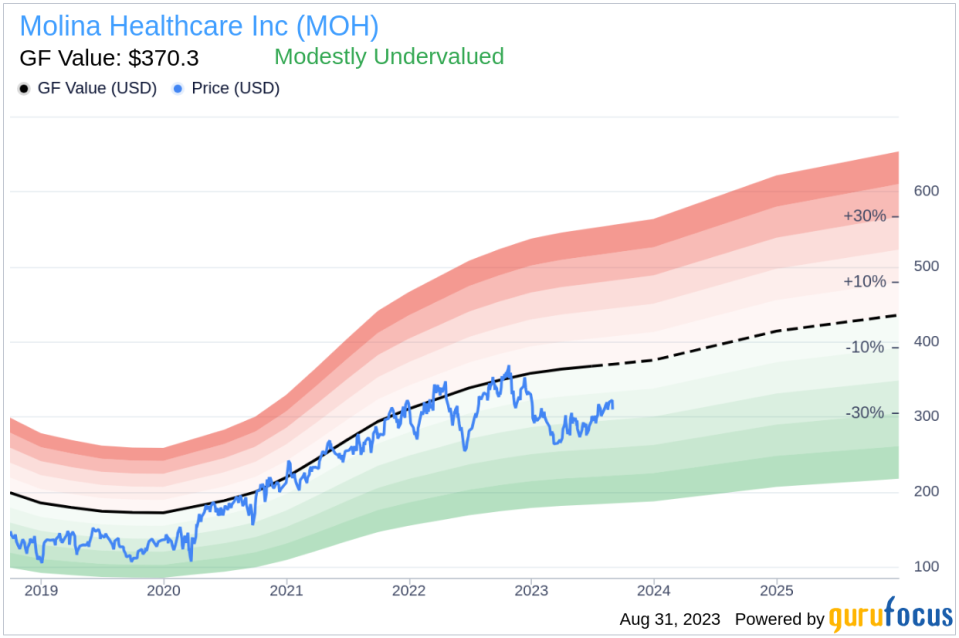

At a current stock price of $310.12, Molina Healthcare Inc (NYSE:MOH) has a market cap of $18.10 billion. Its GF Value, an estimation of fair value, is $370.3, suggesting that the stock might be modestly undervalued.

Understanding the GF Value of Molina Healthcare (NYSE:MOH)

The GF Value offers a unique perspective on a stock's intrinsic value, calculated based on historical multiples, a GuruFocus adjustment factor considering the company's past performance and growth, and future business performance estimates. The GF Value Line provides an overview of the fair value at which the stock should ideally trade. If the stock price significantly deviates from the GF Value Line, it may indicate that the stock is either overvalued or undervalued, potentially impacting future returns. Based on this valuation method, Molina Healthcare's stock appears to be modestly undervalued.

Given this undervaluation, the long-term return of Molina Healthcare's stock is likely to exceed its business growth. This presents a potentially lucrative opportunity for value investors.

Assessing the Financial Strength of Molina Healthcare

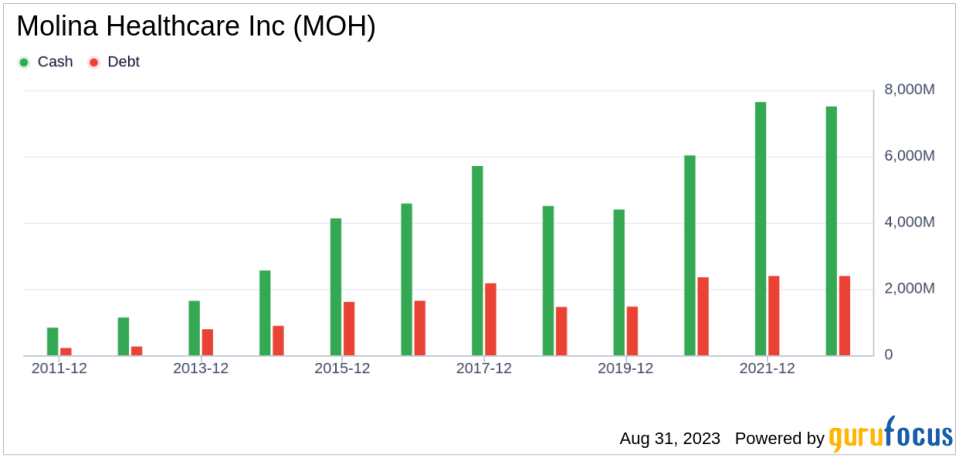

Before investing in a company, it's crucial to evaluate its financial strength. Companies with poor financial strength present a higher risk of permanent loss to investors. Metrics like the cash-to-debt ratio and interest coverage offer valuable insights into a company's financial health. With a cash-to-debt ratio of 3.69, Molina Healthcare ranks better than 68.42% of companies in the Healthcare Plans industry. Its overall financial strength is 7 out of 10, indicating a fair financial condition.

Profitability and Growth of Molina Healthcare

Consistent profitability over the long term often signifies a safer investment. Higher profit margins typically indicate a more promising investment compared to a company with lower profit margins. Molina Healthcare has been profitable 9 out of the past 10 years. Over the past twelve months, the company reported a revenue of $32.60 billion and an Earnings Per Share (EPS) of $15.78. Its operating margin is 4.74%, ranking better than 60% of companies in the Healthcare Plans industry. Overall, the profitability of Molina Healthcare is ranked 9 out of 10, indicating strong profitability.

One of the most crucial factors in a company's valuation is its growth. Companies that grow faster create more value for shareholders, especially if that growth is profitable. Molina Healthcare's average annual revenue growth is 27.8%, ranking better than 72.22% of companies in the Healthcare Plans industry. Its 3-year average EBITDA growth is 8.8%, ranking better than 64.71% of companies in the Healthcare Plans industry.

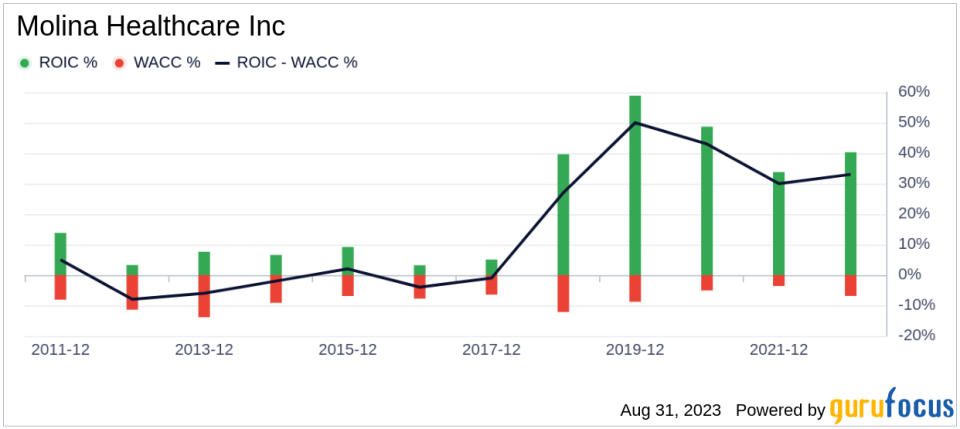

Return on Invested Capital Vs. Weighted Average Cost of Capital

Comparing a company's Return on Invested Capital (ROIC) and the Weighted Average Cost of Capital (WACC) offers another perspective on its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business, while WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. Ideally, ROIC should be higher than WACC. For the past 12 months, Molina Healthcare's ROIC is 43.33, and its WACC is 7.93.

Conclusion

Overall, Molina Healthcare's stock appears to be modestly undervalued. The company's financial condition is fair, and its profitability is strong. Its growth ranks better than 64.71% of companies in the Healthcare Plans industry. To learn more about Molina Healthcare's stock, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.